The crypto industry is still debating the true cause of the 1011 crypto crash, one of the most violent market events since FTX. A public clash between OKX founder Star, Dragonfly partner Haseeb Qureshi, Binance’s CZ, and Ethena founder Guy Young has reopened questions around leverage, exchange responsibility, and systemic risk.

Key Highlights

OKX CEO associates the 1011 Crypto Crash with the Binance campaign and used loops.

Dragonfly disagrees with the timeline, terming the theory as factually flawed.

The alternative explanations are Binance API failure and market panic.

The 1011 crash is the name of the extreme volatility in the market and the cascading liquidations that took place on October 11, wiping out billions of leveraged positions on the leading crypto exchanges. Many insiders argue its impact rivaled — or even exceeded — the FTX collapse in terms of market structure damage.

Despite months of analysis, no single explanation has achieved industry-wide consensus.

Source: Wu Blockchain X

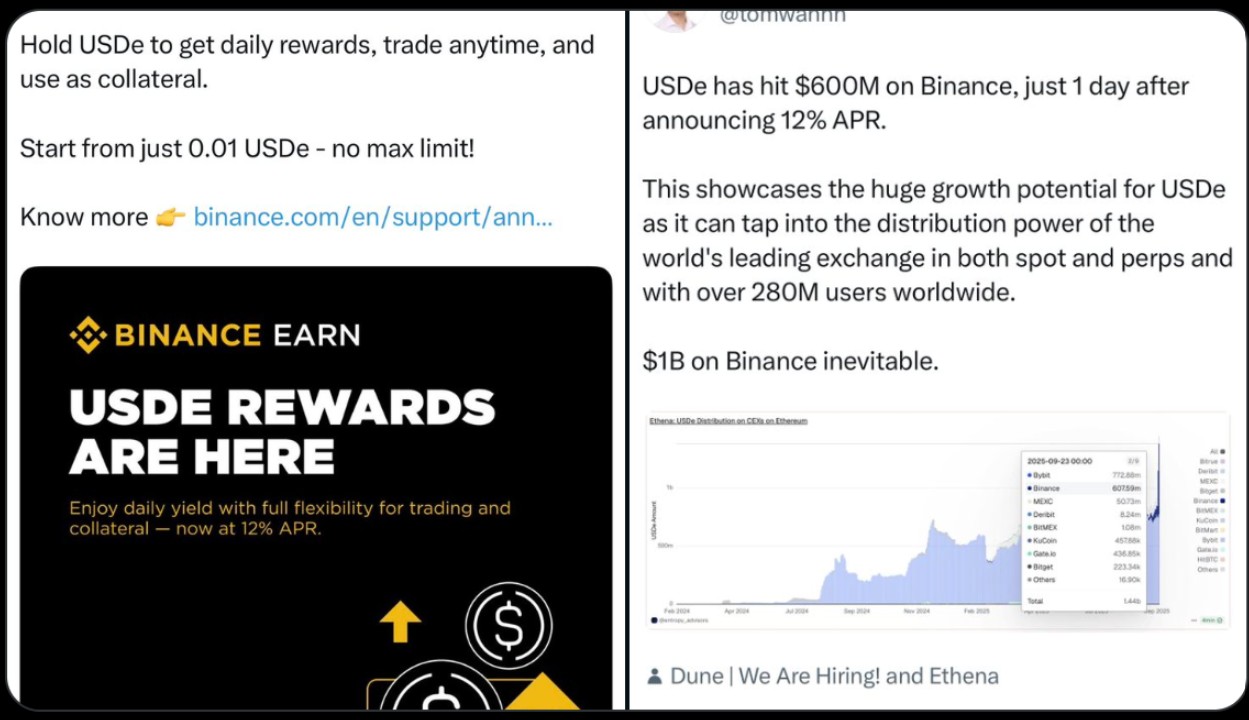

On 31st January post, Okx founder and CEO Star, claimed that the role of Binance in the 1011 crash was central to the management of USDe, which is a yield-generating stablecoin by Ethena.

Star claims that the problem that led to the crash at 1011 is the way Binance promoted and integrated USDe, a yield-producing asset by Ethena.

Key Claims from OKX CEO

Binance was providing temporary incentives of around 12% APY on USDe.

USDe was considered collateral to USDT and USDC.

As opposed to conventional stablecoins, USDe is a tokenized hedge-fund-like strategy, which is riskier.

The users were invited to take part in a leveraged loop, either explicitly or implicitly:

Convert USDT/USDC - USDe

Borrow USDT against USDe

Rebuy USDe and repeat

This cycle supposedly developed concealed systemic leverage, and thus, the market was weak. USDe's was short-livedly de-pegged when volatility struck, and this caused liquidation cascades, which exacerbated the crash at 1011.

Star stresses that this is not an assault on Binance, but a request of the industry giants whose product design may have an effect on the stability of the global market.

Haseeb Qureshi, a partner of Dragonfly, vehemently denied the story of Star, terming it as not consistent with the market data.

Why Dragonfly Disagrees?

BTC bottomed 30 minutesbeforeo USDe de-pegging, causingand effect to reverse.

USDe price deviation was seen only in Binance, but liquidation was seen worldwide.

Real systemic collapses (Terra, FTX, 3AC) permeated throughout all exchanges did not.

Haseeb also wondered why Star was raising these concerns months after, saying that information about the order books had been public.

Source: X

A more complicated, yet data-consistent, explanation of the 1011 was suggested by Haseeb:

Panic selling was caused by Trump and his threats of tariffs.

The 24/7 trading was the reason crypto markets plummeted.

The API of Binance is said to have crashed at the time of the highest volatility.

The makers were unable to redistribute inventory across exchanges.

Liquidations were aggravated by auto-deleveraging (ADL) systems.

There was no buyer of last resort and, as a result, altcoins collapsed quickly.

In contrast to traditional markets, crypto liquidation systems cannot stabilize themselves, and a crash is path-dependent and more difficult to contain.

The founder CZ, publicly concurred with the timeline argument presented by Haseeb, but removed his tweet. Ethena founder Guy Young also attacked Star, saying that the USDe price differences were experienced in the aftermath the loss.

Haseeb revealed the possible conflicts transparently:

Dragonfly invested in Ethena.

Binance exchange and OKX were also partners of Ethena.

OKX was an earlier investor in Dragonfly funds.

He stressed that it was a question of precision, and not loyalty.

There is still no single, simple explanation for the 1011 crypto market crash. The evidence suggests a convergence of panic, leverage, technical failures, and fragile market design rather than one actor alone.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.