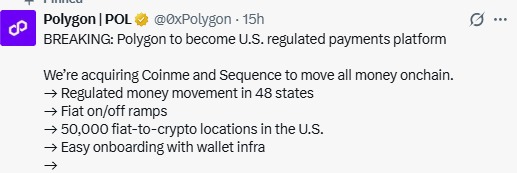

Polygon is making a bold move that could change how crypto payments work in the United States. Polygon acquires crypto firms Coinme and Sequence in a deal worth over $250 million, marking its entry into regulated digital payments.

This is not just another partnership. It is a full shift in strategy. They wants to become a U.S.-regulated payments platform that moves real money onchain.

This step shows the organisation is thinking beyond speculation and focusing on real-world use cases. The goal is simple: make sending money as easy as sending a message.

“Earlier, Sandeep Nailwal had teased the update with a simple message: ‘You’re not ready for what’s coming next for Polygon.

When Polygon acquires crypto firms like Coinme and Sequence, it gains something very powerful: control. Instead of depending on outside companies for wallets, compliance, and on-ramps, it now owns the full pipeline.

Source: X (formerly Twitter)

Coinme gives the firm money-transmitter licenses in 48 U.S. states and access to over 50,000 fiat-to-crypto locations. These include kiosks like Coinstar and retail partners across America. This means users can walk into a store and turn cash into digital currencies legally and easily.

Sequence adds smart wallets and one-click cross-chain transactions. Users no longer need to understand gas fees, bridges, or swaps. Everything happens in the background.

Together, this forms the Open Money Stack.

The Polygon Open Money Stack is a complete system for payments. It includes wallets, stablecoins, compliance tools, blockchain rails, and cross-chain movement. When they acquires crypto firms, it fills the missing parts of this system.

Now a business can go from bank account to blockchain settlement using one API. That is huge for banks, fintech companies, remittance platforms, and payout providers.

It is no longer just infrastructure. It is becoming a financial infrastructure.

With this move, the organisation acquired crypto firms to become a fully regulated U.S. payments company. It now has:

Money transmitter licenses in 48 states

50,000 retail on-ramp locations

Regulated wallet services

Fiat on/off ramps

Cross-chain payment execution

This is rare for a public blockchain. Usually, only private or permissioned chains take this route. It is doing it while staying open and decentralized.

For years, blockchains depended on token price growth. This step is to build real business revenue. The company plans to earn money from transaction fees and stablecoin movement, targeting over $100 million annually.

This is a big change. They are building income that does not rely on POL price speculation.

With POL already down over 60% from its peak, this strategy helps stabilize the ecosystem.

Polygon Price Today shows steady strength. POL rose almost 8% in the last 24 hours currently trading around $0.1635.

Source: CoinMarketCap

The reasons are clear:

Regulated payments push

12.5 million POL burned in 2026

Network activity hitting new highs

Technical breakout above $0.164

When the acquisition happens, investors see long-term value, not short-term hype.

Short-Term Price Outlook

If POL stays above $0.16, traders may target $0.185 and then $0.208.

If it falls below $0.155, the price could pull back to $0.131.

The trend remains bullish as long as network usage and burns stay strong.

This move is not just buying companies. It is buying the future of regulated blockchain payments. Coinme brings legality. Sequence brings simplicity. The project brings scale.

This is how digital assets becomes real finance.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Digital assets are volatile, and readers should do their own research or consult a financial advisor before making any decisions.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.