In a major regulatory development, Nevada sues Coinbase Financial Markets over its event-based contracts, claiming they amount to unlicensed wagering under state law.

The civil enforcement action was filed on February 2, 2026, in Carson City District Court by the Nevada Gaming Control Board (NGCB).

Regulators are now seeking a temporary restraining order and preliminary injunction that could immediately stop the company from offering these products to users located in Nevada.

The case highlights rising tension between state gaming laws and federally regulated crypto derivatives, creating uncertainty around how prediction markets will operate in the future.

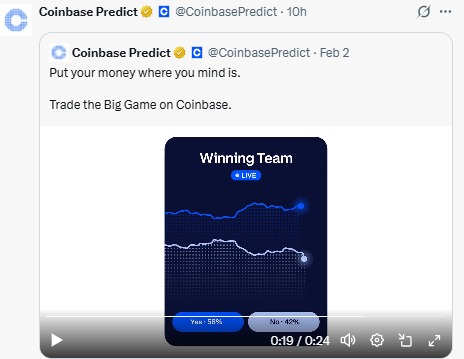

The update came just around when the exchange launched a prediction market platform, Coinbase Predict, allowing users to trade on real-world events across sports, politics, crypto, and culture, available in all 50 U.S. states.

Source: X (formerly Twitter)

The complaint focuses on Coinbase’s prediction-style contracts tied to sports and real-world outcomes. According to Nevada regulators, these products function like traditional bets and therefore require a gaming license.

State officials argue the rule is straightforward: if a product looks like a bet and settles like one, it should be treated as wagering. The regulator believes Brian Armstrong's platform made these contracts available to Nevada residents without proper authorization, which it considers unlawful.

NGCB Chairman Mike Dreitzer emphasized that protecting citizens and preserving the state’s gaming industry remains a top priority. Nevada’s casino-driven economy generates billions each year, so regulators tend to act quickly when they see potential threats to oversight.

The NGCB sues Coinbase is especially important because it follows a recent legal win against Polymarket, another platform offering event-based contracts. Courts previously sided with regulators, stating such products could qualify as sports pools.

The platform allows access to these contracts through third-party designated contract markets regulated by the Commodity Futures Trading Commission (CFTC). However, NGCB is challenging whether federal supervision overrides state gambling laws.

This creates the possibility of a larger state-versus-federal legal battle. The outcome could set a precedent for how crypto platforms design future products that blend finance with real-world events.

For everyday traders, the lawsuit introduces immediate uncertainty. If the restraining order is granted, the organisation may have to shut down its prediction markets feature in NGCB almost overnight.

Such a move would likely halt trading activity in the state and reduce user participation. Community sentiment often leans toward clear rules because they help platforms operate safely and protect customer funds. At the same time, sudden regulatory actions can disrupt trading plans and limit access to new financial tools.

Many users also worry that if NGCB succeeds, other states could adopt similar measures.

Investors reacted quickly after this news, sending Coinbase stock down roughly 4.4% during Tuesday’s session. The drop adds to a weekly decline of more than 10%, reflecting caution among traders already watching regulatory risks.

Source: Google Finance

Shares recently traded near $179.66, showing continued volatility. Analysts say the platform still has a strong market position, but legal uncertainty could weigh on trading volumes and future product launches.

Prediction markets were viewed as a fresh growth opportunity for the exchange. Now, they may turn into a regulatory challenge that affects expansion plans.

Nevada’s action sends a strong message that crypto companies cannot bypass local gambling rules simply by labeling products as derivatives. By taking this step, the state is reinforcing its long-standing approach to strict gaming oversight.

For the exchange, the defense may depend on arguing that federal regulators should have primary authority. Still, Nevada’s track record suggests the legal path could be challenging.

As Nevada sues Coinbase, the case may influence how regulators across the country treat prediction markets. It also reminds the crypto industry that innovation often moves faster than regulation but eventually, the rules catch up.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.