Can real blockchain growth come from usage and not just hype? The latest polygon price surge suggests that the project is entering a strong phase driven by real demand.

POL (previously MATIC) jumped nearly 14% in 24 hours and is trading near $0.167, backed by rising network activity, heavy token burns, and a clear long-term vision.

This price rally is not coming from speculation. It is supported by on-chain data and solid upgrades.

Founder Sandeep Nailwal post fueled excitement with his tweet, “You are not READY for this,” pointing to a major update on January 13, 2026.

Source: X (Formerly Twitter)

At the same time, Project’s official account said, “2026 is the year POL powers global money movement.” These messages show growing confidence inside the ecosystem.

The main driver behind the price surge is network usage. The blockchain recently saw all-time-high activity. During this phase:

Over 13.6 million POL were generated in fees

More than 12.5 million tokens were burned

Daily burns crossed around 1 million tokens

A single day saw nearly 3 million token burned

This means supply is shrinking fast. When supply falls and demand remains strong, prices usually rise. The platform also ranked number one in network revenue among blockchains over the last week, proving people are truly using the chain.

Another major reason for the price surge is the Polygon Open Money Stack. This is a full financial framework that covers:

Payments

Wallets

Stablecoins

Compliance

Financial services

Blockchain infrastructure

The idea is simple: money should move like information on the internet. Users should not need to understand blockchains, and businesses should not depend on slow banks. This turns it into serious financial infrastructure.

They made it clear that holders benefit when the network grows. POL earns value from:

Transaction fees

Token burns that reduce supply

Staking rewards

Future interoperability fees through Agglayer

When Polygon Chain and Agglayer succeed, holders benefit. That is why the $POL price rally feels more fundamental than speculative.

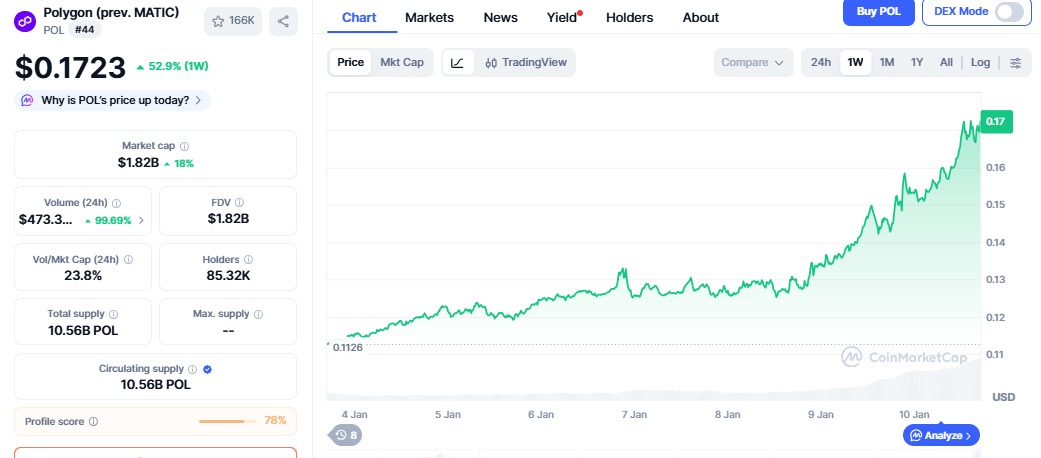

According to CoinMarketCap, It has gained more than 50% in one week.

Source: CoinMarketCap

This is not just market excitement. It is driven by:

Record network activity

Rapid token burns

Strong technical upgrades

Clear financial roadmap

What’s Next for the Price?

Short term: It has broken resistance between $0.15 and $0.16. RSI is above 80, meaning it is slightly overbought. A small pullback is possible. If it holds above $0.16, the next targets are $0.18 and $0.20.

Long term: If the Open Money Stack gains adoption and burn rates stay strong, it could move toward $0.30 to $0.50 in 2026. Strong real-world payment usage could push it higher.

The polygon price surge shows that the it is growing through real demand, not marketing hype. Heavy token burns, strong network usage, and a bold financial vision are changing how investors see this digital currency. It is quietly building the rails for the future of digital money.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly conduct your own research before investing in the crypto markets.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.