A massive data anomaly has been identified in the cryptocurrency prediction market vertical. Paradigm Capital researchers have highlighted a pervasive analytics bug. Leading tracking services have consistently overstated Polymarket's reported trading volume.

The reason lies with a misinterpretation of on-chain blockchain events. Among the affected dashboards were DefiLlama and Dune Analytics, among others. This suggests that the headline metric for activity on the platform looks artificially inflated.This was first identified by Paradigm research partner Storm Slivkoff. His team reviewed the smart contract structure of the platform and its event logs.

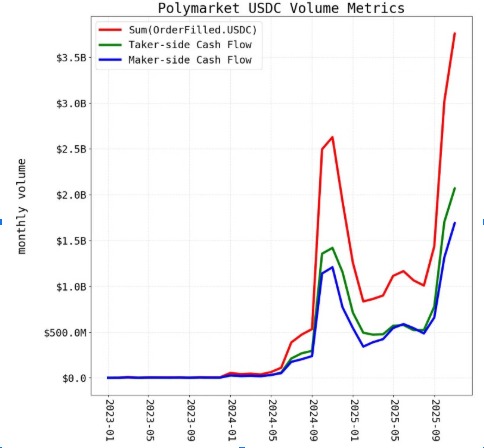

They found that there are duplicate data representations of every market transaction. Each trade sends two different blockchain events-one for the maker and one for the taker. Analytics providers summed both events, thereby double counting each trade. Double counting distorts both cash flow and notional calculations.

The root issue is how the platform processes the `OrderFilled` events. Polymarket's architecture emits one event for the maker of the order, and another for the taker. These two events describe the same economic transaction from the perspective of the two parties. However, they represent the same cash flow and movement of the contract. Summing them creates a fundamental accounting error. A simple token swap valued at $4.13 would be recorded as $8.26.

Slivkoff's analysis dissects the unique trade anatomy of the platform. All transactions follow a specific template with one maker and one taker. Around fifty externally-owned accounts under Polymarket submit these transactions. The redundant events serve internal tracking purposes but confuse public dashboards. Thereby, raw data from blockchain explorers is most misleading to analysts. Trading volume should only count one side of the transaction, the research explains.

This discovery raises some questions about the perceived success and growth of the platform. The Paradigm finding suggests that the actual figure could be close to half of $3.7 billion. This data flaw touches on the platform's multi-billion dollar valuation assessments. Accurate metrics go hand-in-hand with investor confidence and market integrity. Paradigm created a public simulator to demonstrate proper ways of calculating.

Source: Paradigm

This simulator models eight different trade types on the prediction market. It shows how splits, merges, and swaps affect open interest and volume. The team believes consistent and transparent reporting standards across the industry are necessary. As prediction markets continue to mature, quality data is crucial for all participants in the market. This episode features the increased importance of sophisticated on-chain analytics in the future of decentralized finance. Proper reporting of trading volume is integral to a trustworthy financial system.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.