What happens when institutions start holding a crypto as a long-term reserve? This is the key question investors are asking after Interlink Network was officially declared a treasury asset. With millions of verified users and rising institutional interest, attention is now shifting toward the Interlink network listing date and possible price behavior after launch.

Interlink Network is developing a phone-based human blockchain where the focus will be on real humans, not bots. In an environment where AI reigns supreme, the human blockchain project believes in retaining the focus on humans when it comes to digital ownership. The platform has now exceeded 3,053,815 daily active users and has just breached the 5 million verified humans milestone.

One significant development took place on the 28th December, with the announcement by various institutions globally that the ITL token is now classified as a treasury asset. The team shared the details over X.

Source: Official X

The institutions are New To The Street (USA), AI Supercluster (Singapore), Superior AI Labs (Hong Kong), Immersion Consulting (Singapore), Idom Capital (USA), HPX LLC (Dubai), and Qihong Entertainment (Hong Kong).

This kind of announcement is an indicator of future confidence and not speculative action. Treasury partners are involved in the protection of values, controlling the output, and real-world use, which can have a stabilizing effect on the risk involved in the marketplace.

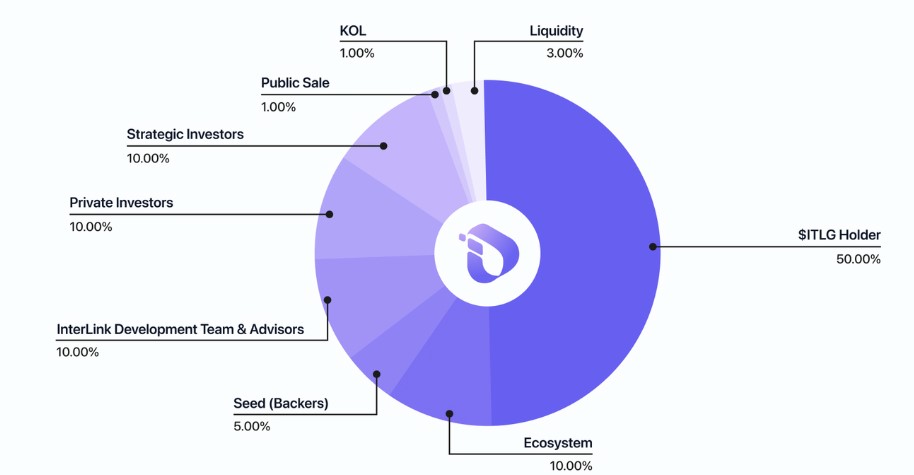

The tokenomics structure is bifurcated into two different tokens: ITL and ITLG. ITL is used for institutional entry into the Human Layer. Although the total supply for the ITL token has not been revealed, the distribution is already set.

Source: White Paper

ITLG Holders: 50%

Ecosystem: 10%

Seed (Backers):5%

Team and Advisors: 10%

Private investors: 10%

Strategic Investors: 10%

Public Sale: 1%

KOL:1%

Liquidity: 3%

The ITLG has a constant token supply of 10 billion tokens; 80% of that token supply will go to human node miners, while 20% will be allocated to rewards and incentives.

The launch of the coin is yet to be announced. Looking at the current stage of progress, the token listing is expected to take place in Q1 of 2026, and February is reportedly the month to look out for. However, this is just a speculation as there is no update from the team yet.

Estimates for the price of the early ITL coin and ITLG coin price are only speculative. Market analysts point out that institutional support and adoption rate are factors that could fuel considerable demand, though price discovery will require considerations for liquidity and exchange selection.

The project appears to reach a rare juncture that connects the adoption of the user base, the trust level of the institution, and the identity of the token before listing. Though the Interlink Network listing date and price are not set, the foundation promotes a measured process of data-driven entry into the market.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.