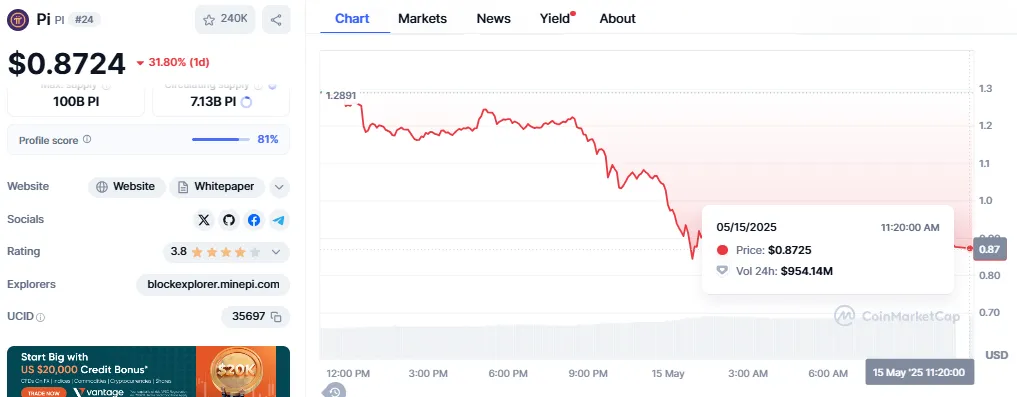

The Pi Coin shocked its cryptocurrency community this week. On 14 May, the Network had a big announcement that most of them had been hoping to be a game changer. However, rather than good news, the Pi coin announcement failed to impress users. This led to an unexpected price drop from $1.2897 to $0.8711—32.90% less in one day, according to CoinMarketCap.

Source: CoinMarketCap

During the past week, the coin had appreciated by nearly 40%, and all thought a robust uptrend was in store. But no, the project is once again in downtrend. So what actually led to this huge drop? Here are the reasons explained.

No Binance Listing: Most of the users were expecting a much-awaited Binance listing of the token, particularly after the community vote, when 86% voted for it. The May 14 update, however, did not say anything about being listed on Binance. This was the biggest letdown.

Instead, the platform announced something unexpected—Pi Network Ventures, a new $100 million fund to support startups and improve real-world use of Pi. Though this will benefit the project in the long run, the community was evidently waiting for something else.

Source: X

No Token Burn Announcement: Another key cause of the crash is the absence of a token burn. A burn event tends to decrease the overall supply of tokens in existence, thus increasing the value of each of the remaining coins. More than 1.3 billion tokens will be issued in 2025, so a burn would have alleviated inflation fears.

But again, nothing of that sort was mentioned. This made the users even more anxious about the future worth of their investments.

Mass Sell-Off: Frustrated by not being able to list on Binance and token burn failure, all of the users began frantically selling out their tokens. The mass sell-off caused the price to drop even quicker. It indicates that users still believe in the project a lot, but are losing trust because of continuous delays and failed promises.

The TradingView chart shows that the coin has been very unstable lately. After hitting a high of around $1.70 on May 12, it has dropped sharply. Right now, it’s trading near $0.86.

Source: TradingView

Bullish Case: If buyers return and push the price above $1.00, it could move toward $1.20 and maybe retest the $1.50–$1.70 range. For this to happen, the project needs more attention from big investors or some major exchange news. Technical signs like bullish RSI and higher lows could support this move.

Bearish Case: If the token goes below $0.85, and especially under $0.80, it could fall further to $0.70 or even lower. A weak trading volume, negative outlook, or delay in launching the full platform may cause more losses. The chart also shows lower highs, meaning sellers are still in control.

At this point, $0.85 is a key level to watch. A rise above $1.00 or drop below $0.80 will likely decide where the coin heads next.

The Pi Coin crash shows how much the community was counting on positive news. But without a Binance listing or a token-burning event, many users lost faith. While the platform is still working on real-world use cases, trust and timing are everything in the crypto world. Investors should keep a close eye on how the team moves forward and how the price reacts in the coming days.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.