Markets do not wait for wars or policies to become real. They react to fear first. Right now, that fear is coming from Europe’s “Sell America Trade” motive, which is putting Trump EU tariff news in the spotlight today.

When Ash Crypto shared that the EU may begin selling US assets as part of a new conflict, it sent a shock through the community. The idea of Europe Selling US Bonds is no longer just a theory. It is now a risk that traders must watch closely.

This is dangerous because the United States economy depends heavily on foreign money. Once that trust weakens, everything from stocks to crypto can shake.

The trigger came from politics. On January 17, Donald Trump posted on Truth Social that European countries like Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland would face a 10% tariff from February 1.

He also added that from June 1, this tariff would rise to 25%. These taxes would stay until a deal was reached for the “complete and total purchase of Trump Greenland.” This has added fuel to the US Europe tension narrative.

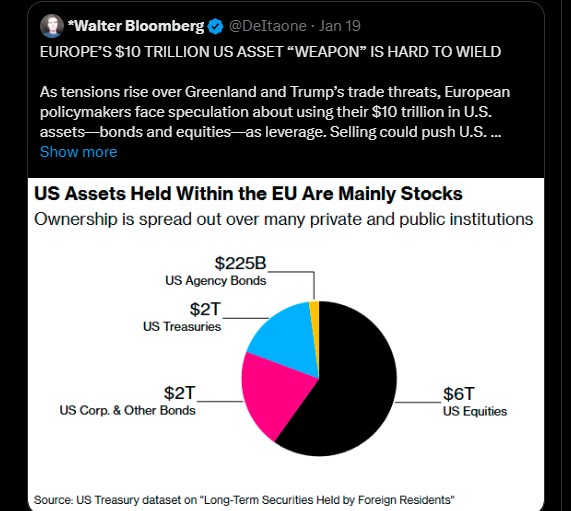

After this news, Walter Bloomberg recently highlighted that the EU owns between $8-$10 trillion in US bonds and equities. This is almost twice as much as the rest of the world combined.

This is why analysts call it the “Sell America trade weapon.” If news of Europe selling of US bonds comes true, the United States borrowing costs will rise,along with bond yield, and the dollar will weaken.

But Walter Bloomberg pointed out these assets are owned by private investors, not governments. Any forced selling would hurt both the countries equally. That is why strategists say the chance is low, but the risk is real.

The reaction has already started as crypto crashed around 3% today. Nearly $150 billion was wiped out. Bitcoin slipped back to $89K after failing at $91K.

Ethereum lost its $3,000 level and is now trading near $2,959. XRP also fell around 2% in the last 24 hours. This shows how sensitive the financial industry is to global political and money flow risks.

This blood-red reaction is just from fear. No assets have been sold yet. Imagine what happens if Europe Selling US Bonds becomes real.

If European countries begin to sell U.S. securities, global liquidity will shrink. Investors will pull money from all risky assets, including crypto.

Bitcoin could drop 8–12% quickly. That places BTC in the $80K–$82K zone. If panic deepens, $76K becomes possible before real support appears.

Ethereum is weaker than Bitcoin right now. It already lost the $3,000 level. ETH could drop 12–18%, which brings the bearish level around $2,300. Altcoins usually fall harder. XRP’s 2% drop today is just the start of a panic phase.

Even Deutsche Bank analysts warned that America depends deeply on foreign capital. Once that stops, the dollar’s power becomes weak. This is why the Trump Europe tariff trade war is not just a market story. It is a structural risk to the global financial order.

Europe Selling US Bonds and the Sell America trade are real tail risks, not market rumors. First comes panic, falling prices, and lost liquidity. Then comes a shift in trust, weaker dollar strength, and Bitcoin’s return as a hedge. Cryptocurrency remains a short-term risk asset and a long-term protection tool against weakening confidence in traditional financial systems.

YMYL Disclaimer: This content is strictly for educational purposes only. It does not constitute investment advice. Cryptocurrency markets are highly volatile and risky. Always do your own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.