The days of Bitcoin and Ethereum hogging the institutional spotlight are officially over. On Monday, January 26, 2026, the financial world shifted as VanEck rang the opening bell for the first-ever U.S. spot Avalanche ETF VAVX on the Nasdaq. For a long time, if you wanted a piece of Avalanche (AVAX), you had to navigate clunky exchanges and sweat over private keys. Now, you can buy it as easily as a share of Apple or Tesla.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

This isn't just another ticker symbol on a screen. The debut of the Avalanche ETF VAVX is a massive nod of approval for a network that’s been working behind the scenes to prove it’s more than just "another blockchain." While the broader market has been a bit of a roller coaster lately, VanEck’s move puts AVAX in the big leagues alongside Solana and XRP, which fought their way into the ETF club late last year.

What makes the Avalanche ETF VAVX actually interesting and not just a boring price tracker is the staking element. Usually, when you buy a crypto ETF, you're just betting on the price. But the Avalanche network is built on "proof-of-stake," which means the tokens themselves earn rewards just for existing and securing the network. VanEck is actually staking a portion of the fund’s holdings and passing those rewards back to the shareholders.

Think of it like a stock that pays a dividend. You get the potential price growth of AVAX, plus a little extra "blockchain "interest" on top. To get people through the door, VanEck is even playing the "no-fee" card. They’re waiving the 0.20% sponsor fee for the first $500 million that flows in, or until the end of February. It’s a classic Wall Street land grab, and it's great for early investors.

The timing here is pretty fascinating. If you look at the data, the Avalanche network is currently on fire. Last week, active addresses shot up by over 1,700% jumping from a quiet 30,000 to over 600,000. Big names like KKR are starting to put real-world assets on the chain, and even the California DMV is using it for vehicle titles.

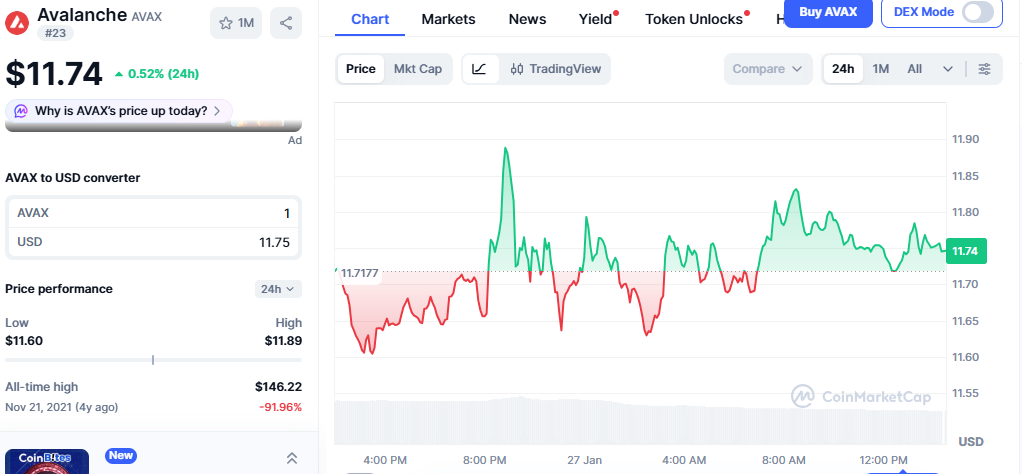

Source: CoinMarketCap Data

Source: CoinMarketCap Data

However, the price of AVAX itself is playing hard to get. It’s sitting right around $11.74, hovering over a support level that analysts say must hold. If it can climb back above $14.80, we’re looking at a clear path to $20. If it slips, things could get a bit messy in the $9 range. The launch of the AVAX ETF VAVX might just be the "institutional shove" the price needs to break out of this slump.

We’re moving into a phase where "altcoins" are becoming "institutional assets." The AVAX ETF VAVX is the perfect example of this. Avalanche’s secret weapon has always been its speed and its "subnets" basically custom blockchains for specific companies.

In my view, the real test won’t be the first day of trading, but how many traditional financial advisors start putting this in their clients' portfolios six months from now. If they can explain to a 60-year-old retiree why "time-to-finality" matters and why they're getting a staking yield, AVAX could become a staple of the modern portfolio. It’s no longer about speculation; it’s about participating in the new plumbing of the global financial system.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.