Building a strong security system is a wise decision. It just locked in a game changing deal with Oasis pro for US securities licenses. Ondo Finance Acquisition is going to be a major move in the tokenization space. On July 4, the tokenization platform said that Ondo Finance Acquisition deals with the registered broker Oasis Pro in order to speed up its growth in the regulated tokenized securities market in the United States.

The platform announced that it is purchasing Oasis Pro, which includes its Securities and Exchange Commission (SEC)-regulated broker-dealer, alternative trading system (ATS), and transfer agent (TA).

Source: X

In addition to digitizing equities, the technique lowers trading costs by utilizing fractional offerings. According to the statement, analysts estimate the market would reach over $18 trillion by 2033. In the upcoming months, the tokenization platform announced it will make tokenized stocks available to investors outside of the United States via its Global Markets platform.

The most recent Ondo Finance Acquisition is a component of its planned development, which now includes more than $1.4 billion in tokenization assets managed.

The Company founded in 2019, is a US-based broker-dealer and Alternative Trading System (ATS) provider with a proven regulatory track record. It operates through subsidiaries, including an SEC-registered broker-dealer and Transfer Agent. It supported by investors like Mirae Asset Ventures, was one of the first US-regulated ATSs to settle digital securities in fiat and stablecoins. As a FINRA member since 2020, Oasis Pro has contributed to the evolving regulatory framework for tokenized assets in the US.

The company’s CEO Nathan Allman plans to build a robust, accessible tokenized financial system with strong regulatory foundations. Oasis Pro CEO Pat LaVecchia combines Oasis Pro's brokerage platform with it's institutional-grade infrastructure, creating a regulated securities ecosystem.

Ondo Finance Acquisition of Oasis Pro announced following the launch of the Ondo Catalyst fund, a $250 million joint venture with Pantera Capital. Ian De Bode, Chief Strategy Officer, stated that the new fund Catalyst, will assist early-stage enterprises by purchasing both stock and token positions.

Source: X

The platform has helped JPMorgan's blockchain unit, Kinexys, complete cross-chain Delivery versus Payment transactions using tokenized US Treasuries on the platforms Chain testnet. This move reflects a broader shift in financial institutions towards tokenizing traditional assets, including stocks and bonds. Crypto platforms Bybit, Kraken, and Robinhood have launched services for European investors to access tokenized versions of major US stocks and ETFs. Other major players include BlackRock's BUIDL and Franklin Templeton's FOBXX.

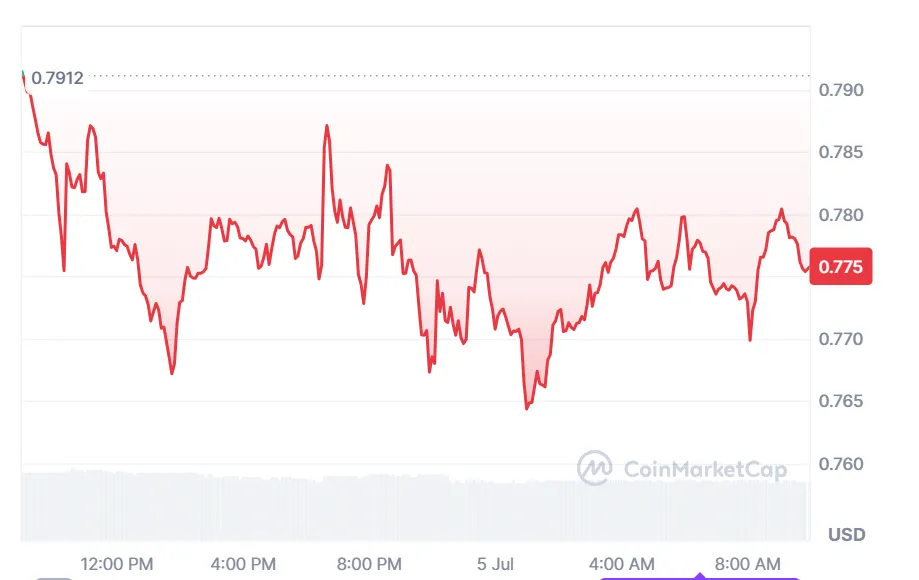

Source: Coinmarketcap

Despite the announcement of Ondo Finance Acquisition, it is down 3% and is searching for support close to a rising trendline that starts on June 22. It can drop toward $0.72 if it breaks below this trendline. Historically, its frequently has "sell-the-news" reactions following significant revisions.

Fireworks aren’t just for the 4th of July. True independence for assets is coming. Ondo Finance Acquisition is a regulatory breakthrough in the tokenization space, legitimizing blockchain-based securities for mainstream adoption. With $1.4B AUM and full U.S. regulatory compliance, the company is positioning itself as a bridge between TradFi and DeFi, aiming for a $18T market projection by 2033. This sets the stage for institutional-grade tokenization at scale, with regulatory compliance and blockchain infrastructure being key factors in the next cycle.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.