Paxos Trust Company, the issuer behind USDP stablecoin, has once again applied to convert its New York limited-purpose trust charter into a US national trust bank charter. A formal OCC filing has been made for the application. The team shared the filing news over X (formerly Twitter).

Source: X

If approved, this licence would allow it to be recognised as a federally regulated agency for asset custody and payment settlement across the US. However, unlike traditional banks, a national trust bank cannot take deposits or give loans.

The company first got conditional approval in April 2021, but it expired in March 2023 because the company didn’t meet the OCC’s pre-opening requirements within the given time. Since 2015, it has been operating under a New York trust license. CEO Charles Cascarilla said that being under OCC supervision would strengthen safety, transparency, and trust in the market.

If gets the US bank license, it would become a nationally regulated stablecoin issuer. This would place the company directly under OCC supervision, meeting the high standards of the new GENIUS Act, which sets federal rules for stablecoin issuers.

This kind of oversight could:

Improve investor trust in crypto and its stablecoins.

Increase market adoption due to higher compliance and transparency.

Reduce risk with bank-grade regulation.

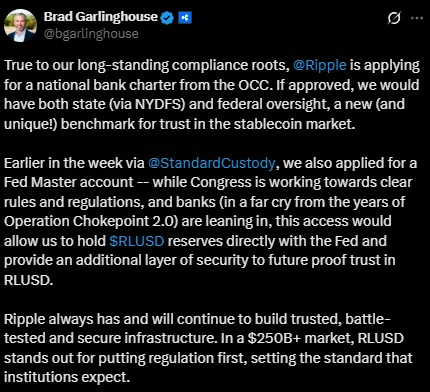

However, Paxos is not the only company that applied for the license. Ripple and Circle has also applied for it with the approval pending.

This move is similar to how Ripple and Circle have also been pursuing federal licenses. The circle ripple news gained attention recently when Ripple files for bank license but faced resistance from traditional banking groups.

Source: X

In July, the American Bankers Association and other groups urged regulators to delay such approvals, citing “policy and process concerns” over virtual currency firms applying for banking charters. This could mean it might also face pushback, as happened with Ripple.

Still, Paxos’s step shows that more crypto firms are seeking national licenses to expand reach and gain trust. With this reapplication, Paxos joins Ripple and Circle in following a similar regulatory path.

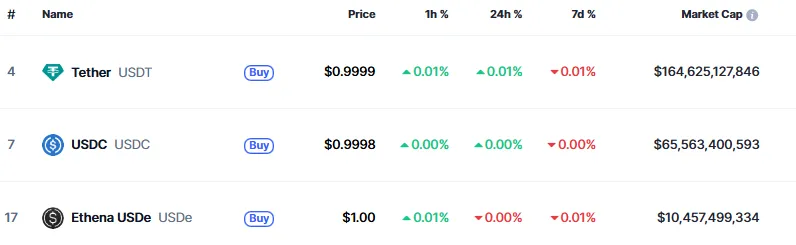

For context, Pax Dollar (USDP) currently has a market cap of about $66.95 million. In comparison, Tether (USDT) is at $164.63 billion, USDC at $65.55 billion, and Ethena USDe at $10.45 billion. Even with approval, it has a long way to go to compete with the top three.

Source: CoinMarketCap

If the license is approved, it could help in bridging the gap to overtake leaders like Tether and USDC is massive. To match Tether, USDP would need over $164 billion more in market cap.

For now, stablecoin news shows that regulation is becoming the key to growth. Whether USDP can close this gap will depend on both market demand and regulatory success.

The bank reapplication marks one major leap in the stablecoin industry. While OCC approval may imbibe additional faith to the platform and drive it to greater heights, resistance from traditional banks can present a hurdle. The next few months shall prove whether Paxos gets the license or will suffer delay as has been the case with the Ripple stablecoin.

Disclaimer: This article is for informational purposes only and does not provide any sort of financial advice. Readers should do their own research before making any investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.