The Grayscale Sui ETF is scheduled to begin trading tomorrow on NYSE Arca under the ticker GSUI. This launch gives investors regulated exposure to SUI, without directly holding the asset. The timing is important because it comes just one day after a fresh regulatory update.

On February 17, 2026, Grayscale filed Amendment No. 3 to its Form S-1 registration statement for the Grayscale Sui Trust with the U.S. Securities and Exchange Commission. This updated filing shows that the product is actively moving through the SEC process. While amendments are a normal part of Exchange Traded Funds approvals, they signal ongoing regulatory review and preparation before trading begins.

It is designed to passively hold tokens. Its goal is simple. It aims to reflect the value of the altcoin held by the fund, minus fees and expenses. Investors will gain price exposure through a brokerage account instead of managing private wallets or crypto keys.

Source: X (formerly Twitter)

A major feature of this crypto investment product is staking exposure. The fund’s tokens may participate in staking on the Sui network. Staking helps secure the blockchain and earns rewards. Historically, staking rewards of the token have ranged between 1.7% and 3.3% per year. These rewards are earned by the trust and may improve the overall value of the fund.

However, investors should understand the risks. It is not registered under the Investment Company Act of 1940. It does not provide the same protections as traditional mutual funds or standard ETFs. It also carries high volatility, meaning prices can move quickly in either direction.

The launch takes place during a period of overall growth of the crypto products market in the United States. Bitcoin, Ethereum, Solana, and XRP have already received spot Exchange Traded Funds approvals. Currently, more than 100 ETF filings for 35 digital assets are reportedly waiting on the SEC’s desk.

The next wave of potential approvals includes ADA, AAVE, DOT, AVAX, CRO, SUI, SEI, and ZEC. Decisions are expected by March 27. Some of these filings include staking features, which would be a first for U.S. ETF markets.

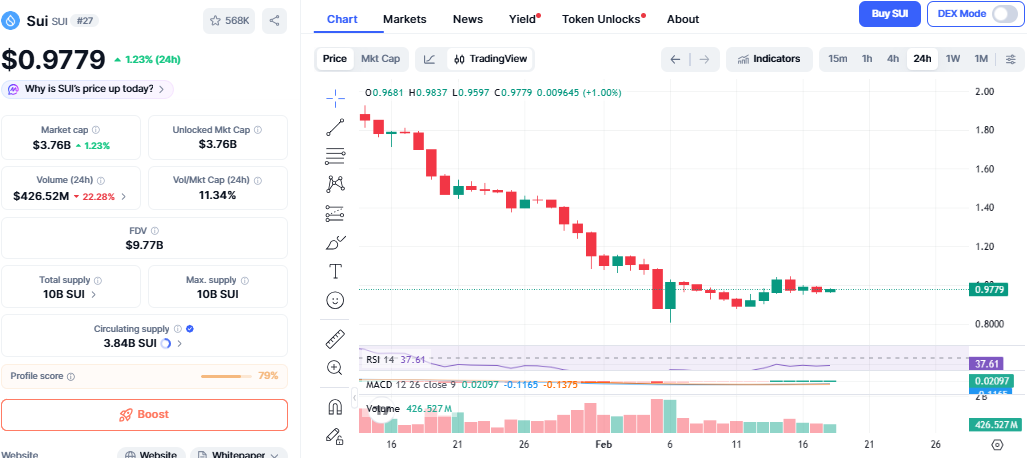

It is trading around $0.978, up 0.79% in the last 24 hours. The gain slightly outperformed a mostly flat broader crypto market. However, trading volume fell more than 20%, suggesting that the move lacks strong conviction.

Source: CoinMarketCap

There is no major news catalyst behind the recent price change. Instead, it appears to be consolidating independently of Bitcoin. Technically, it is holding above the key $0.971 support level, which aligns with its 30-day moving average.

If it manages to maintain its position above $0.971, a possible move towards the psychological level of $1.00 may be expected in the short term.

A breakout above $1.00 with high trading volumes may result in even stronger bullish movements.

Conversely, if the price drops below $0.971, the next significant level of support may be expected around $0.955.

The launch of the Grayscale Sui ETF, in addition to the recent amendment of the SEC S-1 filing, is a significant step towards the further development of the regulated altcoin investment products market.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.