Why is LTC suddenly being referred to as digital silver again? That question pops up more often when Litecoin news around supply, technology, and global metal markets bring this cryptocurrency back into the conversation.

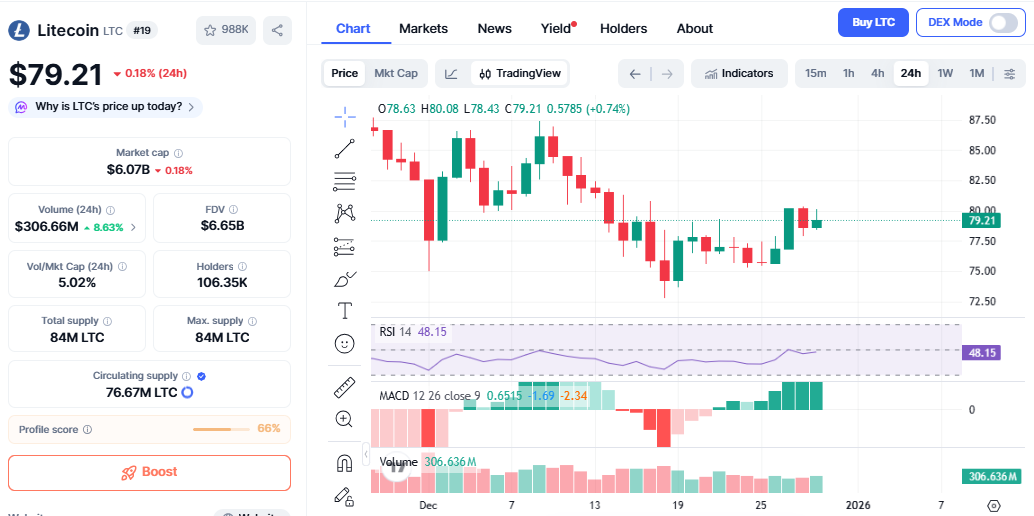

At the moment, today's LTC price is hovering around $79. As such, while the price isn't moving much, the story of LTC is just about to get interesting.

One simple reason people compare LTC to XAGUSD is its limited supply;

There will only ever be 84 million LTCs.

About 76 million are already in circulation

And the rest will be mined slowly over the next 120 years.

This makes it predictable. Everyone knows how many coins are in existence, and how fast new ones will come. Physical asset is different. Its supply depends on mining, exports, and government rules.

Source: X (formerly Twitter)

Recently, China silver exports restrictions were announced. To this news Litecoin’s official account reacted that physical metals can be affected by policies. The digital version, Litecoin, does not have these limits.

The concept is not new. The creator Charlie Lee once referred to this altcoin as “silver to Bitcoin’s gold.”

Bitcoin is often thought of as digital gold because it is scarce and secure. LTC is similar to it, yet faster and cheaper to use. Just like $SLV compared to gold, is used more in everyday life, LTC was designed for everyday payments.

Silver vs LTC: The chart show both the assets are trading at nearly the same price level, highlighting how closely the crypto is tracking asset's value narrative as “digital silver” rather than just another altcoin. Silver hit all time high, officially opening above a record $81 per ounce, reinforcing strong demand for scarce assets.

In the meantime, the digital currency has been going quietly about its business, carrying out evolutions in its technology.

Another reason LTC has been making news again is its new Layer-2 system called LitVM, which will go live sometime in early 2026. Using BitcoinOS and Polygon technology, LitVM will run smart contracts and apps on the platform.

This means that developers can create DeFi applications and NFTs, among others, without altering it's core network. As such, the currency remains focused on serving the payment function while LitVM adds flexibility to it.

At the moment, the coin is holding above the $78 support level. Currently, technical signals reflect that the market is calm and neither excited nor fearful. The next area to watch is around $82 to $84, while a bigger challenge remains near $99.

Source: CoinMarketCap Chart

This usually means that such price action occurs when traders are in a wait-and-see mode for clearer direction.

This digital asset is not chasing hype; it is building its case incrementally. In supply, it is capped, has a strong digital silver identity, has proven upgrades like Taproot, and future plans like LitVM. Less about price spikes, this is a phase of Litecoin News that deals with long-term positioning. And that's precisely the reason this coin still matters to many investors.

Disclaimer: This article is for informational purposes only, kindly do your own research before investing in the crypto markets.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.