Could the US be heading toward a new Federal Reserve leader sooner than expected?

Markets are paying close attention after President Donald Trump said he is leaning toward Kevin Warsh or Kevin Hassett as the next Fed chair. Even though no official decision has been made, the comment alone has stirred debate about the future of interest rates and the direction of the economy.

Source: X (formerly Twitter)

The timing matters. With markets already uneasy after the latest FOMC meeting, Trump’s remarks have added another layer of uncertainty especially for crypto investors.

Jerome Powell’s term as Fed chair is set to end in May 2026, but Trump’s comments have raised a simple question: Could Powell leave earlier?

Trump told reporters that both candidates are strong choices, but said Kevin Warsh is currently at the top of his list. Warsh is a former Fed Governor, while Kevin Hassett is a senior White House economic advisor who has worked closely with the president in the past.

Trump also made his position on interest rates very clear. He said the next Fed chair should talk with him about rate decisions, and that interest rates should be cut to 1% or even lower within a year. That statement alone has pushed investors to rethink what future central bank's policy could look like.

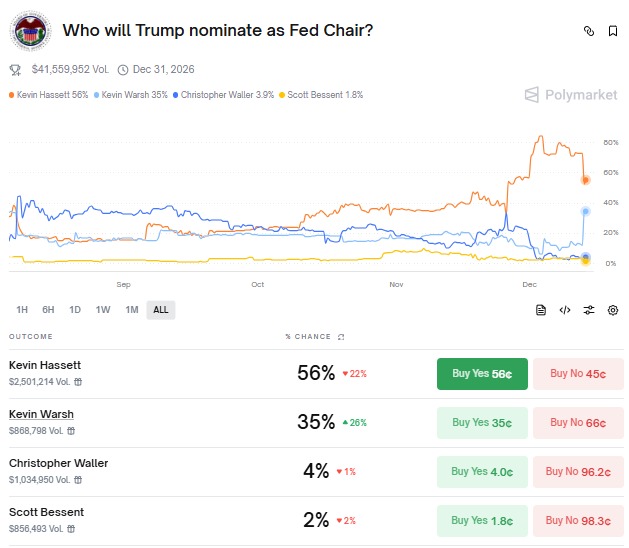

Trump’s comments are not the only signal markets are watching. On Polymarket, a crypto-based prediction platform, traders are placing bets on who they believe will become the next Fed chair.

Source: Polymarket

Right now, Kevin Warsh leads the odds, with Kevin Hassett behind him. These numbers do not mean a decision has been made. Instead, they show how people are positioning their money based on current political signals. In crypto circles, Polymarket is often used as a way to track early market sentiment.

This debate comes just days after the Federal Reserve cut interest rates by 0.25%, bringing the upper rate down to 3.75%. While the cut was expected, the message from the Central Bank was mixed.

Two officials voted against the cut, while one wanted a bigger move. The Fed’s own projections now suggest only one more rate cut in 2026, which has left traders unsure about what comes next. Powell said the Central Bank is comfortable waiting, which suggests January may bring no new rate changes.

For crypto markets, interest rates matter a lot. Lower rates usually help Bitcoin and other risk assets. Trump’s call for 1% rates sounds positive for crypto in the long term, but the lack of clarity is hurting sentiment right now.

In the past 24 hours, the crypto market fell 2.31%, adding to a 10.38% drop this month. Bitcoin saw over $71 million in long positions liquidated, and traders reduced exposure. Bitcoin ETF holdings also fell by $3.5 billion this week, showing that big investors are staying cautious.

Markets are now watching the PCE inflation report, future statements, and any new comments from Trump about the next Fed chair. The biggest question remains unanswered: Will Powell stay until May 2026, or will pressure build for an earlier change?

Until there is more clarity, both crypto and traditional markets are likely to stay volatile.

Disclaimer: This article is for informational purposes only, kindly do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.