India crypto TDS collections saw a sharp rise in Financial Year (FY) 2024–25, showing stronger government tracking of digital asset activity.

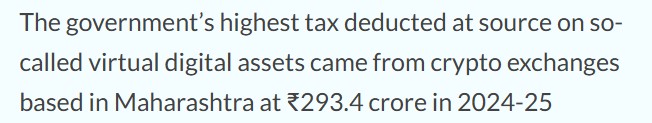

According to data from the finance ministry, India crypto TDS collections jumped 41% year-on-year to ₹511.83 crore ($57 million) in FY25, compared with ₹362.70 crore ($40.34 million) in financial year 2024. This tax is deducted at source on every virtual asset transaction to help authorities track trading activity in real time.

Source: Hindustan Times

Maharashtra-based cryptocurrency exchanges contributed the most, with ₹293.40 Cr. (+30.63%) in tax deduction during financial year 2025. Karnataka followed with ₹133.94 crore (+63.4%), while Gujarat recorded ₹28.63 Cr, a slight decline of 2.3%.

Capital city, Delhi, ranked fourth, collecting ₹28.33 Cr., a sharp rise from the previous year.

These figures reflect where exchanges are registered, not where trades actually take place.

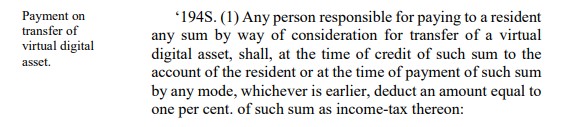

The 1% TDS rule, introduced in Union Budget 2022–23 under Section 194S, applies to all cryptocurrency transfers to help the government monitor transactions in real time. Income from virtual digital assets (VDAs) is taxed at 30%.

Between FY23 and FY25, total India Crypto TDS collections crossed ₹1,096 cr ($122 million). While Indian exchanges largely comply, overseas platforms serving Indian users remain under scrutiny.

The government has also acted against 18 digital asset exchanges for alleged GST evasion worth over ₹824 cr, and 44,000 notices were sent to unreported crypto investors.

India continues to dominate as the #1 in cryptocurrency adoption. Adoption is now expanding beyond metros, with Tier-2 cities contributing 32.2% of users and Tier-3 and Tier-4 cities 43.4%. The tax deduction growth is closely linked to this wider digital asset participation.

This mass adoption, still in the absence of clear regulatory and heavy taxes, shows the strong belief of the country’s population in the virtual products.

In response to this acceptance, the government is also putting efforts towards a clear legal framework for cryptos. While the RBI, the central Bank of Country, still denies cryptocurrencies as a legal asset, some indirect laws and acts are already there in the country’s rule book while some direct ones are yet to pass.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.