MicroStrategy has done it again. The company just bought 10,100 more BTC for about $1.05 billion. That’s a huge amount, and it shows how serious they are about crypto.

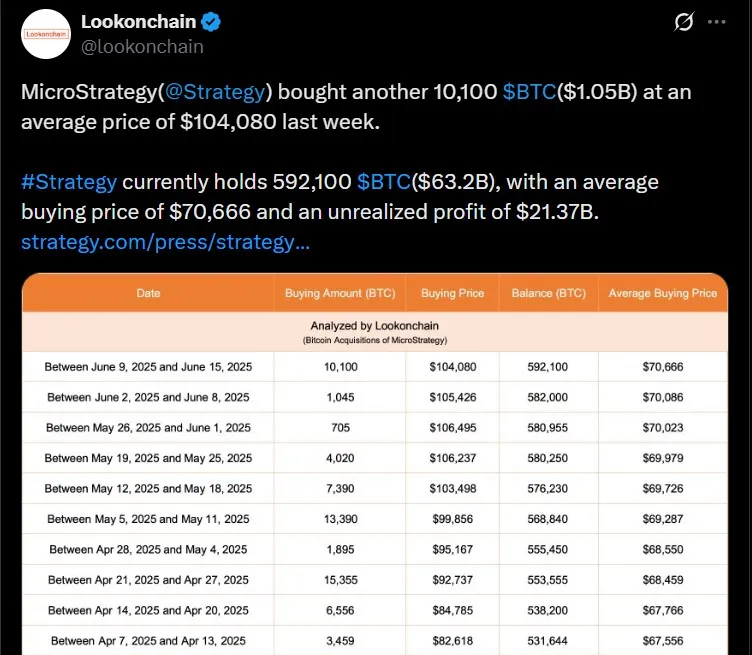

This latest Microstrategy Bitcoin purchase was done at an average price of $104,080 per coin. Now, the firm holds a total of 592,100 BTC, which cost them around $41.84 billion. The current value of this stash is $63.2 billion, based on market prices as of June 15, 2025.

Source: Lookonchain

This means the company is sitting on an unrealized gain of over $21 billion, according to reliable data from Lookonchain.

Even after this massive buy, the crypto price hasn’t jumped wildly. But it is holding strong. As of now, the price stands at ₹107,131, up about 1.43% in 24 hours.

Here’s a snapshot of the latest market data:

Market Cap: $2.11 trillion (+1.05%)

24-Hour Volume: $43.17 billion (+22.85%)

The increased trading volume shows people are getting active again. Some are calling this a sign of returning investor interest, especially after large Bitcoin institutional buys like this one.

Being an crypto observer, looking at the daily price chart on TradingView to see what’s really going on, my analysis says:

Source: TradingView

RSI (Relative Strength Index) is now at 54.28, just above the neutral 50 line. Which means there's more buying pressure than selling.

MACD (Moving Average Convergence Divergence) shows the MACD line trying to cross the signal line. If it does, it could signal a fresh rally.

Volume bars are also rising, and green candles are starting to build. All this means that the trend could turn more bullish in the short term.

Based on the charts and expert opinions:

Support Zone: $104,000 – $102,000f

Resistance Level: $110,000 – $114,000

If the price moves above $108,000 with strong volume, there’s a high chance of a break above the $110,000 mark.

Let’s break down what might happen next:

Short-Term (Next 7 Days): $110,500 to $112,000 possible if buying continues

Mid-Term (1–2 Months): Could touch $120,000–$125,000 depending on news and market mood

Long-Term (By End of 2025): If trends stay strong, it might even reach $145,000 or more

If the buying interest cools off, we may see some pullback toward $102,000 before the next move.

MicroStrategy BTC holdings and constant crypto buying isn’t just about one company. It shows how more big players are betting on cryptocurrency. It also sets an example for others who might follow the same path.

According to multiple analysts, this type of institutional buying supports long-term price growth. With their average purchase price at $70,666 and current value far above that, the company is already in profit.

MicroStrategy Bitcoin purchase latest move makes it clear: they are all-in on digital assets. With over 592,000 BTC and $21 billion in gains, they’re far ahead of the game.

For traders and investors watching the market, all signs point toward a possible price breakout. With technical indicators showing strength and institutional interest still high, the next few weeks could be very important.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.