Japanese investment firm Metaplanet has taken another major step in expanding its Bitcoin holdings. The company announced on X (previously Twitter) of 1,088 additional bitcoins for around $117 million. The average cost per coin came in at approximately $108,072. With this latest buy, total holdings of Metaplanet now stand at 8,888 BTC, positioning the firm as one of Asia’s most committed corporate crypto holders. The company previously raised about $50 million via issuing private placements of zero interest bonds with the motive of boosting crypto holdings.

Source: Simon Gerovich

Metaplanet director Simon Gerovich didn’t just share the numbers, he shared a vision. In a tweet following the announcement. His tweet reflects that, Even though the number of coins is impressive, the meaning of Metaplanet’s 8,888 BTC is even greater. Numerous East Asian cultures believe that the number 8 is lucky and is linked to wealth, abundance and good luck. The company views reaching 8,888 BTC as a sign of abundance and success and not only as a revenue target.

This is not only about being positive; it shows many more aspects. It reveals that companies consider this crypto as a digital currency and something that is important to their identity and future plans.

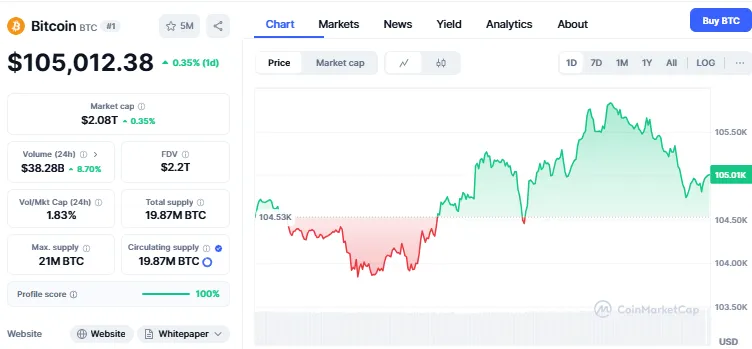

Gerovich also posted an update on the company’s BTC yield performance. According to him, Metaplanet got a yield of 66.3% in the Q2 of 2025. The company’s target for this is 35% yield per quarter, suggesting they’re well ahead of schedule. As of writing the currency is trading at $105,012.38 with an increase of 0.35% and an increasing trading volume of 8.70% as per the CoinMarketCap.

Source: CoinMarketCap

He stressed that BTC yield is the most important metric for treasury-focused Bitcoin companies, not just how much currency they hold. This shows that Metaplanet is not only acquiring this cryptocurrency but also working to grow its value actively.

Metaplanet isn’t alone in its bullish approach. Across industries, more companies are entering this crypto space. Michael Saylor’s firm Strategy recently added 4,020 BTC, staying focused on their goal. Semler Scientific, a health-tech firm, also jumped in with a 455 BTC purchase.

New organizations are also getting involved. The Gamestop now has a total of 4,710 BTC. A food company DayDayCook (DDC) got off to a strong start by buying 21 coins. Paris Saint-Germain (PSG) became the pioneer in the sports club to own this biggest cryptocurrency. Only days after joining the world’s cryptocurrencies, Trump Media and Technology Group said it had gathered $2.4 billion to build a reserve for this prominent digital asset.

The purchase by Metaplanet and its symbolic achievement signal a new approach to digital assets by businesses. Corporate finance isn’t only looking at Bitcoin as an inflation hedge, but also includes it in their plans. As the yield grows, the focus on the long-term value and more people become investors, Bitcoin is maturing in the business world.

For Metaplanet, there is more to 8,888 than its numerical value. It signals the start of a bigger time, when this currency could be more than a backup, but the core of the field.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.