The global cryptocurrency market cap today is $3.95 Trillion, a 1.87% change in the last 24 hours. Total cryptocurrency trading volume on the last day is at $242.80 Billion. Bitcoin dominance is at +60.16% and Ethereum dominance is at +10.65%.

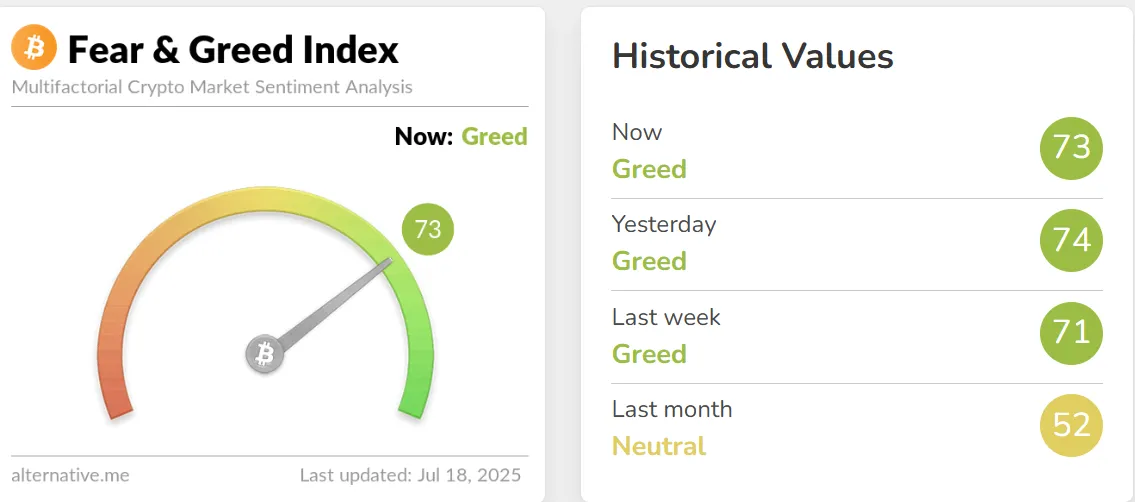

Over the last 24 hours, the "Fear and Greed Index." Presently holding at 73 on a scale ranging from 0 to 100, the current crypto market sentiment reflects a sense of optimism. With a brief spike into Extreme Greed one week ago, the sentiment of the cryptocurrency market has remained steadily in Greed over the past month.

With a strong technical momentum and an increase from institutional buying and selling, Bitcoin rose +0.77% to $119,589 in a single day.

Ethereum surged 2.78% in the last 24 hours and is currently trading at $3,468.89 USD. Technical momentum, institutional treasury tactics, and altcoin-favoring factors all contributed to Ethereum's surge.

XRP soared 14.9% in 24 hours to $3.49, boosted by advances in US crypto legislation and technical momentum.

Tether's capitalization climbed by +0.20%, while USDC increased by +1.95% in the last 24 hours.

Caldera (ERA) massively surged 94.8% in a single day as a result of major exchange listings, airdrop incentives, and volatile trading linked to its modular blockchain ecosystem. Caldera's current price is $1.64 USD, with a 24-hour trading volume of $1,352,282,100 USD.

The three most popular cryptocurrencies right now are XRP, Caldera, and Pump.fun. The price of XRP changed 14.7%, Caldera changed 94.8%, and Pump.fun changed 15.0% over the last day.

Other well-known cryptocurrencies, such as Solana ($SOL), Dogecoin ($DOGE), and Binance ($BNB), saw impressive rises.

Breaking News: Three crypto bills have passed the House: the Clarity Act (294-134), the Genius Act (308-122), and the Anti-CBDC Act (219-210), with the GENIUS Act set for President Trump's signature tomorrow.

In the last three hours, the Bitcoin OG deposited 40,192 $BTC ($4.77B) to GalaxyDigital, leaving 80,009 $BTC ($9.46B) in total.

US President Trump is preparing an executive order to permit 401(k) plans to invest in alternative assets like cryptocurrency, gold, and private equity, opening up the $9 trillion retirement plan, instructing regulators to assess barriers, and considering a safe harbor.

SharpLink Gaming has increased its ATM offering from $1 billion to $6 billion under an amended agreement with A.G.P., including forward sales, primarily for purchasing ETH and remaining funds for corporate and marketing purposes.

Coinbase will list Caldera (ERA), an ERC-20 token on the Ethereum network, under the Experimental label, focusing on high-performance, customizable Layer 2 blockchains, with the ERA-USD trading pair set to launch later today.

Bit Origin, a Nasdaq-listed company, is launching a Dogecoin treasury strategy to raise $500 million through equity financing and convertible bonds. The company plans to use Dogecoin as a primary asset, becoming one of the first public corporations to do so. Bit Origin has completed its first $15 million financing tranche.

A US-China Business Council survey shows that 52% of US companies do not plan to make new investments in China, a significant increase from 20% last year. The survey covers major US multinationals, with over 40% generating at least $1 billion in revenue in China last year. Additionally, 27% of firms have moved or plan to move operations out of China, the most since 2016. Trump's trade war is reshaping the global economy.

The crypto market is gaining traction, fueled by institutional investment, favorable laws, and rising sentiment. Investors are keeping a close eye on Bitcoin as it approaches $120,000 and alternatives like Ethereum and XRP register double-digit gains. Political developments in the United States, such as new crypto-friendly laws and executive decisions, are boosting worldwide optimism.

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments are for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.

3 months ago

GooD