Key Highlights:

Crypto market cap rises to $2.69T despite extreme fear sentiment.

Bitcoin steadies near $77K, Ethereum faces sharper selling pressure.

Hacks, macro events, and policy signals drive short-term volatility.

Overall Crypto Market Update, 2 Feb 2026: The cryptocurrency edged higher overall, but fear remained extreme as Bitcoin stayed stable, Ethereum declined, and investors reacted to exploits, macro uncertainty, and mixed sector performance.

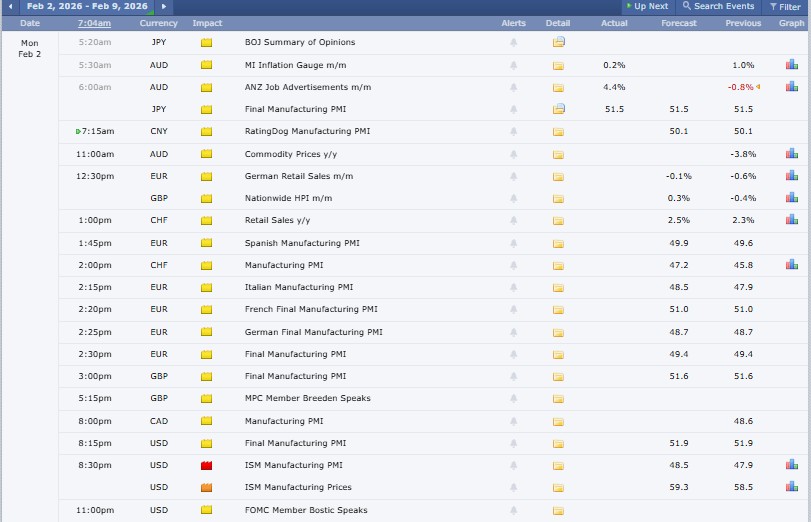

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.69 trillion, noted another 1.8% upward trend in the last 24 hours, whereas Total trading volume was recorded at $158.2 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 57.6%, while Ethereum (ETH) carries 10.3%. The largest gainers of the industry are Polkadot and XRP Ledger Ecosystem in the past day.

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $77642.5, dips 0.99% in the last 24 hours, with a trading volume of $53.71 billion and a market cap of $1.55 trillion.

Ethereum (ETH) price today is at $2301.55, drops 5.5% in 24 hours with a trading volume of $41.57 billion and a market cap of $278 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

River price (RIVER): $18.94, down 24.1% in the last 24 hours, trading volume (TV): $136.27M.

Terra Classic price (LUNC): $0.00003702, up 7.6%, TV: $50.01M.

Bitcoin price (BTC): $77,691.32, down 0.8%, TV: $53.98B.

World Liberty Financial price (WLFI): $0.1331, up 1.93%, TV: $279.58M.

1inch price (1INCH): $0.1168, up 11.71%, TV: $68.19M.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

MYX Finance price today (MYX): $5.52, jumps 14.25%, trading activity $20.52 million.

Story price today (IP): $1.56, climbed 8.41%, trading activity $171.27 million.

Canton price today (CC): $0.1866, rises 5.00%, trading activity $30.46 million.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

Monero price (XMR): $418.52, down 8.45%, trading activity around $127.10 million.

Ethereum price (ETH): $2,309.01, lower by 5.44%, with trading volume near $41.03 billion.

Bitget Token price (BGB): $3.04, slipped 5.42%, trading activity close to $41.08 million.

Stablecoins and Defi Update:

Stablecoins reflect no change over the past 24 hours, with a market capitalization of $309.7 billion and trading volume of $120 billion.

The Overall (Defi) Decentralized Finance market declined 2.6% over the last 24 hours, recording a market cap of $93.3 billion and trading volume (TV) at $5.8 billion. Defi dominance globally marked 3.5%.

Source: Alternative Me

Today’s Fear and Greed Index is 14 (Extreme Fear), unchanged from yesterday. Last week was 20, and last month was 29. The sharp numerical decline reflects heavy selling pressure, weak sentiment, macro uncertainty, and recent drawdowns driving investor fear.

(Note: All of these updates have an effect on traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. CrossCurve Bridge Exploited: Cross-chain protocol CrossCurve confirmed a $3 million bridge exploit from a smart contract flaw, urged attackers to return funds within 72 hours or face action.

2. Macro Week Ahead: Last week, the Fed held rates as December PPI beat forecasts; this week, markets watch US nonfarm payrolls and the ECB rate decision closely ahead.

3. World Laureates Summit 2026 Opens in Dubai: World Laureates Summit 2026 opened in Dubai, uniting scientists and policymakers to link fundamental science with governance, featuring AI, blockchain, and energy forums led by KuCoin.

4. January Record set by Prediction Markets: In January, records reached an all-time high with Kalshi, Polymarket, Opinion, and Probable crossing more than $12 billion in volume, and on-chain fees reaching more than $11 million in the world.

5. Circle Announces Stablecoin Vision 2026: Circle 2026 roadmap, which is an Arc blockchain-centric expansion of USDC and USYC, and development of payment and FX infrastructure to mainstream finance based on stablecoins around the world.

6. Nomura Cuts Crypto Risk following Q3 losses: Nomura reduced crypto exposure following Laser Digital losses in the 3 rd quarter, but reiterated its commitment to digital assets, with medium- to long-term expansion.

The sentiment has deteriorated significantly compared to last month, and the Fear and Greed Index decreased to 14. Although the total capitalization rose, the trading pattern indicates defensive positioning, picky altcoin profits, and ongoing risk-aversion towards large-cap assets.

In the eyes of crypto users, this would be an indication of a short-term opportunity with high risk. There are price recoveries, yet there is severe fear, security breaches, and future macro data, which may indicate that volatility will continue, and careful trading, risk management, and research are necessary.

Risk Context: This commentary is not about long-term conditions and is merely informational. It does not point in the direction of the price or show an action to be taken on the investment.

Based on the last 24 hours, crypto investing remains risky but selectively beneficial. Short-term traders may find opportunities in volume-driven movers, while long-term investors should stay patient, avoid overexposure, and prioritize capital protection amid uncertainty and fear-driven sentiment.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.