Indian cryptocurrency sector is asking the government to cut high taxes and set clear laws. Industry leaders say the government is finally listening after Donald Trump’s return to the U.S. presidency and his support for digital assets. However, India’s Supreme Court is also pressing the government to act fast, warning that delays are causing fraud and confusion.

In 2022, India implemented strict taxes: a 30% tax on the profits earned (capital gains), while a 1% tax on every crypto trade (TDS). These rules were meant to stop illegal activities but ended up pushing more than 90% of cryptocurrency trading offshore, according to a study by the Esya Centre.

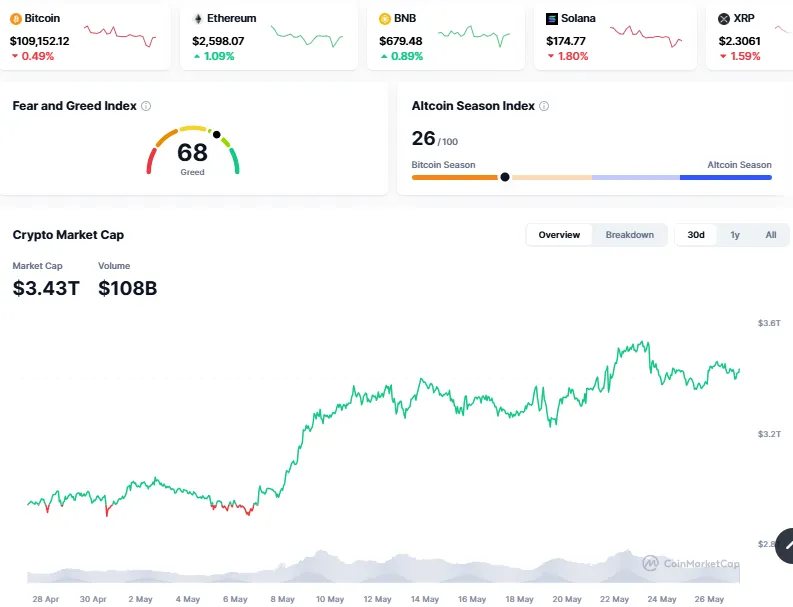

Ashish Singhal, co-founder of CoinSwitch, called the taxes “very harsh” and said a lower 0.1% transaction tax could still assist track trades without hurting users. It is one of India’s largest cryptocurrency platforms, having more than 20 million users. The global cryptocurrency market currently has the market cap of $3.43 Trillion and trading volume of $108 billion. The major digital currencies like Bitcoin and Ethereum have seen an upward move in the prices within the last 30 days as per the CoinMarketCap.

Source: CoinMarketCap

Industry leaders say India’s attitude toward crypto has become more open after Donald Trump returned to the White House. Trump’s positive view of digital currencies has encouraged Indian policymakers to talk more with crypto businesses.

Ashish Singhal, founder of CoinSwitch noted that meetings between the industry and government, which used to organise two times a year, now happen every month or even weekly. This increasing engagement is giving hope to the organisations like Binance and Coinbase, that are trying to re-enter the Indian market after stopping operations due to strict rules.

Grant Thornton stated, the cryptocurrency market is expected to grow more than $15 billion by the year 2035 if the appropriate policies are in place. It was worth $2.5 billion last year as reported by the Reuters.

While the industry lobbies for tax reform, the Supreme Court of the nation has taken a tough stand on the lack of cryptocurrency laws. During a bail hearing for Shailesh Bhatt, accused of fraud in multiple states, the Court questioned why the central government hasn’t introduced proper regulations yet.

The Court reminded the government that it had asked for clear laws two years ago, but nothing has been done. It warned that without rules, fraud and scams will continue to grow.

The Supreme Court rejected the idea of banning cryptocurrency. The judges said banning it would be like “shutting eyes to reality.” Instead, they asked the government to create strong laws to prevent misuse. Right now, in digital assets isn’t banned, but it also isn’t officially recognized or protected under law.

Senior lawyer Mukul Rohatgi pointed out that trading crypto is not illegal. However, without rules, users have no legal safety, and many get caught in scams like the GainBitcoin fraud, which promised fake returns and sold worthless tokens.

Without proper rules, India’s crypto scene is facing serious problems. Many cryptocurrency startups are leaving the country to build their businesses where laws are more supportive. At the same time, people are losing money in scams because there’s no legal protection. The government is also losing out on tax money it could have collected with a better system. All of this is shaking public trust in digital assets.

Last year, Indian authorities even blocked major global exchanges like Binance and KuCoin for not meeting local requirements. Until then, crypto in India remains stuck in a grey area, taxed, but not fully recognized or regulated.

This demonstrates the loopholes existing in the system. The Supreme Court demands proper rules from the government for the crypto industry without delay. The next court hearing is on May 30.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.