The XRP regulated listing on a CFTC-supervised U.S. exchange introduces a decisive moment for digital currency oversight. This development positions XRP within a secure regulatory structure that traditional institutions monitor closely. The update also draws wider interest across latest cryptocurrency news outlets, where analysts evaluate the scale of its influence on the evolving market structure.

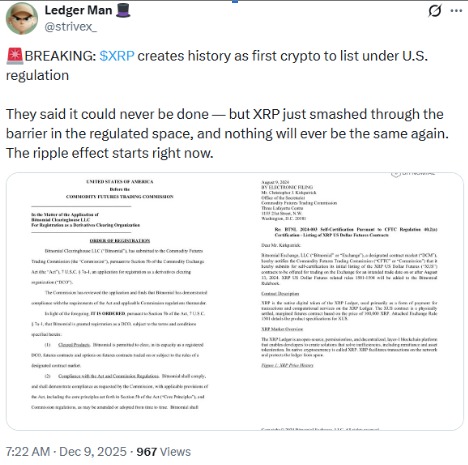

Bitnomial’s move to launch the first CFTC-regulated U.S. spot market for XRP sets a new operational standard. The framework places the asset under one federal regulator for spot, futures, perpetuals, and options. This set up is an indication of a structured environment to traders who need accountability. The question arising among market participants is now whether this move accelerates institutional participation, which is a frequent topic across crypto market news and regulatory debates.

The approval as trading collateral adds another structural layer. Institutions can use this asset in margin portfolios, similar to Treasuries or stablecoins. This function strengthens landscape flexibility and offers a strategic option for firms that analyze collateral efficiency. The compliant trading and collateral status combine to give a strong base to long-term participation. Analysts reviewing digital asset news highlight that this digital token now meets criteria often required for cross-market strategies.

The XRP regulated listing reduces years of uncertainty and places the asset inside established financial processes.This change prompts banks, funds, and trading firms to review compliance barriers that previously blocked exposure. The development is also of interest in networks monitoring the latest cryptocurrency news, with regulated access being a frequent topic.

Regulated spot trading improves price discovery and offers a better execution process. Futures and options present risk-management avenues, which institutions use in assessing long-term exposure. This multidimensional structure increases confidence among firms that monitor crypto market news for regulatory direction. The arrangement also broadens liquidity potential because participants can consolidate strategies within a unified federal framework.

The status of the token as approved collateral strengthens functional utility. This transition shifts the asset out of the speculative use and enhances the operational functions in the structured portfolios. It brings controlled stability which traders watch in evaluating standards of new coin listing and institutional flows.

The wider implication is that the ecosystem is still continuing to align digital assets with the traditional oversight. The XRP compliant listing shows how compliance-based access can affect price perception. With the news circulating across the news outlets, observers can evaluate whether this model can form the basis of future regulatory approvals.

The XRP regulated listing represents a structural turning point for the U.S. digital asset sector. Having more regulatory clarity, now the asset works within a transparent and rule-based environment facilitating institutional adoption and sustained participation.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.