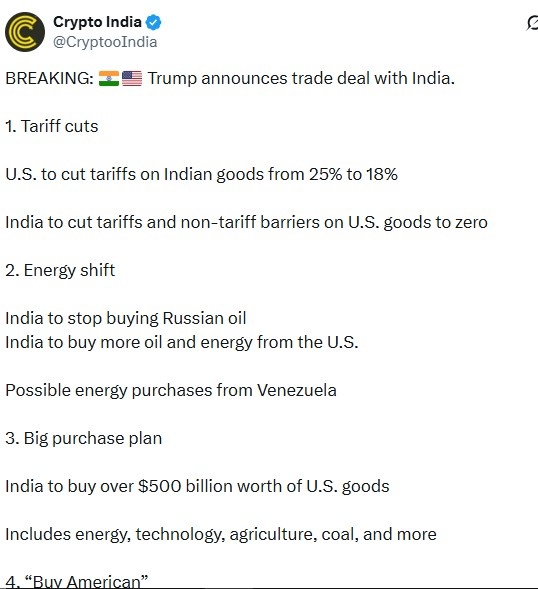

The recent India–US Trade Deal marks a clear turn toward macro stability. Under the new terms, US tariffs on Indian exports have been lowered to 18%, a sharp improvement from the 25% rate and a major reversal from last year’s peak levels near 50%.

For global markets, this is not just a trade headline. It removes a key layer of uncertainty that had weighed on risk assets, including crypto. Lower tariffs reduce supply-chain friction, ease inflation pressure, and improve cross-border capital flow expectations — all factors that influence digital asset sentiment.

Source: X official

A critical part of the agreement lies in energy and strategic alignment. India has agreed to halt Russian oil purchases and shift imports toward the US and potentially Venezuela. This move aligns with broader global efforts tied to the Russia–Ukraine War, which has already caused massive economic disruption and loss of life.

From a crypto perspective, energy stability matters more than it appears. Predictable energy pricing reduces volatility in mining economics and lowers the risk of sudden cost shocks. In parallel, India’s commitment to buy $500 billion worth of US goods, spanning energy, technology, agriculture, coal, and industrial inputs, signals long-term capital movement rather than short-term commerce balancing.

Large, predictable capital flows support global liquidity — a core driver of crypto cycles.

Just one week earlier, India finalized a landmark trade pact with the European Union, widely described as the “queen of all deals.” Under that agreement, India committed to cutting tariffs on 96% of European goods, while Europe agreed to reduce duties on 99% of Indian exports.

Taken together, the US and EU agreements position the country as a central commerce bridge between major economic blocs. For crypto markets, this matters because synchronized global growth reduces the probability of aggressive monetary tightening — a condition that historically suppresses risk assets.

Crypto does not react only to blockchain-specific news. It responds strongly to macro signals, liquidity conditions, and geopolitical stability. These trade deals contribute to a risk-on environment, even if the impact is gradual.

For Bitcoin, improved macro clarity helps defend key support zones by reducing panic-driven selling. For the broader cryptocurrency market, the effect is more structural: smoother capital flows, better investor confidence, and a stronger foundation for future upside catalysts such as ETF inflows or rate adjustments.

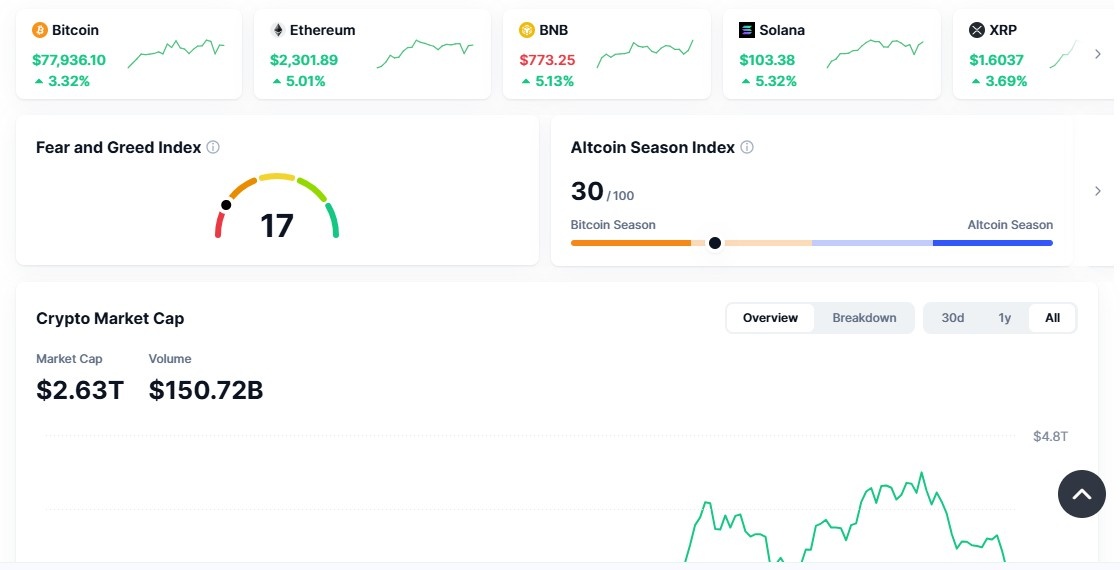

Today’s crypto market action shows a clear and direct reaction to the India–US Trade Deal. As news of tariff cuts and easing business tensions spread, investor confidence improved across risk assets. The total crypto market cap has risen by 3.8%, pushing overall market value to around $2.64 trillion, a sign that fresh capital is flowing back in rather than staying on the sidelines. This positive mood is also visible in Bitcoin, which has jumped 4.31% in the last 24 hours and is now trading near $78,378.14. For many investors, the trade agreement signals lower global uncertainty and better liquidity conditions, making crypto feel like a safer bet today than it did just a few sessions ago.

Source: CoinMarketCap official

YMYL Description: This article explains how the India–US trade agreement has influenced global market sentiment and short-term price movements. It presents recent data on market capitalization and Bitcoin performance for informational purposes only and does not constitute investment, financial, or trading advice.

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.