Entering in 2026 becoming more tense for the digital currency era as the known-to-be safest storage methods are also now under the crypto scams fear. A hardware wallet scam recently shocked the crypto market after a victim lost $282 million in Bitcoin and Litecoin, proving that “cold wallets” are no longer risk-free if users are tricked.

Source: ZachXBT Official

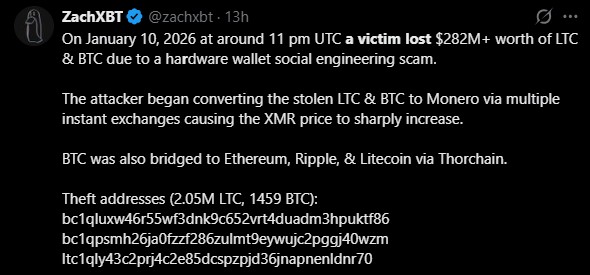

On January 10, blockchain investigator ZachXBT reported that scammers impersonated official wallet or exchange support. They manipulated the user to unveil their sensitive recovery (seed) phrase, in other words authorize malicious transactions. As long as the seed phrase was exposed, the scammers took full control of the funds.

Here the question arises – If physical wallets are designed for safety, how did this happen?

According to ZachXBT, the victim lost 1,459 BTC and 2.05 million LTC through the hardware wallet scam. The wallet itself was not hacked. Instead, the attacker exploited human trust – the most common weak point in crypto security.

After stealing the funds, the scammers moved quickly. Much of the Bitcoin and Litecoin was swapped into Monero (XMR) using instant, no-KYC exchanges. This sudden activity caused Monero’s price to spike sharply, with reports showing gains of 60% to 74% before prices cooled back to the $640–$670 range.

Investigators also traced cross-chain transfers using THORChain, where stolen Bitcoin was bridged to Ethereum, XRP, and additional Litecoin. ZachXBT shared suspected theft addresses publicly to help track the movement of funds.

This scam is now considered the largest individual crypto theft of 2026, surpassing several major social-engineering cases from previous years.

In the emerging digitalized markets, safety is becoming more crucial, but how much is enough? Analyzing the recent incident, the indicent took place despite the strong device securities.

So, for now, taking measures on-devices is not enough to stay safe in the rapidly growing infrastructure but mentally readiness is equally important.

On-chain security firms’ data underscores how social engineering is still leading as a major crypto loss cause, calculating billions in stolen amounts in recent years.

As we understand that nothing is safe in this era without general self-awareness, even the strongest methods. While hardware wallets are often seen as one of the safest options, users are equally responsible for protecting their assets.

Never share your recovery phrase, no real support team will ever ask for it. Store seed phrases offline, verify every transaction on the wallet’s screen, and ignore unsolicited messages claiming “urgent security issues.”

Security experts also recommend using multisig wallets, extra passphrases, and official apps only. Hardware wallets can block most technical attacks, but staying alert and skeptical is what truly keeps crypto safe.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.

1 month ago

After loosing $60k to binary crypto investment scam. I thought I’d never recover my money back, until i met a testimony of Mr Kim online talking about COIN HACK who helped him recover his funds back. I decided to give it a try and contacted them on coinhackrecovery @ Gmail. com luckily for me they responded to my message and as i speak to you all now, my funds has been recovered and was delivered to me within 24 hours..

1 month ago

Being a scam victim can depressing, you were given empty promises. They usually stop replying after achieving their aim which hurts even more, I have been there too as i was too ambitious and wanted financial security which made me invest a huge chunk of my life savings. I never thought i would be getting back a dime and already lost hope until i contacted a team which was just a leap of faith as i wasn’t going to go down without a fight.COIN HACK RECOVERY was the recovery team that helped me recover my $500,000 back from those scammers. Do not brood alone, you can send a mail to their team via; coinhackrecovery @gmail .com If you are also a victim of scam and get your funds back, hopefully its not too late for you too.