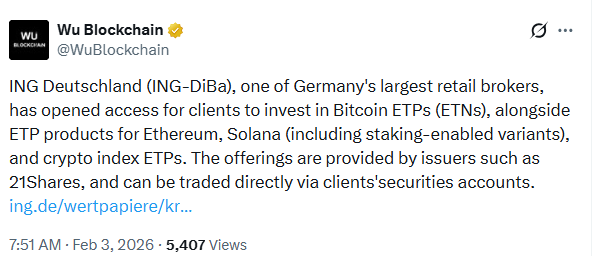

The way Germans invest in digital assets changed on February 2, 2026. ING Deutschland Crypto ETPs are now live for over 9 million people. This is a huge step for the crypto world. One of the biggest banks in Germany now lets you buy coins without the usual tech stress. You can now trade Bitcoin, Ethereum, and Solana right in your "Direct Depot" account. This means you do not need to learn about complex private keys or digital wallets anymore.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

By using ING Deutschland Crypto ETPs, the bank solves the biggest problem for new users: it makes things simple. You don't have to worry about losing a 24-word seed phrase. These products come from big names like VanEck, 21Shares, and Bitwise. They work just like a normal stock or ETF. This "human-first" style brings the safety of a bank to the new world of decentralized finance.

The launch of these regulated instruments follows a massive rise in digital asset interest. By late 2025, 9% of Germans were already using digital assets. Now, there is a safe and regulated way for everyone to join in.

The best part of ING Deutschland Crypto ETPs is how they fit into your life. You can see them right next to your regular savings.

All-in-One Account: Your virtual holdings sits next to your stocks and ETFs.

Solana Staking: Some Solana products offer "staking". This lets you earn a small reward (like interest) just for holding the asset.

Ready-Made Portfolios: You can also buy a "Market Index." This is like a basket of the top 10 coins, so you don't have to pick just one.

Many people pick ING Deutschland Crypto ETPs because of the tax perks in Germany. The 2026 rules from the BMF (Ministry of Finance) are very clear.

Tax-Free Gains: If you hold these assets for more than one year, you pay 0% tax on your profit.

Easy Reports: Your bank does most of the work for you. This is much easier than tracking trades on a small, unregulated exchange.

Digital assets prices can go up and down fast. However, ING Deutschland Crypto ETPs offer better protection. These are "physically-backed." This means the companies (like Bitwise or VanEck) actually buy and hold the real Bitcoin in safe, cold storage. This is much safer than keeping money on a platform that might not be regulated.

The move to offer these products shows that banks are finally embracing the blockchain. They are no longer fighting it; they are building bridges. This is perfect for "careful" investors who want to try new assets but trust their bank more than a new app.

In 2026, this will likely be the new normal. With MiCA laws now in place across Europe, the rules are clear. Banks that offer a great user experience and low fees will win. ING has taken the lead by making Bitcoin as easy to buy as a share of a big company.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.