The crypto market is buzzing after Saylor's latest tweet Bitcoin is Hope. Is Michael Saylor setting the new paradigm for finance around the asset? The community is in a buzz not just because of its early timing, but also because of the message and the following events of the purchase of $100 million by MicroStrategy and the related upsizing of the company's Bitcoin-backed share offering.

The Executive Chairman at MicroStrategy, upset his usual tweet schedule by posting this powerful statement: "Bitcoin is hope," along with a symbolic AI-generated image of himself in a desert standing beside a blooming cactus. The strong metaphor of resilience is also what it stands for, especially in hostile financial environments.

He message managed to land just as BTC started its recovery is coming down 4% to hike 1% to $104,850 today. As with many other of his utterances, the timing seems to be extremely precise—and calculated.

"Bitcoin is hope" tweet is not merely a statement but rather a vision. In line with doctrines widely promulgated by Bitcoin evangelists like Max Keiser, he reiterated the belief as a decentralized system can eliminate, or at least lessen, conflicts arising from money around the globe.

Back in a follow-up tweet, he went on to say, "If you have everything, you don't need BTC," emphasizing that BTC has value for the underserved and economically discriminated-against as Bitcoin is Hope. His unshakable belief as an engine of financial empowerment is not just a matter of doctrine but has been acted on with great vigor.

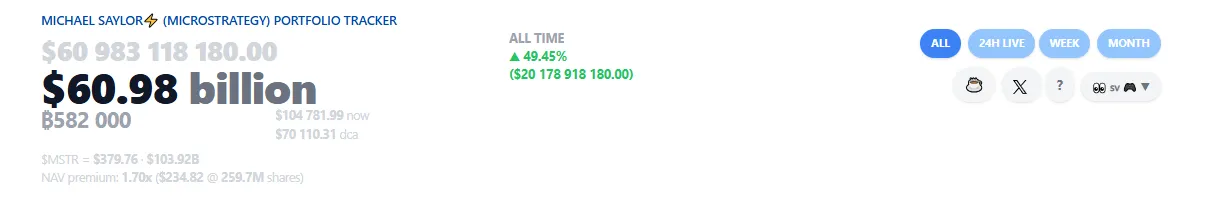

MicroStrategy has gone on another aggressive acquisition spree under leadership of Michael Saylor, confirming its position as the top corporate holder. This week, the purchase of $100 million worth of BTC pushed the firm’s stash to a jaw-dropping 582,000 that are worth over $60 billion at current prices as Saylor tweet Bitcoin is Hope.

Source: saylortracker

This timing concurs with newfound momentum in the world's largest cryptocurrency, with Saylor and MicroStrategy viewing prices today as a long-term entry point rather than a peak.

Finally, acting in an even more bullish fashion, MicroStrategy has also increased the size of its STRD (Structured Digital Reserve) shares offering from $250 million to $1 billion. These Bitcoin-backed securities, listed on Nasdaq, create a new way for institutional investors to get exposure—this is effectively adding a trad-fi-rendering dimension to digital assets.

This move further supports MicroStrategy’s Bitcoin treasury on a strategic level but also points to confidence in crypto as an asset class in the capital markets. This is another endorsement of mainstream institutional acceptance of BTC.

With the asset slowly in the process of recovery, this bigger question looms on the minds of investors and institutions: Is now the best time to follow Saylor’s lead?

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.