Today, the Crypto Fear & Greed Index sits at 51 as per the data of Alternativeme which is showing a neutral market mood and the investors are neither too scared nor overly greedy.

Yesterday it was 48 and a week ago the fear dominated at 44. A month back, the market was deep in greed at 75. This shift shows that sentiment is slowly balancing out with traders now taking a more cautious wait-and-watch approach.

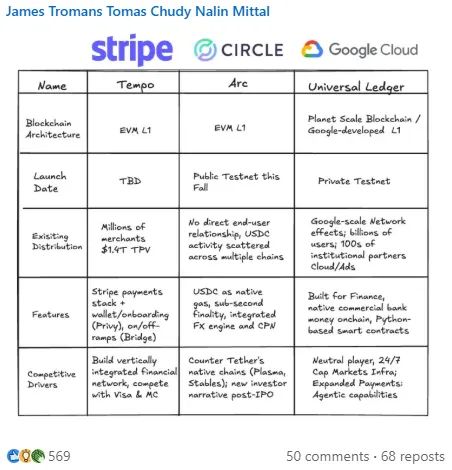

Google Cloud has stepped into blockchain with its new Layer-1 network GCUL that is aiming to reshape financial systems. Unlike most chains that rely on Solidity or Rust. GCUL uses Python-based smart contracts that is making it easier for enterprise developers and banks to adopt.

Source: Linkedin

Earlier this year, Google Cloud launched its Universal Ledger with CME Group to test tokenization and wholesale payments now in private testnet. Positioned as a rival to Stripe’s Tempo and Circle’s Arc, GCUL promises speed, transparency and scalability for next-gen finance.

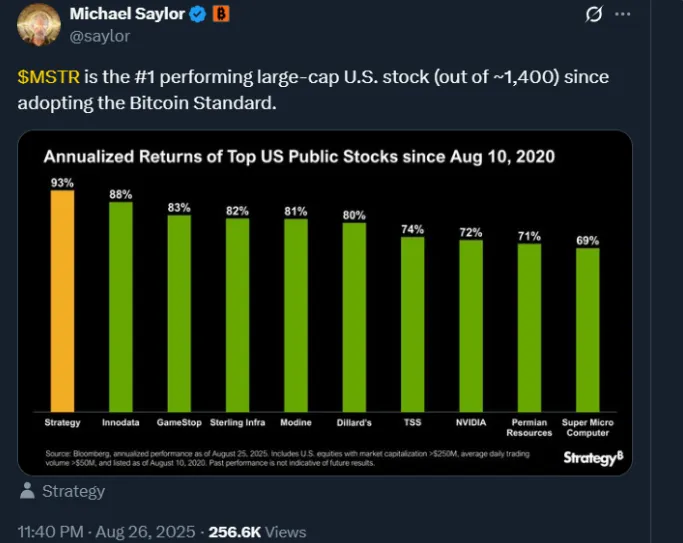

Strategy ($MSTR), led by Michael Saylor has become the best-performing large-cap U.S stock since shifting its strategy to Bitcoin in August 2020. With annualized returns of 83%, it has even outperformed giants like NVIDIA and Tesla.

Source: X

Firstly Strategy invested $425M into BTC and has expanded its holdings to over 632,474 BTC which is worth $46.5B. While short-term volatility remains a risk, Michael Saylor’s bold Bitcoin Standard approach shows how corporate crypto adoption can drive massive long-term growth, reshaping balance sheet strategies.

U.S. President Donald Trump has triggered a major clash by trying to fire Federal Reserve Governor Lisa Cook through an executive order citing old mortgage fraud claims. Cook refused to step down arguing the president has no legal power to remove Fed officials, whose 14-year terms protect the central bank’s independence.

Source: X

Legal experts say that the allegations are weak and politically driven. Markets reacted with concern as the investors feared White House influence over interest rates. Cook is now suing Trump and setting up a historic legal fight over the Fed’s future.

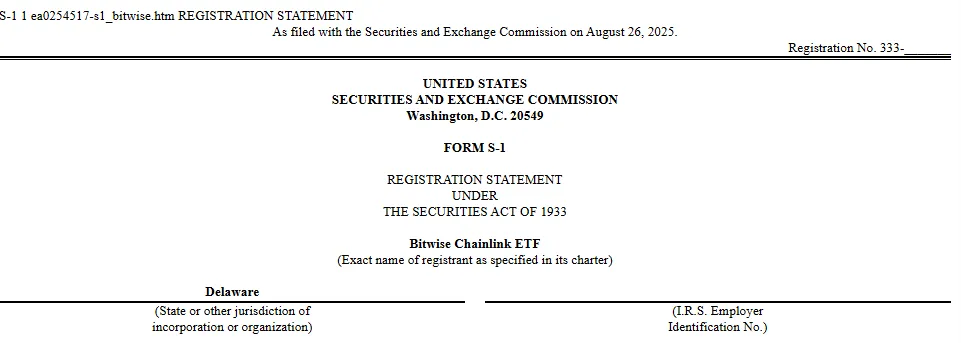

Bitwise has filed a Form S-1 with the SEC to launch the Bitwise Chainlink ETF that is giving the investors regulated access to LINK. If approved then the ETF will directly hold Chainlink tokens with its value tracked by the CME CF Chainlink-Dollar Reference Rate.

Source: Official site

Shares will be issued in blocks of 10,000 managed by authorized institutions. Coinbase will secure LINK in cold storage with insurance protections. While the filing shows risks like volatility, regulation and custody issues, this move focuses on a major step toward mainstream, institutional-grade access to Chainlink.

KuCoin has recently partnered with Thailand’s Ministry of Finance to support the G-Token program. The world’s first tokenized government bond. Backed by XSpring Digital, SIX Network and Krungthai XSpring. KuCoin will help manage subscription, redemption and listing of G-Token on Thai exchanges and later expand globally.

Source: PR Newswire

The first issuance worth 5 billion baht ($153M), aims to make sovereign debt more accessible to retail investors. This move highlights Thailand’s push to become a crypto hub following initiatives like TouristDigiPay and a planned crypto sandbox in Phuket.

Today’s crypto news shows a market that is cooling down and finding balance. From Google Cloud’s big blockchain move to Strategy Bitcoin success, Trump Fed clash, Bitwise Chainlink ETF, it is clear that crypto is shaping global finance while investors stay cautious yet hopeful.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.