Highlights:

The attack leveraged a missing cross-chain message validation.

PortalV2 contract balance dropped from ~$3 million to near zero.

The exploit spanned multiple networks, not limited to a single chain.

CrossCurve, previously EYWA, has verified that its cross-chain liquidity protocol was hacked because of a severe smart contract vulnerability. This event caused it to lose around $3 million of its PortalV2 contract on several blockchain networks.

According to the team, the attack was caused by a lack of gateway validation that enabled the attackers to forge cross-chain messages and bypass validation to unlock tokens without authorization.

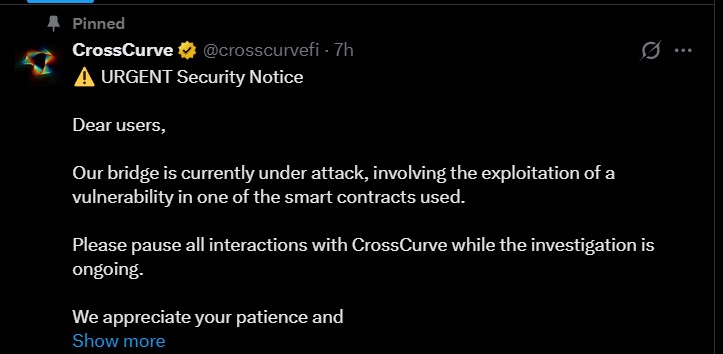

Source: Official X

Security analysis showed that the vulnerability was in the ReceiverAxelar contract. Precisely, its expressExecute option might be called directly using spoofed messages, which allowed the attackers to circumvent the built-in gateway verification tests.

This exploit is similar to other high-profile bridge attacks of the past, including the Nomad hack of 2022, indicating that protocols are still vulnerable to attacks, according to blockchain security firm Defimon Alerts.

CrossCurve began taking action to avert harm and contact affected users:

The money was sent to 10 addresses. Non-malicious holders have an opportunity to keep 10% in the form of a bounty.

The rest of the money has to be refunded to an address beginning with 0x624E.

The addresses will be considered malicious in case of non-refundment of funds or failure on the part of holders to communicate with CrossCurve within 72 hours.

Source: X

The protocol has threatened that non-compliance will be followed up by judicial proceedings, which include:

Criminal reporting and civil litigation.

Collaboration with exchanges and Circle to freeze assets.

Malicious addresses and the results of the analysis should be disclosed publicly.

CrossCurve is a cross-chain DEX and cross-chain consensus bridge that runs transactions with a variety of validation protocols, such as Axelar, LayerZero, and EYWA Oracle Network,k in collaboration with Curve Finance.

The project also focused on its security-first design and stated that the likelihood of multiple cross-chain protocols being compromised at the same time is almost zero. Remarkably, Michael Egorov, the founder of Curve Finance, invested in CrossCurve in September 2023, and the protocol raised $7 million with the help of venture capitalists.

Curve Finance recommended that userwhoat have invested in Eywa-related pools should check their holdings and think about withdrawing their votes. CrossCurve also advised everyone to cease communications until the investigation is over.

Security experts caution that bridge protocols are a risky field in DeFi, particularly when the project relies on multi-chain validation systems.

The CrossCurve crypto hack news highlights the persistence of cross-chain bridge vulnerabilities, impacting millions of users, and the necessity to be cautious about smart contract security and user behavior on DeFi platforms.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.