Investors are wondering: Is the current Spur Protocol price showing weakness, or is this the calm before the TGE date of January 26, 2026? With the CyreneAI $SON token fair launch now live and listing just 10 days away, many experts are watching to see if this early dip is a warning sign or a perfect chance to buy.

Source: SON Official X

The asset is now officially holding its fair launch and SAFT fundraise on CyreneAI. Cyrene AI is an AI-powered platform built on the Solana network for the internet’s financial markets.

The token earns revenue through its DEX aggregator, decentralized governance system, gaming access and education tools, and blockchain network fees.

These income streams add real value in the project's ecosystem, which is important for the long-term direction of the Spur Protocol listing date and price.

According to the CyreneAI live chart, the SON price is currently trading near $0.0073 after falling almost 48% from its early peak. This drop mainly came from $SON airdrop season 1 selling and quick profit booking.

In low-liquidity markets, such moves are normal during pre-launch phases. The good sign is that it has started to stabilize between $0.006 and $0.007. This tells us that fewer people are panic selling and more buyers are starting to jump in.

Right now, the project has a market cap of about $37K and a daily trading volume of roughly $0.08M. Since it is still a very small token, even small trades can make the Spur Protocol price move up or down very quickly.

The growing number of people using the asset is one of its best signs of success. In only 10 months, the project has reached:

500,000+ registered and verified users

90,000+ people using it every single day

400,000+ community members around the world

20+ partnerships with big names in the industry

These numbers prove that people are actually using the platform and finding value in it. If this activity converts into higher on-chain usage after TGE, it can support stronger stability for the Spur Protocol price prediction 2026 over time.

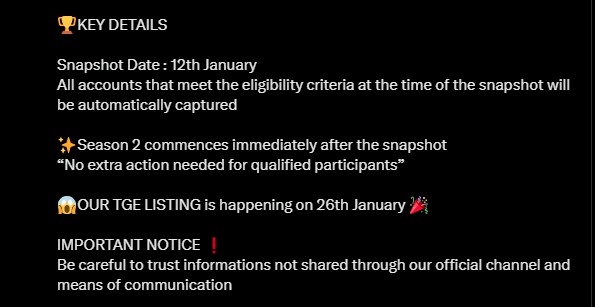

The snapshot was taken on January 12, with airdrop eligibility reduced to 100,000 points. If a user’s balance dropped, it means they qualified for Season 1.

If it stayed the same, they were not captured. Season 2 is now live and has been strengthened by the partnership with We Labs.

The team has confirmed that the $SON token launch date is scheduled for January 26. They also advised users to update the app to access the latest improvements and stay informed. All information should only be trusted if shared through official channels.

These updates directly affect short-term supply and demand, which keeps the Spur Protocol price highly sensitive before listing.

Based on CyreneAI data and current volume behavior, earlier predictions of $0.058–$0.080 are no longer realistic. The updated ranges as per Coingabbar’s cryptocurrency experts are:

Bullish Spur Protocol listing price : $0.012 to $0.020

Base case: $0.008 to $0.012

Bearish: $0.0035 to $0.0050

From the current $0.0073 level, a move to $0.012–$0.020 offers a 60% to 170% upside. That is strong but still realistic for a micro-cap token like $SON. Any move above $0.02 would need heavy volume, strong liquidity, and major exchange backing, including Binance, OKX, MEXC, ByBit, and more.

The Spur Protocol price for listing day and beyond is now in a critical phase. SON has found early support after heavy selling, while Airdrop Season 2 and the January 26 TGE are shaping fresh expectations.

Traders should note that, if activity and volume rise together, it could move towards the $1 range with a strong user activity and revenue model.

YMYL Disclaimer: This article is for informational purposes only and does not provide financial advice. Cryptocurrency investments are highly risky, and readers should conduct their own research before making any financial decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.