Shares of Nomura Holdings Inc fell about 5.3% after the company said crypto-linked losses hurt its third-quarter results. Investors sold quickly because the losses came from a part of the business that is supposed to be managed with strict risk controls. This move pushed Nomura crypto losses into focus across both stock and crypto markets.

It is one of Japan’s biggest wealth managers, with around $153 trillion in client assets, and it controls roughly 15% of the domestic market. So when Nomura reports a crypto setback, people pay attention.

Source: X (formerly Twitter)

Nomura confirmed that its Swiss-based crypto trading arm, Laser Digital, recorded losses in Q3. Analysts estimate those were more than ¥10 billion. Nomura did not publish an exact number, but it did say the amount were serious enough to trigger a change in how it manages its crypto positions.

Nomura said it has reduced its positions in cryptocurrencies and tightened risk exposure to avoid big swings in short-term profits. In simple terms: the company is taking smaller bets and watching risk more closely after the latest hit. That message was shared by its CFO Hiroyuki Moriuchi.

Even after the cutback, Nomura said it is still committed to digital assets. The company says it wants to expand its digital assets business in the medium to long term, instead of pulling out.

Laser Digital is also pushing forward with growth plans. It recently applied for a U.S. operating permit. Reports say it applied for a national trust bank charter, which would allow it to operate across the U.S. and offer services like digital assets custody and spot trading to firms and residents.

The organisation launched Laser Digital in September 2022 in Switzerland, and earlier expectations suggested the unit could become profitable by 2024. The latest loss is a setback, but not a full stop.

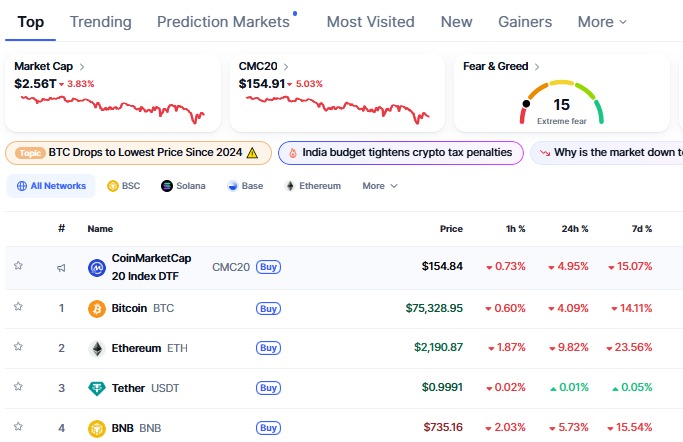

This news landed during a broad sell-off. As per the CoinMarketCap, in the last 24 hours:

Bitcoin fell about 4.56% to around $75,132.

Ethereum dropped about 9.1% to around $2,214.

Total market value fell 5.04% to about $2.53 trillion.

Source: CoinMarketCap

Risk fear is high: the Fear and Greed Index was cited at 15 (extreme fear). Data also pointed to heavy liquidations, including $110 million in Bitcoin long liquidations, and a broader $1.6 billion in liquidations across the market in 24 hours. Bitcoin’s RSI near 23 was described as deeply oversold, and traders are watching the $75,000–$78,000 support zone. A clean break below could drag the total market closer to $2.42 trillion, while holding support could allow a bounce.

The key point is that losses did not come from simply holding Bitcoin. The volatality appears tied to trading and lending-style activity inside a subsidiary. That brings up bigger questions about counterparty risk who was on the other side of these trades, and how well exposures were hedged.

For now, the firm is cutting risk, not quitting. But the market reaction shows a clear message: when losses hit a major bank’s earnings, investors treat it as a serious warning sign.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.