Hyperliquid crypto news is creating a buzz in the crypto market today, but what is it about? Its total assets under management (Hype AUM) have now reached $6.2 billion, crossing $6 billion for the first time in history.

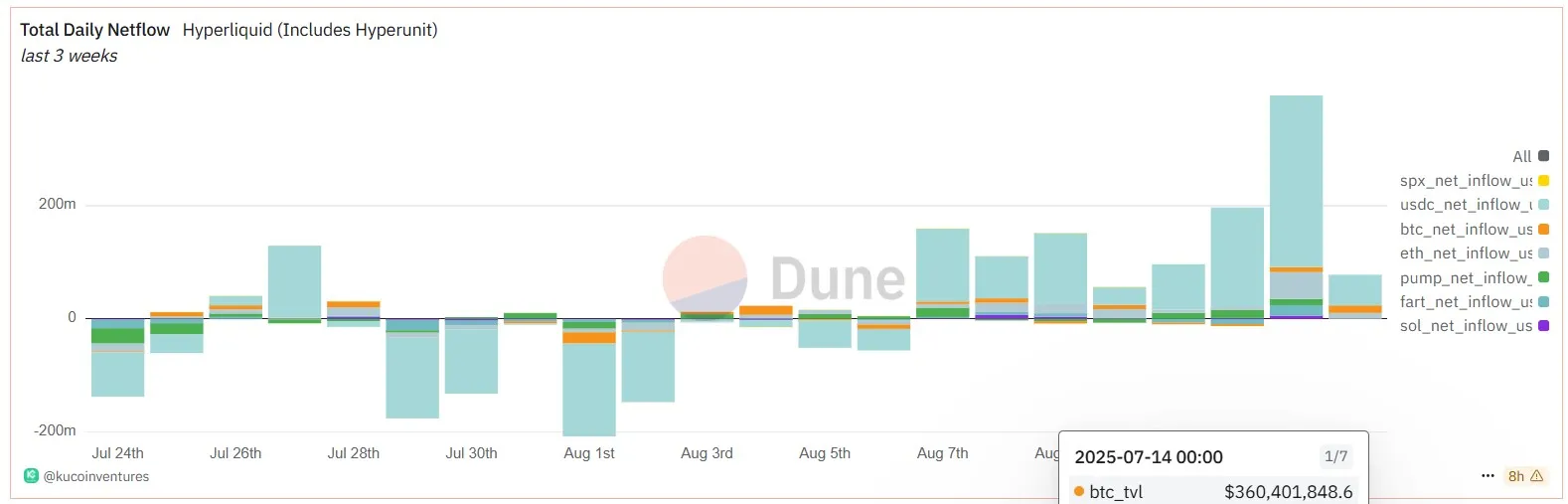

On August 13, $HYPE breakout saw $395 million net inflow, including $304 million in USDC and about $47.6 million in ETH giving a strong support to Hyperliquid price analysis today.

This is the largest single-day deposit in the token’s history and shows strong interest from investors across the market. The inflow chart given below clearly shows a huge spike, with light blue (USDC) and green (ETH) bars standing out as the tallest on the graph.

Source: Kucoin Ventures Hyper

Now the question comes: Where is the money going?

The Hyperunit TVL chart shows in mid-August, a lot of money moved to BTC, ETH, and Pump, which means traders are using stablecoins to trade more actively.

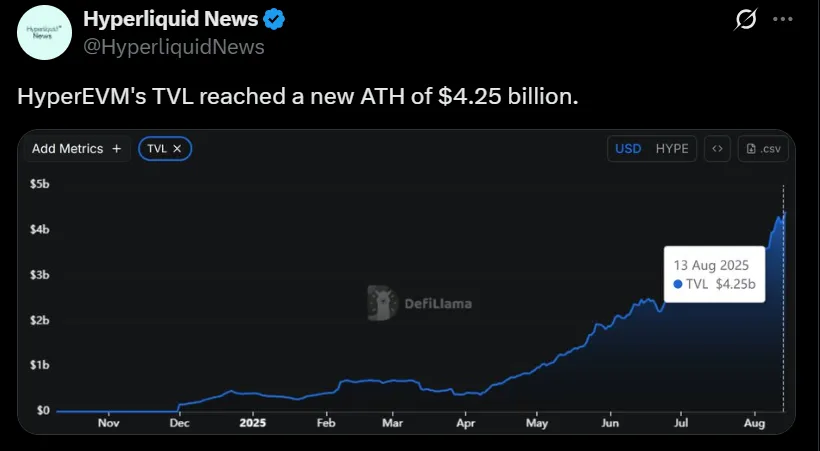

Hyperliquid news account on X also shared that HyperEVM’s TVL reached $4.25 billion, a new all-time high. This shows that the platform is growing fast, and this growth can affect $HYPE price prediction positively.

Right now, the token is trading at $46.69, up 2.98% in 24 hours. The trading volume in the last 24 hours is $556.53 million, which is 26.9% higher than before.

Recently, it went from around $40 to almost $48, then faced a small sell-off, as seen in the TradingView chart.

Important signals investors should watch:

RSI: 60.35 – still safe to go up, not overbought.

MACD: Shows green bars, which is a sign of upward momentum.

Being a crypto analyst this brings me to a key note: This chart reading makes the current price analysis positive, and the token may test its $HYPE ATH soon.

Here are the main reasons for the for today’s price surge:

Historic net Inflow: The $395 million deposit on August 13 is the biggest ever, giving a strong boost to the price.

Altcoin Rally 2025 : Searches for “altcoin” are the highest since 2021. Experts say altcoin market caps are breaking big trend lines. This alt season rally often helps tokens like this to follow up.

Bitcoin’s All-Time High: $BTC reached $124,000, pushing Ethereum close to $5,000. This makes altcoins like $HYPE rise along with the market.

Bullish Case: If the token stays above $46, then it can reach a target between $48-$50 breaking its all time high of $49.

Bearish Case: If the coin gets rejected at $48-50, then price may fall back to $44-45

Note: If the trading volume stays strong, this price prediction can even match expert forecasts of $55-$57 in the upcoming run.

Strong Hyperliquid price analysis, growing interest in altcoins, net inflow hitting record, and technical signals are all aligning for a big breakout. Investors should keep an eye on the support and resistance levels, because a clean close here may push the price toward $55–$57 breaking HYPE ATH soon .

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.