India’s crypto regulation framework took a major step forward in financial year 2024–25, as 49 cryptocurrency exchanges officially registered with the Financial Intelligence Unit of India (FIU-IND) under anti-money laundering laws.

Out of these, 45 exchanges are India-based, while 4 are offshore platforms, highlighting how both domestic and global players are being pulled into India crypto compliance net.

Source: CryptoIndia Official

Some of the major native registered names include CoinDCX, WazirX, CoinSwitch, ZebPay, Mudrex, Unocoin, Giottus, Bitbns, BuyUcoin, Flitpay, etc

Four offshore networks – Binance and KuCoin are registered in 2024 after being fined, while Coinbase and Bybit in early 2025.

The data comes from FIU-IND’s annual report, and has also been reported by outlets such as The Economic Times.

Unlike some nations that have banned digital assets completely, India chooses a compliance-first framework:

Heavy taxation (30% tax + 1% TDS)

Strong AML (Anti Money Laundering) oversight via FIU-IND

Allowing operations only through registered entities

Since crypto exchanges were put under Prevention of Money Laundering Act (PMLA) in 2023, FIU registration for any platform running inside the country is compulsory. Registered platforms must:

Report suspicious transactions

Follow strict KYC and AML rules

Maintain transaction records

Cooperate with law-enforcement agencies

Non-compliance can now lead to fines, show-cause notices, website blocks, and service bans.

During the 2024–25 financial year, FIU-IND charged ₹28 crore ($3.37 million) in penalties on cryptocurrency exchanges that failed to meet rules under the PMLA, 2002. While some investigations also linked non-compliant platforms to hawala networks and terror-funding risks, underlining why enforcement has intensified.

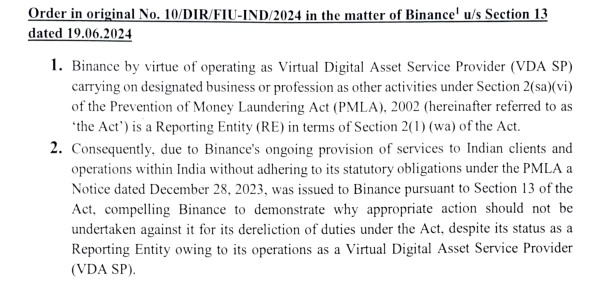

The well-known global platforms were the most significantly fined exchanges. Binance was fined ₹18.82 crore ($2.27 million) in June 2024 for operating in the nation without registration. The exchange later paid the fine, registered with FIU-IND, and resumed services.

Source: fiuindia Official

Bybit Fintech Limited was fined ₹9.27 crore in January 2025 for similar violations. Smaller penalties on platforms like KuCoin and others contributed to the total ₹28 crore figure.

Even after facing the strict compliances, why platforms still want to work in the country is the question many traders search. While the platforms have to follow the rules, paying taxes and penalties, India is one of the largest digital trading marketplace for them.

The young and huge population, interested in cryptocurrencies, drives their profit portfolio up to ten times higher than what they are being charged. The country ranks in the crypto adoption list, and no one wants to miss this big opportunity.

On the other hand, the country is also working towards its digital asset infrastructure enhancement, even if it is gradual.

India’s digital asset market is maturing fast. With 49 registered exchanges and ₹28 crore in penalties, FIU-IND has made it clear that crypto can operate in the country, but only under strict rules.

This strictness can move some traffic offshore, but it marks important safety measures:

Safer platforms with stronger compliance for users

Reduced risk of fraud and illicit activity

More transparency in exchange operations

Following the similar measures, the rules are developing on the global levels. The EU’s MiCA regulation already covers the region, while the US introduced a stablecoin law, GENIUS Act, in 2025. Singapore, UAE, and Hong Kong are licensing exchanges.

Over 100 jurisdictions now regulate crypto in some form, highlighting the importance of being regulated. FIU-led model fits into this global shift toward structured oversight instead of unchecked growth.

Disclaimer: This article is based on publicly available regulatory disclosures and official reports.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.