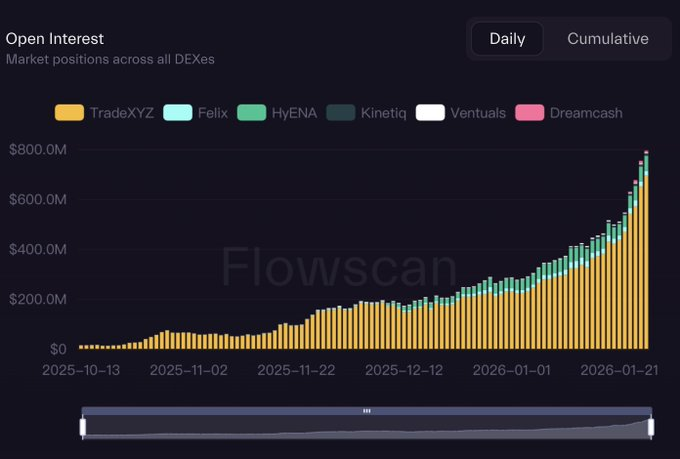

Hyperliquid News is getting massive attention after the platform reached a significant liquidity milestone. The decentralized exchange has now officially broken past $790 million in open interest for its HIP-3 markets.

This is a significant indicator of how quickly the network is growing and how robust its trading volumes have become. Within a month, the HIP-3 open interest has increased from $260 million to $790 million.

This liquidity milestone is being seen as a turning point for decentralized trading. Founder Jeff Yan shared that Hyperliquid has quietly become the most liquid venue for crypto price discovery globally.

According to his comparison, Hyperliquid’s BTC perpetuals now show tighter spreads and deeper order books than Binance. This is a bold claim and highlights the strength of the Hyperliquid blockchain infrastructure.

Source: X (formerly Twitter)

HIP-3 markets enable developers to create permissionless perpetual trading pairs on the network by staking tokens. These markets include real-world assets and financial instruments. Recently, silver perpetuals emerged as the star performer, topping the list with $141 million in open interest and close to $1 billion in trading volume.

The rising trade of commodities has also helped the total HIP-3 open interest reach a new all-time high. The Hyperliquid HIP-3 DEX model is attractive to traders who seek high-liquidity markets that are not governed by any centralized institution.

Source: X (formerly Twitter)

The sub-second execution speed, 50x leverage, and the absence of KYC processes make it a very tough competitor to CEXs.

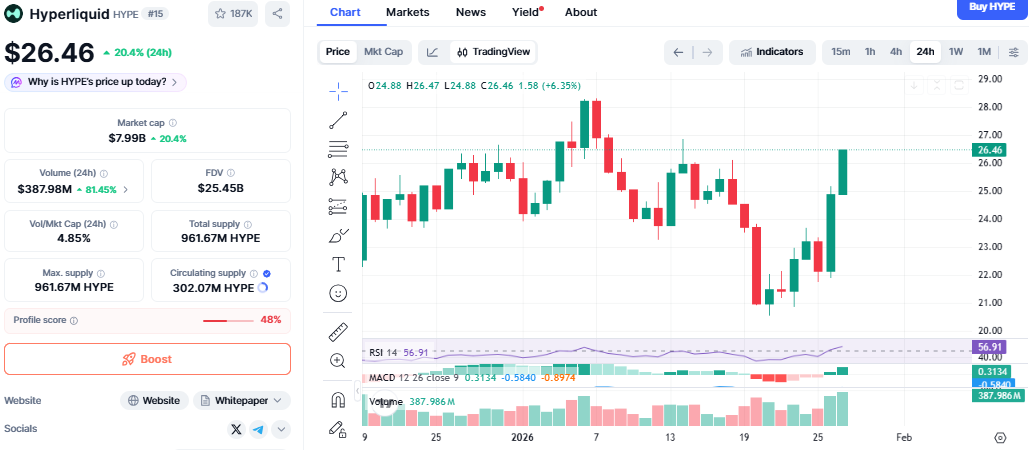

The effect of this trend is evident on the HYPE token. It is close to $26, having surged by 20% in the last 24 hours as per the CoinMarketCap. This price increase is much more robust than the overall crypto market, which has increased by only 1.4% in the same period.

Source: CoinMarketCap

HYPE price today reflects strong confidence from traders. Influencers like Will Clemente III called this development “the biggest story in crypto,” highlighting how fast the platform is redefining decentralized trading. The rise in open interest, liquidity depth, and trading volume is creating solid demand for the Hyperliquid HYPE token.

Another important factor behind this rally was a major whale repositioning. A large trader closed $126 million in BTC and ETH longs, accepting a $9.73 million loss. This reduced leverage risk and removed the pressure of forced liquidations.

Such actions often clean the market structure. In this case, it helped build confidence and allowed fresh buyers to step in. This event supports the idea that the HYPE crypto news cycle is now driven by fundamentals, not only speculation.

The Hyperliquid network sends 97% of protocol fees to buy and burn HYPE tokens. When volume increases, demand for HYPE rises automatically. With HIP-3 markets generating massive activity, fee revenue is accelerating.

This creates a strong economic loop. More users bring more volume, which increases token demand and supports long-term price strength.

HYPE price prediction remains bullish in the short term.

Bullish Case: If HYPE holds above $24.60, it can challenge resistance near $26.46, followed by $28.20. A strong breakout could even push prices toward the $29–$30 zone.

Bearish Case: If volume weakens, consolidation between $24.50 and $26.50 is likely. A daily close below $24.50 would weaken the bullish outlook. Overall, market structure supports continuation rather than reversal.

This liquidity milestone shows that decentralized exchanges can outperform centralized platforms in real execution quality. The Hyperliquid blockchain is becoming a serious backbone for both crypto and traditional finance trading.

YMYL Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing in crypto tokens.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.