The Trump tariff on India isn’t just another headline—it’s a geopolitical earthquake in today’s headline.

Out of nowhere, President Trump has imposed a brutal 50% tax on multi-faceted nation goods, accusing the country of backing Russia through energy imports. This isn't diplomacy—it's a direct hit.

For the first time, the U.S. President is linking trade policy to global alliances in the Ukraine war. So, is this the start of The US India trade war 2025?

Here’s what’s coming next and how it will impact both the countries.

This Trump tariff latest news is breaking the headline today, as he has imposed a 50% tariff on imports—citing the country’s ongoing oil trade with Russia as the cause.

As per The Kobeissi Letter's post on X, the decision comes after months of rising tensions and crumbling trade negotiations between both the countries.

The move marks a sharp shift in U.S. foreign policy, as Donald makes the other country the primary target of his revived tax agenda, a spot previously held by China.

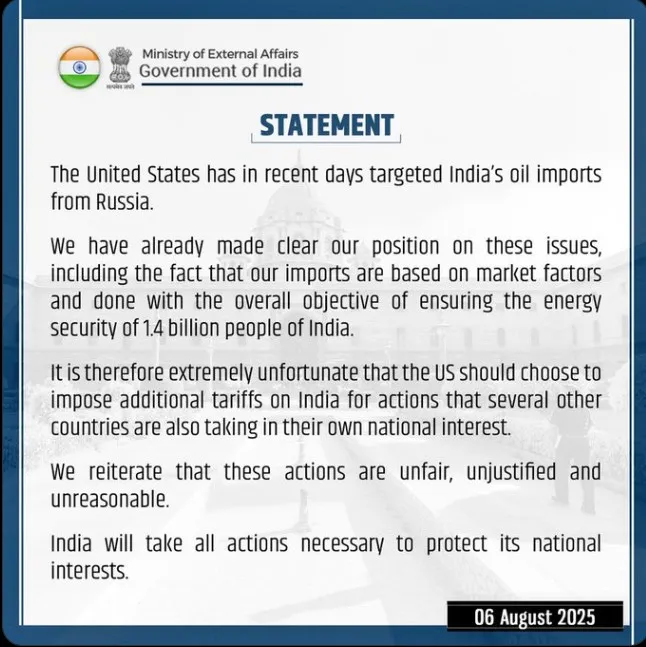

The nation didn’t stay silent. On August 6, the Ministry of External Affairs issued a statement via MyGovIndia twitter account, calling the U.S. decision “unjustified and based on flawed logic.”

They clarified that its energy ties and imports are purely market-based, serving the vital needs of over 1.4 billion citizens. The statement emphasized that other global economies are also buying Russian oil and that targeting us alone reflects a biased narrative.

Response: "We will take all necessary actions to protect national interests," the ministry said—indicating that retaliatory trade steps could follow.

Until recently, the business relations were nearing a landmark agreement. But the tone changed dramatically on July 30, when the President of the US accused the other nation of “supporting Russia’s war agenda.”

Today on August 6, the officials made it clear they will not bow to pressure, vowing to continue Russian oil imports. This triggered Trump Tariff decision of 25% penalty, in addition to existing duties—totaling a massive 50% import tax on multi-faceted country goods.

This dramatic turn of events now threatens the $190 billion annual trade corridor, raising fears of an economic decoupling.

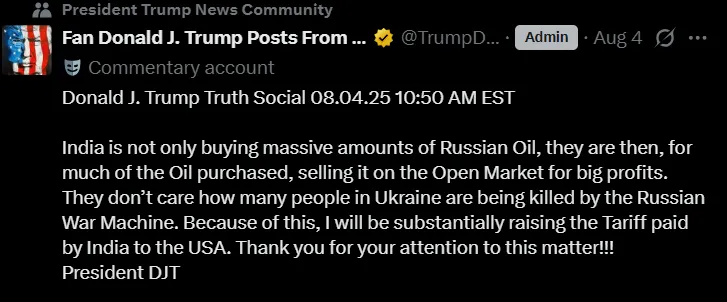

At the heart of the Trump tariff on India issue lies its growing reliance on discounted Russian oil, especially after the 2022 Ukraine conflict began. Despite U.S. calls to reduce energy ties with Moscow, their volume of Russian crude imports hit a record high in 2025, according to data from Bloomberg and S&P Global.

Source: Truth Social X Post

Donald’s administration sees this as “economic support to Russia”, while the other country frames it as “energy sovereignty.” The divide is both political and philosophical.

With the 50% Trump tariff on India now active, many analysts say this country has become the new frontline of Donald’s business war. From pharmaceuticals to textiles, major export sectors of the other country may now suffer billions in losses.

Now, whether the multi-faceted Nation retaliates or doubles down on Russia ties remains to be seen. But for now, one thing is clear: This business relationship between both the nations has entered dangerous new territory.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.