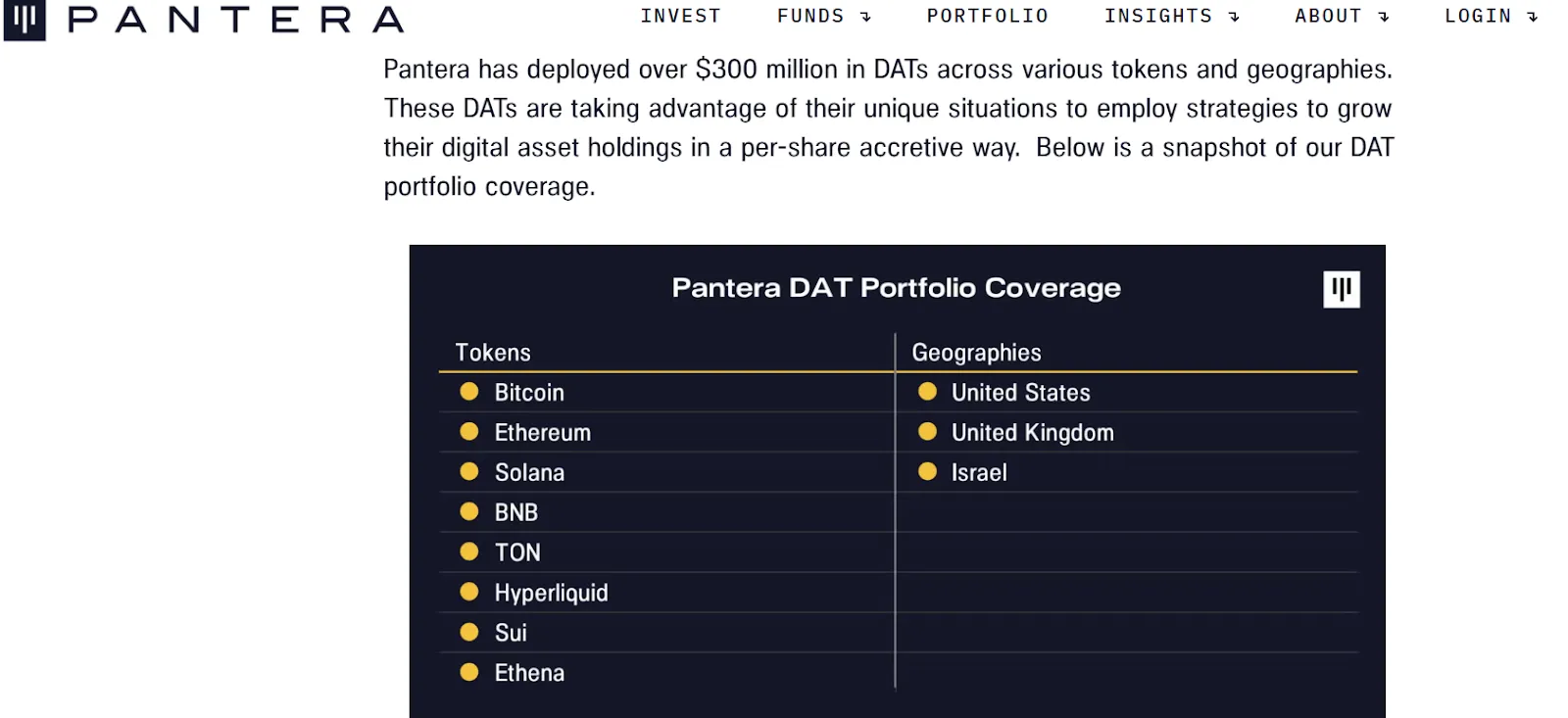

Pantera Capital has announced through its blockchain papers that it has invested $300 million in digital asset treasury companies across multiple countries. These firms are also known as DAT’s that hold crypto currency reserves on their balance sheets to make core strategy.

Source: Website

Pantera Capital DATs portfolio includes 8 tokens: Bitcoin, Ethereum, Solana, BNB, TON, Hyperliquid, Sui and Ethena. The company has expanded to the United States, United Kingdom and Israel. Major treasury companies in which it has invested are BitMine Immersion, Twenty One Capitals, DeFi Development Corp, SharpLink Gaming, Verb Technology Company, CEA Industries, Satsuma Technology, and Mill City Ventures III.

The papers also revealed that DATs is a new way to invest. Investing in DAT can give higher returns than holding a token or ETFs.

Source: Website

The Pantera Capital went on to say that this methodology may provide a larger potential return than simply owning tokens or using exchange-traded funds. Two DAT-specific funds have also been raised by Pantera Capital in recent months, however the exact amounts have not been made public.

Pantera defines Digital Asset Treasury companies that transform itself into an "on-chain crypto treasury" by raising funds through buying assets like Bitcoin, Ethereum, and Solana, and allowing investors to gain exposure to these assets by buying its stock. Unlike ETFs, which are passive investment vehicles, DATs are active operating companies that can stake, lend, yield farm, or hold indefinitely once it acquires crypto. ETFs are passive investments, while DATs are ambitious vaults.

Pantera Capital $300M news particularly highlighted BitMine Immersion to back its DAT thesis. BitMine’s aggressive buying ETH strategy has made it the largest Ether reserve and third largest DAT globally. The most important factor to which Digital asses treasury success depends is the holding the token for long term plan. Bitmine’s DAT is built on Ethereum and will be one of the biggest upcoming investment trends coming for future expansion.

Seeing big organisation’s trust and confidence firms are moving to new trends. Many giant institutions have invested in the ETH corporate treasuries boosting traders confidence. This is the new way of investments other than ETFs to gain higher returns.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.