Polygon (POL) has emerged as one of the strongest-performing cryptocurrencies this month, surging over 70% in just 10 days while the broader crypto market remains largely range-bound. With Bitcoin hovering near $90,000 and Ethereum consolidating above $3,000, most altcoins have struggled to gain momentum.

However, Polygon has defied the trend following major ecosystem developments, rising on strong on-chain activity, record token burns, and a bullish technical breakout.

Let’s break down why Polygon price is up today and what the charts suggest for POL’s next move.

Source: X

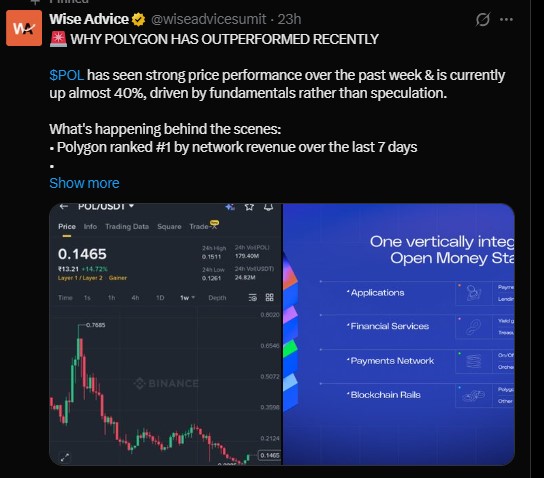

The increase in price comes after the introduction of "Open Money Stack," Polygon's new payment system, which is an initiative of the company to switch over to digital currencies. The new integrative model not only supports transactions through stablecoins but also creates a demand for real-world payment adoption.

Polygon Labs stated that the project encompassed apps, finance, payments, and blockchain technology.

Moreover, the network's fundamentals contributed to the investor's confidence. On January 5th, the network burnt more than 3 million POL tokens, which was the largest amount ever in its PoS history.

In addition, on-chain transactions were growing, with the highest network revenue among all others in the past week. Such situations indicate that the utility increase is responsible for the new price hike and not a temporary boom.

Furthermore, the CEO of Polygon disclosed a new strategic roadmap:

"The Open Money Stack, a vertically integrated on-chain stack covering applications, financial services, payments, and blockchain rails."

This makes Polygon a player in the infrastructure-focused ecosystem instead of being just a narrative trade with a short lifespan.

The pair is showing a bullish reversal with clarity in the daily chart. After a few months of downtrend, the daily chart reflects a bullish reversal very clearly. The price was moving within a clearly defined descending channel, which usually indicates continuation to the downside, but the strong breakout above the upper trendline of the channel has changed the structure in favor of the buyers.

The bullish candles that have formed around this breakout, together with the increase in momentum, are signs that the breakout is not a false one. POL has also gained the 20-day, 50-day, and 100-day EMAs that are now the immediate dynamic support and resistance, while the price is moving towards the 200-day EMAs, which are the key areas of resistance that often determine the direction of the trend.

The RSI is moving in the overbought area that corresponds to the buying pressure; while a slight retreat or consolidation in the short term may happen, however, such high RSI levels are frequent in the early periods of trend reversals.

If POL holds above the $0.14 to $0.15 range, the price would then aim for a short-term move of $0.18 to $0.20, then $0.24 to $0.26 will be the next major resistance zone. If the bullish trend is strong and prolonged, it might even lead to a retest of the $0.28 to $0.30 region in the medium term.

On the other hand, if the price closes below $0.13 on a daily basis, it will be regarded as a weakening of the bullish outlook and an indication of renewed consolidation.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.