Highlights:

Trump Tariffs signs 10% globally after Supreme Court setback.

Section 122 was invoked for a temporary 150-day baseline tariff.

Markets brace for volatility amid renewed global trade tensions.

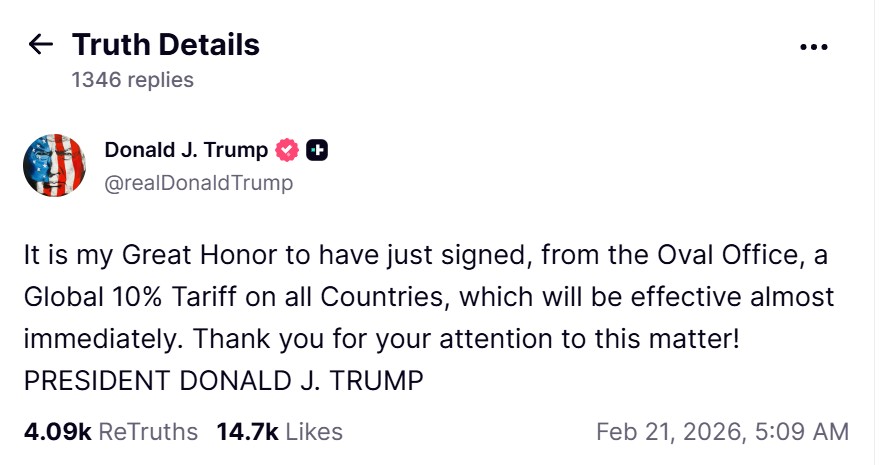

In the recent announcement today, Trump posted on Truth Social about 10% global tariffs being imposed on imports from all countries. Donald supported its statement by signing an executive order from the Oval Office, and that the measure would take effect “almost immediately.”

The announcement comes just hours after the Supreme Court of the United States struck down his earlier emergency-based tariff authority in a 6–3 decision.

The court ruled that Trump overstepped his legal powers by imposing broad taxes under emergency provisions without clear congressional approval. Despite the setback, the administration acted quickly to introduce a new legal route.

Source: Official X

The new order refers to a section of the Trade Act of 1974, which gives the president the power to issue temporary tariffs of no more than 15% for a period of 150 days to address trading imbalances (S-122).

In an interview with the reporters, Trump explained that the 10% tariff on the world will be in existence within a period of five months. Over the same period, the administration is going to carry out inquiries on unfair trade practices and possibly take other actions under Section 301 and 232 authorities.

He stated:

“Today, I will sign an order to impose a 10% global tariff under Section 122, over and above our normal tariffs already being charged.”

The administration emphasized that this new approach is legally durable compared to the previous emergency-based framework under the International Emergency Economic Powers Act (IEEPA), which the Supreme Court rejected.

The transition to the Section 122 tariff is expected, however, to compensate for the possible loss in revenues, which will ensure that the tariff income in 2026 will remain mostly steady.

The ruling represents a significant blow to Trump’s trade agenda. In response, He sharply criticized the decision, calling it “deeply disappointing” and saying he was “ashamed of certain members of the court.” However, he argued that the decision does not limit his authority under other trade laws, including S-122.

When asked whether rates could rise further, Donald indicated that higher taxes remain possible. He noted that Section 301 investigations into unfair trade practices are being launched and that additional national security-based taxes under Section 232 are also under consideration.

“Potentially higher. It depends. Whatever we want them to be,” Trump said, signaling flexibility in future actions.

The administration suggested that some countries accused of unfair practices, while others may receive more moderate treatment.

The Supreme Court ruling casts uncertainty over approximately $175 billion in tariff revenue collected under the earlier emergency authority. According to economic estimates cited by Reuters, refunds could be subject to lengthy litigation.

Treasury officials indicated that the refund issue could take months or even years to resolve. However, the shift to Section 122 is expected to offset potential revenue losses, keeping 2026 trade tariff income largely stable.

The announcement has brought up the possibility of new trade tensions in the world. A universal of 10 percent impacts supply chains in manufacturing, technology, and consumer goods industries.

Such broad strokes, according to financial analysts, may:

Increase import costs

Introduce retaliatory tariffs.

Increase stock market volatility.

Affect supply chain-linked cryptocurrency markets.

As taxes come into effect nearly overnight, markets are keenly tracking the responses of the major economies, such as China, the European Union, and India.

The US president described the move as the beginning of an “adjustment process.” While Section 122 limits tariffs to 150 days, the administration has clearly signaled broader investigations that could lead to long-term structural changes in U.S. trade policy.

For now, Global Trump Tariffs Today mark a decisive escalation in America’s strategy—despite judicial resistance. Whether this move strengthens the domestic industry or intensifies global friction will become clearer in the coming weeks.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.