The stock market is recording a significant bull run, with investments that are at their highest in over 20 years. With investors rushing into stock and gold markets, the debate that has arisen is the crypto market dead. The decline in the global cryptomarket cap has raised fears that it could be extinct.

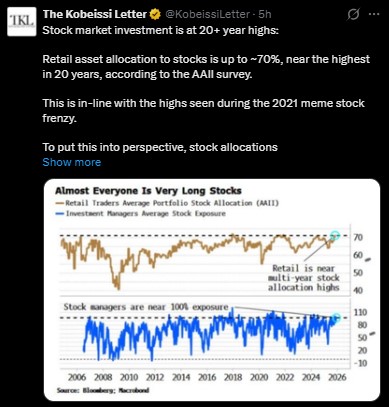

According to “The Kobeissi Letter,” retail investment in stocks is at 70%, which was experienced during the meme stock mania in 2021. On the other hand, investment in stocks among investment managers is at an average of almost 100%, one of the highest levels experienced in two decades. Such high investment in the stock indicates risk appetite that is “through the roof,” despite numerous concerns elsewhere.

Source: The Kobeissi Letter X

A wake-up call in statistics would be that if the worst-performing days are ignored, the S&P 500’s return would be an astonishing 6,400 percent since 1995, whereas the overall return would be 2,600 percent. This would indicate how much those few pivotal days impact overall performance.

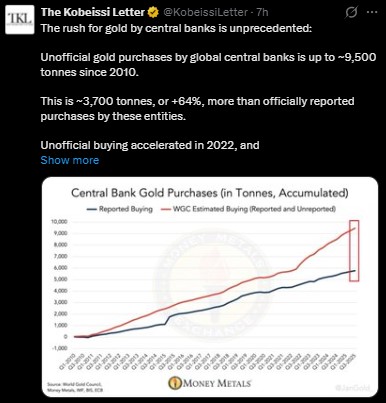

Gold is also witnessing strong demand, especially from central banks. The off-book gold purchase has been approximately 9,500 tonnes since 2010. Central banks have been increasing their acquisitions lately. In Q3 of 2025, Chinese purchases were up 118 tonnes. A whopping rise of 55% was registered on a year-on-year basis. The substantial purchases by central banks reflect a move towards safe assets because of uncertainty in international markets.

Source: The Kobeissi Letter

Presently, however, gold is trading at $4,327 per ounce and is still going higher.

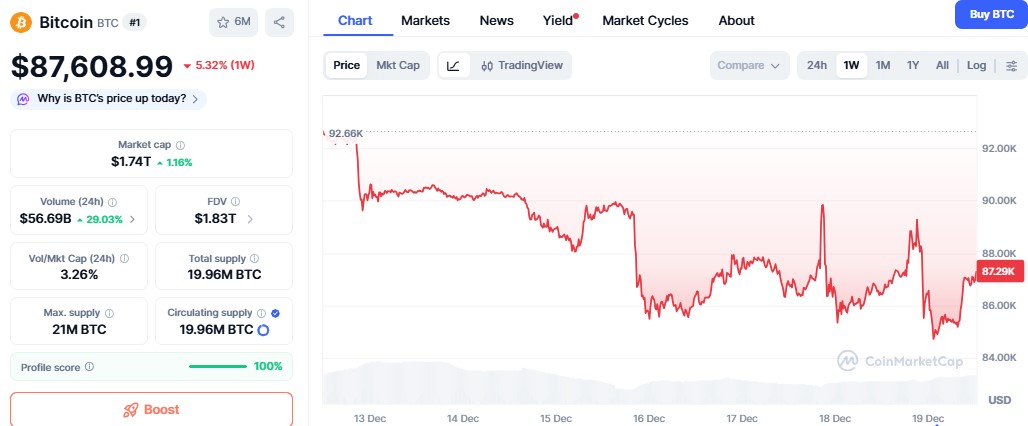

Whereas the stocks and the gold are doing very well, the crypto market has been under immense strain. According to CoinMarketCap, the global cryptomarket cap has declined from $3.21 trillion to a current cap of $2.93 trillion within a span of a week. Bitcoin price, for instance, has declined by more than 5% in a week, from $92.66K to the current market price of $84,724. Ethereum has also fallen by 10% and is now trading at $2,950.

Source: CoinMarketCap

This is attributed to various issues. There have been cases of crypto scams, issues relating to regulation, and geopolitical issues, which are making the investors less confident. There have been reported cases of crypto scams and hacks, such as $1.5B stolen from Bybit and $181M stolen from Beanstalk, which have contributed to this sector. Moreover, there is a lack of regulation and policies in this market. The investors feel that until this is addressed, they will not carry out major trades.

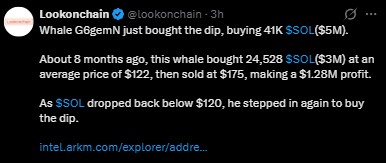

Even with all these challenges, there appear to be glimmers of hope that perhaps the cryptocurrency sector is still not dead yet. Whales and big players are still investing in cryptocurrencies. For instance, Whale G6gemN just purchased 41,000 units of $SOL, worth $5 million, at a price of less than $120.

Source: Lookonchain X

Secondly, MicroStrategy, a top Bitcoin holder, is still adding to its enormous pool of Bitcoin, with a current total of 671,268 BTC.

Such moves indicate that it has not reached its end. The major players are optimistic about its future, and this may well be the best time for those who are looking to buy the dip.

The rise of stock and gold investment has definitely brought about questions about the future. But with continued investment by major players in the industry and changes that keep taking place in the crypto environment, there seems to be hope for a possible revival, regardless of whether there will be a clear future associated with it.

Disclaimer: This article contains general information and is not to be considered financial advice. Cryptocurrency investments have proven to be highly volatile. You must therefore carry out your own personal research prior to making any investments.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.