The Hyperliquid price surge has left the crypto market stunned as the HYPE token broke the $34 barrier. Within the last 24 hours, HYPE has increased by over 24%, which is a clear indication that it has beaten the broader crypto market. This strong move has pushed Hyperliquid’s market cap close to $10 billion and placed it among the most talked-about projects right now.

One of the biggest reasons behind the Hyperliquid price surge is the upcoming Kraken spot listing. Trading for HYPE on Kraken starts today at 15:00 UTC. A listing on a major exchange usually brings new buyers, more liquidity, and higher trust. Even before trading begins, large investors are stepping in. One wallet recently bought HYPE worth $9.8 million, showing strong confidence in the project.

Source: X (formerly Twitter)

The hyperliquid kraken listing is important because Kraken brings retail traders and institutional exposure. Many investors prefer buying tokens on regulated exchanges. This listing gives it wider visibility and stronger credibility.

That is another reason why the price surge looks stronger than a normal rally.

Another major driver of the Hyperliquid price surge is HIP-3. This feature allows traders to create permissionless perpetual markets, not just for crypto but also for real-world assets like silver and commodities.

On 27 January, Silver trading volume crossed $1.2 billion in a single day. That is massive.

This indicates that traders are utilizing the platform for actual trading purposes, not just for speculation.More trading means more fees are generated on the platform.

The network utilizes a maximum of 97% of the fees to buy back and burn HYPE tokens. This helps to reduce the supply of tokens and is a great way to ensure that the price is strong in the long run. That is why many traders see the rise as being backed by real usage, not speculation.

The price rally was also boosted by a strong short squeeze. In the last 24 hours, over $25 million worth of Hyperliquid HYPE futures were liquidated. Around 93% of these were short positions.

When shorts get liquidated, traders are forced to buy back the token. This sudden buying pushes the price even higher. It creates fast and powerful moves, which is exactly what happened here.

Source: CoinMarketCap

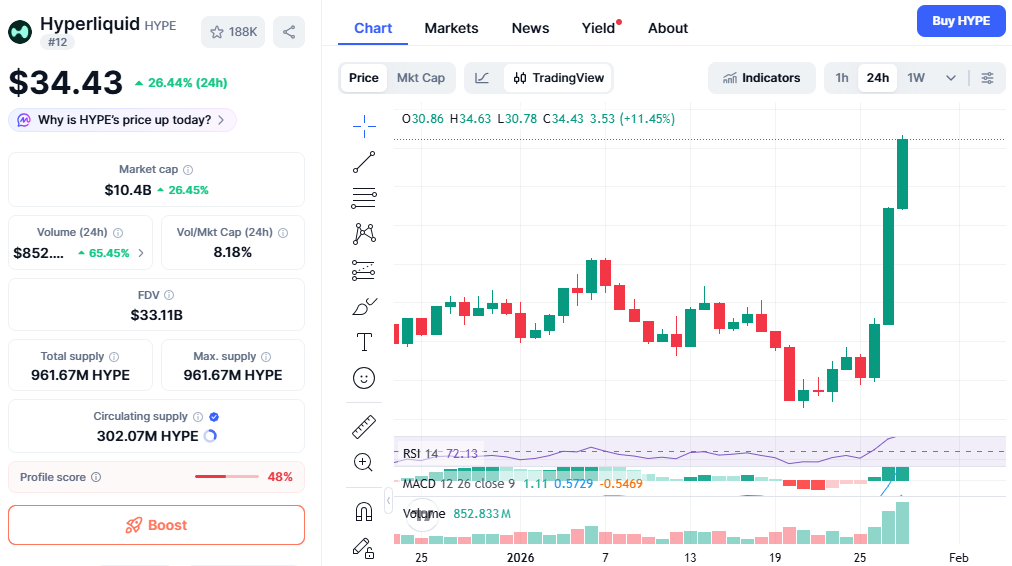

Key indicators:

RSI is near 78, showing strong buying but also short-term overheating

MACD has turned positive, confirming bullish momentum

20-day moving average near $24.70 now acts as strong support

As long as price stays above $30, the structure of the rally remains bullish.

Short-term Hyperliquid price prediction:

Bullish case: If volume stays strong, it could move toward $38–$40.

Base case: Price may stay between $32–$36 as traders take some profits.

Bearish case: If selling pressure rises, a pullback to $30 is possible.

Even if price drops slightly, the momentum remains healthy as long as $30 holds.

The $HYPE price rally is supported by:

Real trading activity from HIP-3

High commodity trading volumes

Token buybacks and burns

A major Kraken listing

Strong technical breakout

However, RSI shows the market is overbought. Small pullbacks are normal after such fast moves. Long-term strength depends on whether HIP-3 volumes stay high and whether new users keep joining.

YMYL Disclaimer: This content is for informational purposes only and not financial advice. Cryptocurrency investments are highly risky; always do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.