The financial world got its biggest shock after $530 billion Japan sell-off US bonds news surfaced in the industry. The shock got even more interesting because, for the first time in 30 years, the Bank of Japan raised its interest rates.

Let’s dive into what this U.S. treasury bonds sell-off news bonds and the new rate hike mean for the crypto market and investors.

The country's decision to sell $530 billion in U.S. treasury bonds is one of the largest financial moves in recent history. They are trying to fix the debt crisis by bringing money back home.

Just a few hours earlier, the Bank of Japan interest rate decision came, which increased by 25 basis points (0.25%). For the past 30 years, the government kept rates at zero or even negative.

Source: 0xNobler Official X Account

Because of this, the 10-year yield for Japanese Government Bonds (JGB) has jumped to 2%, the highest since the dot-com bubble in 1999. This move basically ends the "carry trade"—where people borrowed cheap money to invest in expensive things elsewhere.

Even with the Bank of Japan rate hike, the Japanese Yen has become very weak. Right now, $1 is worth about 161.50 Yen. This is much higher than the 150 level we saw earlier in 2025.

According to Robin Brooks , Chief FX Strategist, this weak Yen is a "scary" sign of country debt crisis. According to Brooks, the country needs to:

Cut government spending.

Raise taxes.

Sell off government assets to stop the Yen from crashing further.

If they don't fix this debt problem, the Yen weakness would go even worse, causing trouble for the whole country’s economy.

While the world watches the unfolding economic drama, crypto investors are also on edge. When the $530M Japan sell-off of US bonds officially implements, it pulls "easy money" out of the world.

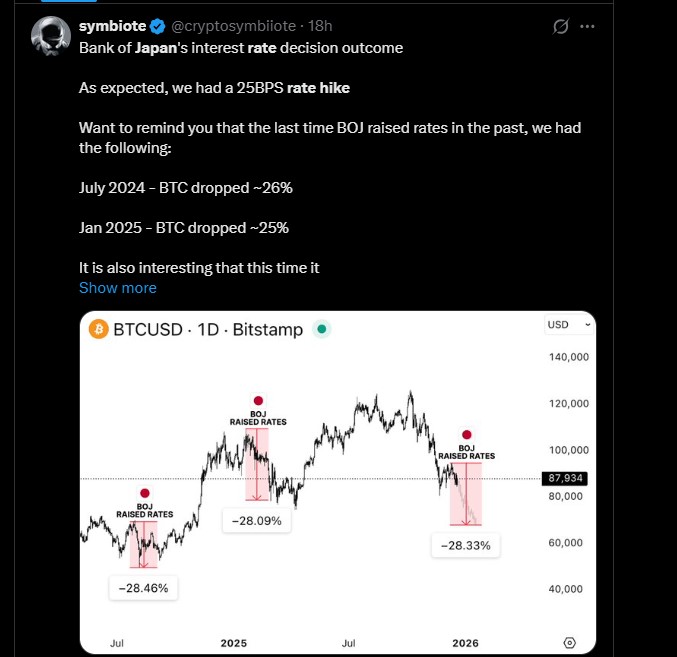

This usually makes the crypto market drop. Financial Experts like Symbiote say, past rate hikes by the BoJ in 2024 and 2025 led to significant drops in Bitcoin (BTC) prices, approximately 26% in July 2024 and 25% in January 2025.

Now, with the BoJ raising rates to 0.75%, the highest since 1995, there’s a possibility that $BTC could experience a similar drop.

Bitcoin Price Analysis : Right now, as per CoinMarketCap chart, it is trading around $88,219, reflecting a slight increase of 0.12% in the last 24 hours.

Support: The most important safety floor is at $87,000. If it falls below this, the price could crash to $80,000 or even $70,000.

Resistance: $90,000.

The Prediction: Symbiote believes Bitcoin could drop by 30% soon. In the short term, it might hit $80,000–$85,000. However, if things settle down, it could eventually reach $100,000 in the long run.

