Highlights:

US Supreme Court Trump Tariffs and Fed speeches could trigger sharp volatility.

Polymarket shows 71% odds of Trump’s tariffs being ruled illegal

Analysts warn leveraged traders to avoid headline-driven moves.

The next 24 hours could be one of the most volatile periods of 2026 so far, as two major U.S. macro events are set to unfold almost back-to-back. According to market analysts and betting data, these developments have the potential to rapidly flip sentiment across stocks, crypto, commodities, and interest-rate markets.

Traders and investors are being warned to avoid emotional, headline-driven decisions.

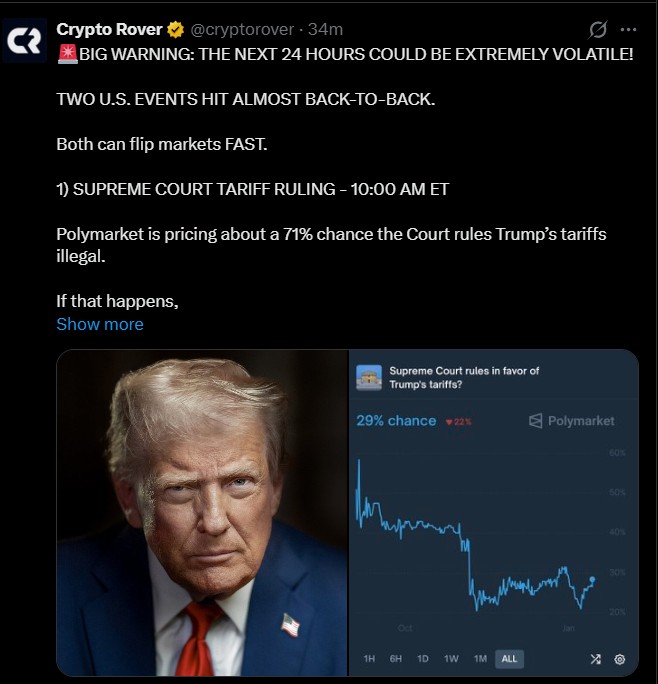

The first major catalyst is the U.S. Supreme Court’s ruling on President Trump global tariffs, expected at 10:00 AM ET.

Prediction markets are signaling serious risk. Polymarket currently assigns a 71% probability that the Court rules Trump’s tariffs illegal, leaving only a 27% chance they are upheld.

The case stems from November 2025 arguments, which challenged Trump’s use of emergency powers under the International Emergency Economic Powers Act (IEEPA).

Source: CryptoRover X

If the tariffs are struck down, markets may immediately begin pricing in refund uncertainty on more than $600 billion in tariff revenues Trump has repeatedly cited. Trump himself has warned that such a ruling would be a “complete mess,” potentially disrupting trade negotiations and fiscal expectations.

This binary outcome creates headline risk, especially for leveraged traders in crypto and equities.

The second volatility trigger is even more sensitive. The three Federal Reserve presidents will speak, and their remarks will come after increased questions of Fed Chair Jerome Powell, following noise over investigations in the previous month.

In the current environment, even subtle changes in tone around inflation, rates, or economic confidence can move markets sharply. Once expectations around interest rates shift, risk assets—from Bitcoin to tech stocks—tend to react immediately.

Crypto analyst Crypto Rover warned that these combined events create a “liquidation trap,” where traders get wiped out reacting to headlines rather than positioning strategically.

Source: X

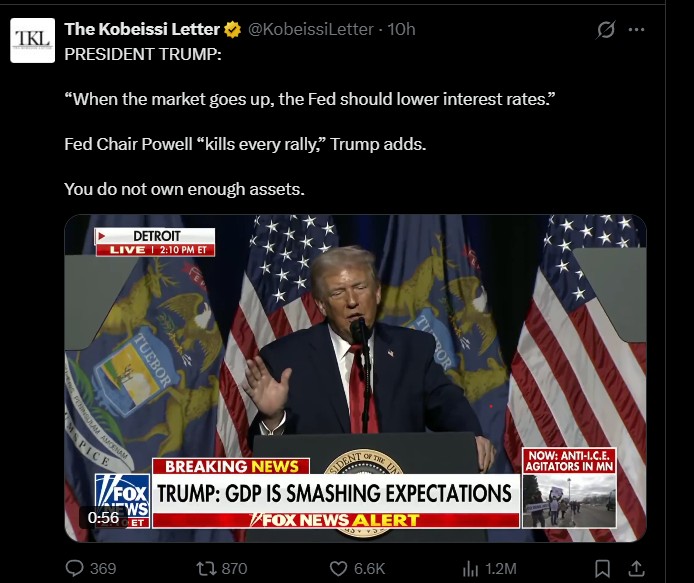

Adding to market unease, The Kobeissi Letter highlighted a striking macro reality: nearly everything is at a record high simultaneously.

Why crypto market up today? Along with Stocks, gold, silver, copper, platinum, home prices, money market funds, U.S. debt, deficit spending, and household debt are all sitting at historic peaks. According to Kobeissi X, this is not a coincidence but evidence that fiat currencies are depreciating.

Their blunt message: “You do not own enough assets.”

Source: X

President has reignited his long-standing criticism of Fed Chair Powell, stating that when markets rise, the Fed should lower interest rates, not raise them.

Trump accused Powell of “killing every rally” and recently escalated his rhetoric by calling him “either incompetent or crooked.”

These remarks come after December CPI data showed inflation cooling, with headline CPI at 2.7% and core CPI at 2.6%, both flat for the month.

Nevertheless, the rate cuts will likely be held at the January Fed meeting, which will only heighten the political and market tension.

Markets have already responded: Bitcoin has already surged to around $95,000, and gold has reached new record highs, indicating a drop in confidence in the stability of policies.

Source: CoinMarketCap

Volatility is not an option; it is a certainty with a Supreme Court decision and several speeches by the Federal Reserve crammed into one day. The traders are encouraged to handle risk prudently, minimize over-leverage, and not act based on the breaking headlines.

In this environment, patience and positioning matter more than prediction. The next 24 hours could reshape market direction—fast.

YMYL Disclaimer: This content is for informational purposes only and is not financial advice. Crypto and financial markets involve risk. Always conduct your own research or consult a licensed advisor.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.