The Polkadot community is currently debating a big and bold proposal, selling 500,000 DOT tokens to slowly buy Bitcoin over one year. The idea was suggested by a community member who goes by the name hippiestank. If approved, the DOT would be used to buy Threshold Bitcoin (tBTC) using a dollar-cost averaging (DCA) method. That means the purchase would happen gradually over 12 months instead of all at once.

As per the reports of Wu Blockchain, The proposal also includes adding the purchased tBTC to Hydration’s Omnipool, a type of DeFi liquidity pool on the platform. The plan would use Threshold Network’s non-custodial Bitcoin bridge, which aims to keep BTC decentralized and safe, without relying on middlemen or central parties. For now, this plan is only being discussed in the forum of the platform, it hasn’t gone live on-chain, and no official vote has been scheduled yet.

Source: Wu Blockchain X Handle

Supporters believe this is a smart long-term strategy. The majority considers BTC as the most trusted and decentralized digital currency. It can be used as a hedge against inflation.

They also believe this could appeal to more users and investment to DeFi platforms of Polkadot, fostering overall development.

Using tBTC also goes well with values of Polkadot. It is created to bring actual BTC into other blockchain systems in a form that is still secure and decentralized.

The Threshold Network uses a special method called threshold-ECDSA to handle BTC without requiring an individual or company to hold it.

Not everyone in the community is of the same opinion. Some consider it as risky, prominently because it is based on bridges and advanced cryptocurrency tools like threshold-ECDSA. If there is any loophole in the tBTC system, there would be a high probability that funds could be lost.

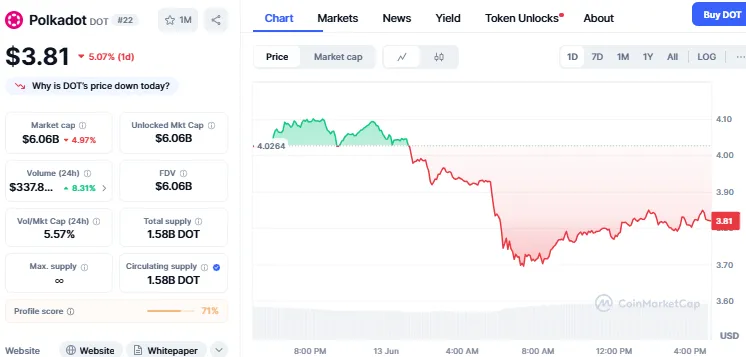

Timing is also one of the concerns. Bitcoin is trading near its ATH, which suggests purchasing now might not be the appropriate decision. Some DOT holders are also questioning what value this brings to them directly. They fear that selling 500,000 DOT could hamper the price or decrease the impact of DOT tokens in the network’s ecosystem. The currency is currently trading at $3.81 with a decrease of 5.07 within the last 24 hours, due to bearish market sentiments as per the CoinMarketCap.

Source: CoinMarketCap

Some critics also say this feels like a distraction. They question that the network has more crucial things to emphasise on, and this strategy might be more about getting attention than resolving actual issues.

It’s not just Polkadot exploring this idea. In the U.S., lawmakers have proposed the BITCOIN Act, which suggests the U.S. Treasury buys up to 1 million BTC over five years as a strategic asset. A law to have Texas hold Bitcoin in its state reserves is also in the process. Recently, Ukraine also said it would launch a national Bitcoin reserve with the support of Binance as part of its efforts to modernize its financial system.

The plan is in its raw forms. It is discussed in the forums, and there has not been an official vote yet. But the concept is getting traction, both within and without the Polkadot ecosystem.

If the vote goes ahead and succeeds, it would represent a significant change in Polkadot treasury management. But the final decision will come down to the community, and their vote will shape the future of the Polkadot treasury.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.