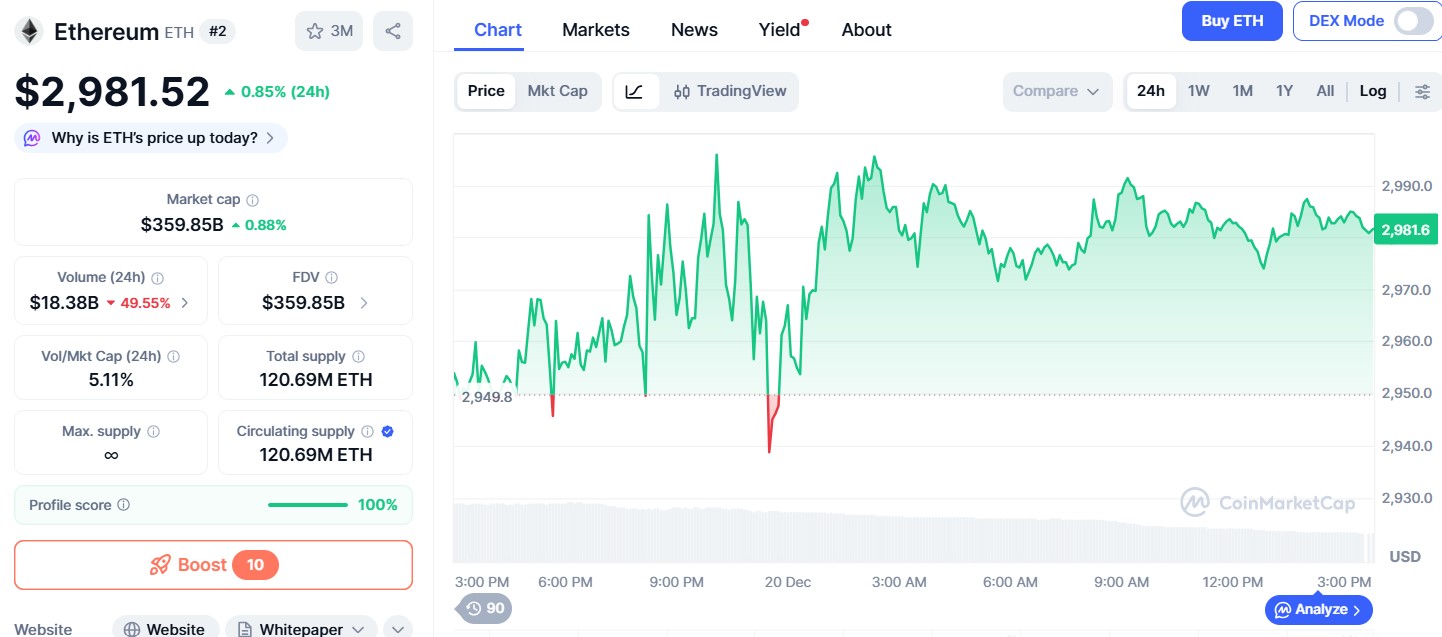

Ethereum Price Analysis: $ETH is currently priced at $2,981 reflecting a slight increase of 0.12% in the last 24 hours. While it surged a little today, it is still under pressure from the potential Japan sell-off US bonds news and rate hike.

Support: Its safety floor is at $2,900. If things get worse, it might dip to $2,700.

Resistance: It needs to break $3,000 to opt for a bullish trend.

The Prediction: Coingabbar’s top crypto analysts believe, $ETH might drop to $2,750 in the short term. But its long-term future depends on the global economy getting stable again.

In short, the Japan sell-off of U.S. bonds and the rate hike mean that the crypto market might stay "red" for a while. Bitcoin and Ethereum are both at risky levels.

If they break their safety floors at $87,000 and $2,900, prices could drop much further. For now, it is best for traders to be careful and keep an eye on Japan’s debt crisis.

Disclaimer: This article is for information only and is not financial advice. Investing in crypto is risky. Always talk to a professional before making any investment decision.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.