Source: X(formerly Twitter)

Source: X(formerly Twitter)

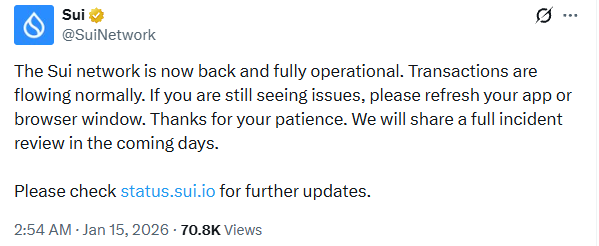

The Sui Foundation confirmed that the network was back to being "fully operational" at 8:44 PM UTC, exactly 5 hours and 52 minutes after the initial stall was detected. While the core team is still working on a detailed incident report, they have advised users that transactions are flowing normally again. If you’re still seeing stuck transactions in your wallet, the team recommends simply refreshing your app or browser.

This wasn’t there first experience; it's actually the second time the ecosystem has hit a major snag since it launched. But even though having the "lights go out" is a total nightmare for anyone trying to move money, the way the market reacted was pretty unexpected. Usually, a six-hour blackout would send investors running for the hills, but this time around, the recovery process actually showed how much trust people still have in the tech.

The core issue was described as a "consensus outage". In plain English, the validators the computers that run the network lost their ability to agree on the order of transactions. This caused block production to stop completely. While this sounds scary, the Sui team was quick to reassure the public that user funds were never at risk; the "machinery" of the blockchain just hit a temporary deadlock.

Usually, if a major blockchain goes dark, you’d expect to see the price of its token go into a freefall. But during this six-hour blackout, The network did something that caught everyone off guard: Sui price actually jumped up by 4% for a moment before leveling out around $1.84. This kind of stability tells us that investors aren’t viewing these outages as "deal-breakers". Instead, they see them as the typical growing pains you’d expect from a young, high-speed network. By the time the "all-clear" was given, the price was basically flat, proving that the community still has a ton of faith in the project's long-term potential.

People all over the world are now paying close attention to how reliable the network really is. As per Bitpinas report, just look at what’s happening in places like Palawan in the Philippines. In December 2025, a group of 50 local students finished a tough training program in Move, which is the coding language The chain is built on. These "Metaverse Filipino Workers" are literally the ones building the next generation of apps on this chain. For them and for the big-money investors waiting on new SUI ETFs, this outage was a massive stress test. It showed that while the network can still hit a snag, the team is fast enough to get everything back on its feet in under six hours.

We’re moving into an era where we expect blockchains to be as reliable as the internet. When the outrage happened, it reminded us that even "Solana killers" are still experimental tech. However, the fact that the price stayed steady and the team was transparent throughout the fix shows a level of professional maturity. Sui is essentially going through the same "trial by fire" that Solana faced years ago.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.