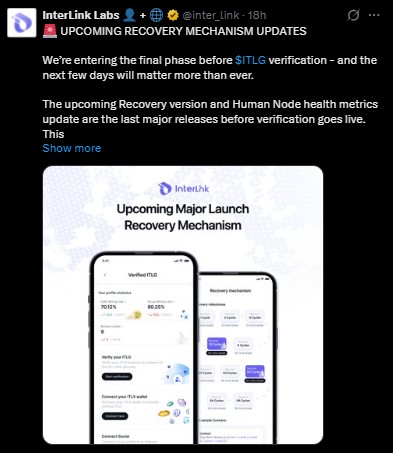

Could the next few days decide who moves first when the Interlink Labs Launch date finally arrives? The project has entered what it calls the “final phase” before verification, releasing recovery upgrades and Human Node health metrics that may determine queue priority. The announcement suggests a strategic shift rather than a routine technical rollout.

Source: Official X

According to official updates, improving Human Node metrics could help participants get matched faster with curators, placing them ahead in the line. This step prepares the system for a private mainnet where ITLX wallets are expected to receive rewards directly from contributors.

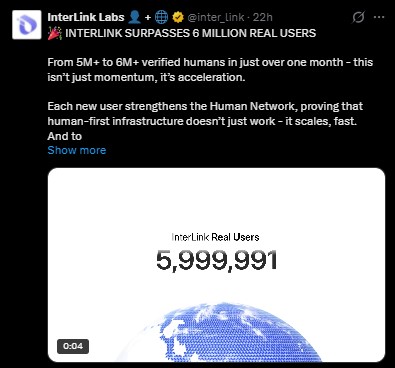

The platform recently crossed 6 million verified human users, adding nearly 1 million in just over a month despite challenging market conditions. The milestone highlights steady adoption at a time when many digital asset projects are struggling to maintain growth.

Source: X (Formarly Twitter)

Verification plays a central role in the ecosystem. Every circulating ITL coin is derived only from the ITLG token, ensuring there are no alternative issuance paths. The internal asset supports the ecosystem infrastructure, while the external currency is designed for payments, scalability, shopping, lending, travel, and broader real-world usage.

Market observers, including CoinGabbar analysts, estimate the Interlink Labs Launch date could fall between Q2 and Q3 2026, aligning with roadmap progress and ecosystem readiness.

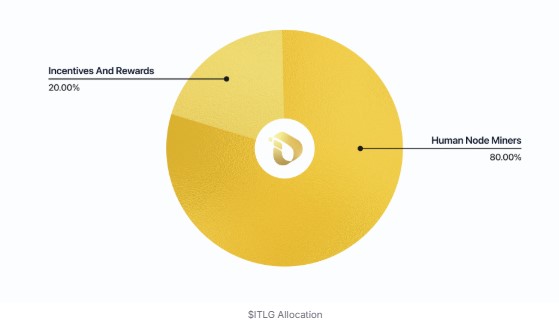

Tokenomics remain a key reason many contributors are tracking the project closely. The Interlink network total supply is set at 100 billion genesis units. Out of this, 20% (20 billion) is reserved for rewards, while 80% (80 billion) is secured for Human Node miners.

Source: Whitepaper

A recently introduced Base Rate Halving aims to protect long-term balance by slowing emissions rather than altering earnings mechanics. The approach focuses on preventing dilution, supporting fair distribution, and creating a healthier reward curve that could sustain future staking and utility functions.

Balanced issuance is also expected to strengthen upcoming features that depend on economic stability rather than rapid expansion.

ITLG Verification is more than a technical checkpoint. It ensures assets belong to real participants, helping reduce short-term farming behavior while supporting long-term value preservation.

Once verified, holders may choose between two strategic routes:

Convert holdings for quicker liquidity and ecosystem access.

Stake for higher yield potential over time, aligning with a vesting-based growth model.

Both paths position verified participants to benefit when adoption expands after the Interlink Labs Launch date.

Expert Opinion: The project’s decision to prioritize human verification, controlled emissions, and structured rewards reflects a long-term infrastructure mindset. Growth backed by identity validation and predictable token flow often signals preparation for scalable utility rather than speculative expansion.

Momentum is building as the Interlink Labs Launch date approaches, supported by verification upgrades, balanced tokenomics, and rising user adoption. While timelines depend on execution, the current phase suggests groundwork for a structured rollout. For observers, the coming months may reveal whether this preparation successfully transitions into measurable real-world utility.

YMYL Disclaimer: This article is for informational purposes only and not financial advice. Digital assets are volatile; always research carefully and consult a qualified financial professional before investing.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.