What does the sudden rise in Pi Network Exchange Reserve really mean for traders? As major exchanges rapidly accumulate millions of coins despite recent price weakness, new on-chain data is sparking fresh market curiosity. With liquidity strengthening and KYC rewards nearing rollout, the latest developments could shape the next price direction.

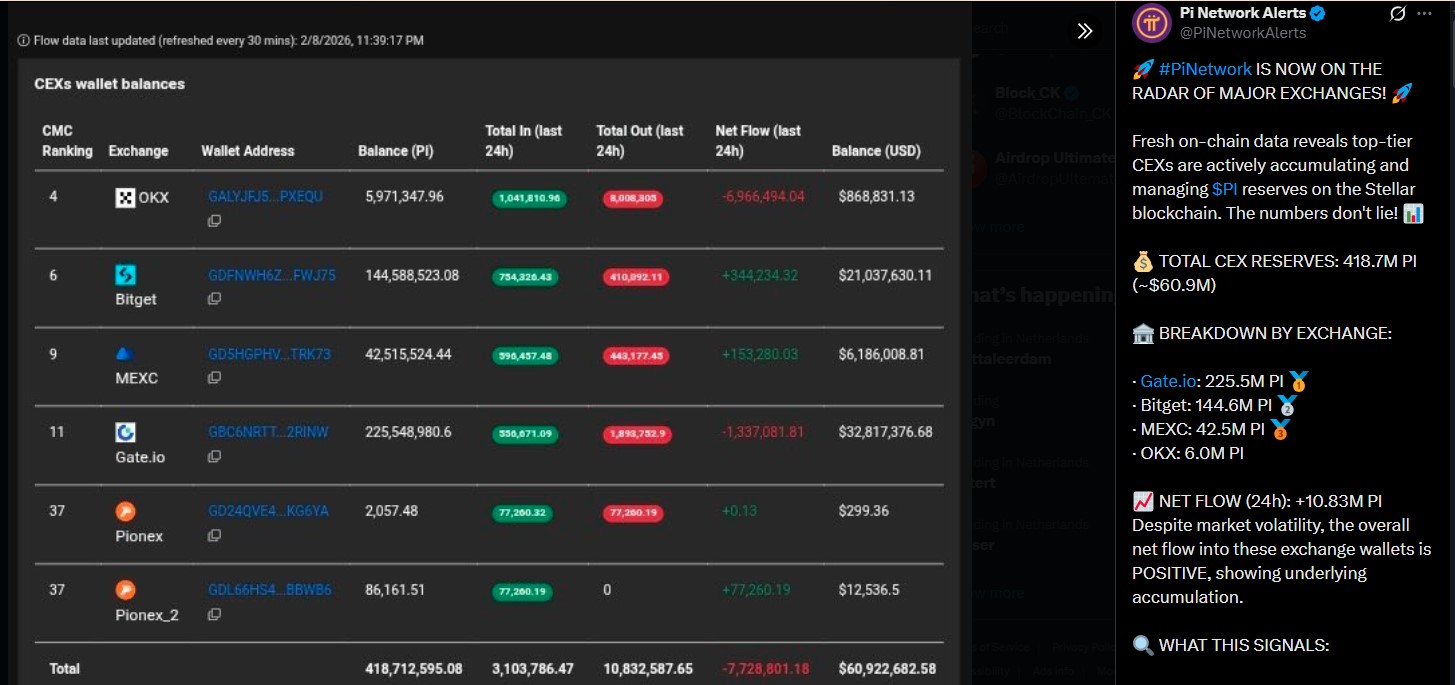

The growing Exchange Reserve shows that bullish price activity may be approaching. According to the official sources, top-tier CEX exchanges collectively manage 418.7 million coins, valued near $60.9 million, on the Stellar blockchain.

Source: Offical Network's Alerts

Over the last 24 hours alone, wallets recorded a net inflow of +10.83 million tokens, showing that buying is slowly increasing even though the overall market is still uncertain. This trend also aligns with the current 28% jump in trading volume.

Reserve Breakdown by Exchange:

Gate.io: 225.5M coins

Bitget: 144.6M

MEXC: 42.5M

OKX: 6.0M

This development is now driving strong attention across today's news as chatter intensified around a possible pi network binance listing. No official confirmation exists; however, speculation alone has increased community engagement.

On February 6, the official account confirmed that kyc rewards distribution is progressing as scheduled. Design has been finalized, implementation completed, and testing is currently underway, with deployment targeted for March 2026.

Finalizing validator incentives helps clean balances, settle obligations, and reduce supply uncertainty — conditions exchanges typically require before expanding support.

This update directly complements the growing Pi Network Exchange Reserve narrative.

Current data answers the question many traders ask — why the asset's price dropped today.

The altcoin is trading near $0.139, down 3% in 24 hours, roughly 12% weekly, and close to 35% monthly, confirming a short-term downward pattern. The asset is crashing because the TradingView chart confirms a continuing short-term downtrend. Yet, trading volume jumped 28% to $12.56 million.

This rising participation during price weakness often signals that selling pressure may be getting absorbed. Let’s look at the major signals:

As per the Technical chart observation, price is trading just above the important $0.13 support. If buyers step in and defend this level, the price could bounce back toward $0.16–$0.18 in the short term.

Meanwhile, the RSI in the mid-30s places the asset close to oversold territory, increasing the probability of a relief move. But if $0.13 breaks, the price may fall towards $0.11–$0.12.

Fundamentally, both the Pi Network exchange reserve expansion and KYC validator progress may improve sentiment and influence the debate around will pi price increase in coming months.

While price remains under pressure, investors should watch the $0.13 support closely to watch the future price trend..

YMYL Disclaimer: This article is strictly for informational purposes only and does not support any financial advice. The crypto market is risky, so always do your own research before investing in any token.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.