The HYPE token has experienced a complete recovery from its previous state, showing an 11% increase in daily value after weeks of low activity.

Traders now face a critical decision which arises from three factors: whale trading activity increases, derivative market activity rises, and the price approaches major resistance levels. Is HYPE preparing for a real breakout, or just another short-lived bounce?

The current price movements will determine whether Hyperliquid completes its corrective phase or stays within its current range.

Let’s break down what the charts, whales, and on-chain data are telling us next.

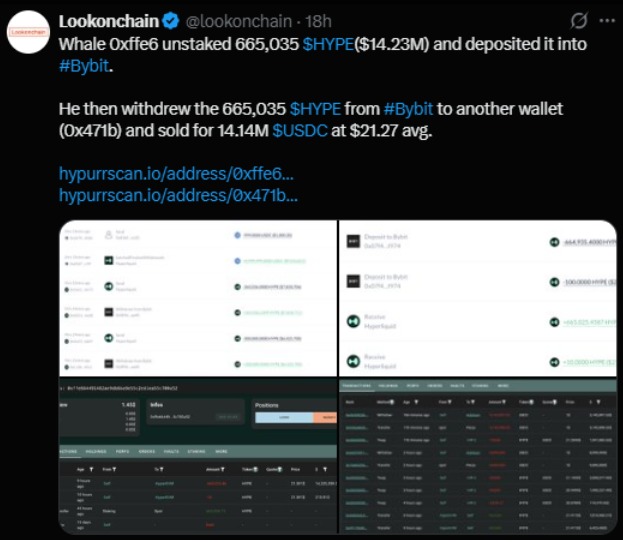

The latest on-chain analysis shows that significant HYPE holders have resumed their trading activities, which usually indicates an upcoming market shift. The whale selected Bybit as his trading platform after he purchased 665,000 tokens, which had a market value of $14.5 million when he acquired them at the $11.5 price and used staking during the price drop.

This action represents profit-taking throughout lucrative times instead of emergency asset liquidation during challenging periods. Whales distribute their assets when market conditions become stable because they must meet their operational requirements through rising liquid assets.

The ongoing whale activity shows that HYPE holders are accumulating their assets to access yield-based incentives, which shows that strategic investors consider Hyperliquid as an asset with long-term value instead of a temporary investment.

The price rebounded strongly from the $20 support level, which has now brought it to the upper boundary of a descending channel that has controlled price action for months. HYPE trades at $23.11, which positions it close to the major resistance level at $24.

The zone functions as a crucial point that determines the future direction of the trend. A breakout above the $24 resistance level would create a new structure, which would lead to the end of the ongoing corrective period.

The token will remain within its current price range if this level experiences rejection. The price has reached its current level due to market forces that link both price points.

Technical indicators are beginning to align with the improving price structure. The Stochastic RSI has started to rise from its oversold position, which indicates that short-term market strength is returning to buyers.

As per CoinGlass, the derivatives data support the current trend. Open Interest has surged to $1.82 billion, while trading volume jumped 29.20%, suggesting fresh participation rather than low-liquidity price movement.

The signals indicate that momentum will reset, which increases the chances of an important market movement in the upcoming trading sessions.

Hyperliquid will reach its next price targets after it successfully breaks and maintains its position above $24.

$30 – First major psychological resistance

$40 – Upper target if bullish momentum sustains

The situation will validate a breakout, which will reverse the overall trend back into bullish territory.

On the downside, failure to clear $24 could keep HYPE trading between $20 and $24, allowing the market more time to build strength before its next attempt.

Disclaimer: The content on this page is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments are highly volatile and involve significant risk.

Always conduct your own research (DYOR) and consult with a licensed financial advisor before making any investment decisions. The authors and publishers are not responsible for any profits, losses, or damages arising from your use of this information.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.