What happened in crypto today has the entire industry buzzing. From geopolitical drama to DeFi surges, the industry is up today by over 4%, hitting a total market cap of $3.25 trillion.

So, why is crypto market surging today? Let’s break down the 5 biggest stories behind this June 24 rally—where a ceasefire, token pump, and policy shifts collide.

The SEI token surged in value by 41% in a 24-hour period. After the news of a brief Iran-Israel ceasefire was announced by Trump. The coin surged to $0.2816 and saw the highest increase in trade volume around 253% according to the TradingView chart.

Source: TradingView

This rally in this industry is likely a reflection of renewed investor confidence, particularly for DeFi tokens. Various technical indicators suggest momentum continues as well.

Ever seen a stock outperform its own token supply? That’s Circle Internet Group (CRCL), which has skyrocketed 750% since its IPO. The Circle stock rally was driven by the passing of the GENIUS Act, giving legal clarity to stablecoins.

With CRCL now worth $63.89B—more than USDC’s $61.68B supply—it’s a rare case of equity exceeding token float. This move reflects why crypto market is up today, with investors favoring compliant Web3 companies.

Turkey has imposed strict regulations to combat money laundering. New rules include transfer note requirements, delayed withdrawals, and stablecoin transaction caps as stated by the official sources.

Source: Wu Blockchain

These policies reshape one of the most active cryptocurrency economies, with licensed platforms possibly receiving relaxed limits. As this crypto market June 24 is revealed, global investors will look on to see if Turkish user behavior will significantly shift first before continuing the trading.

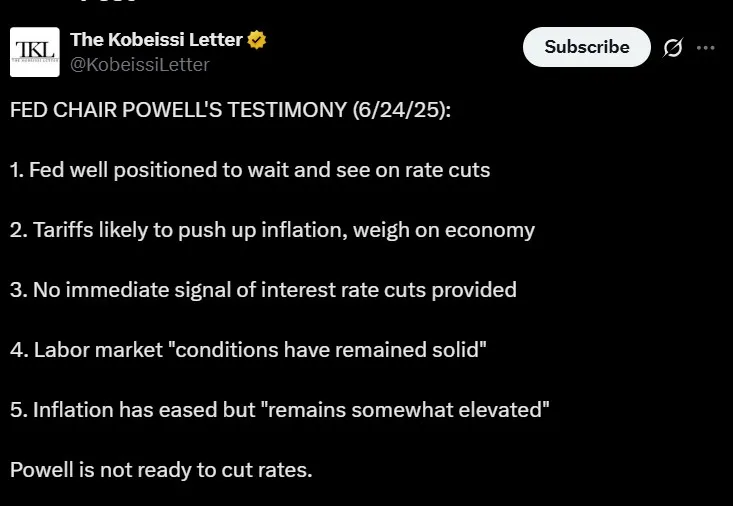

According to The Kobeissi Letter latest post on X, Fed Chair Powell’s testimony today left markets cold on future rate cuts. He stated inflation remains “somewhat elevated” and emphasized a “wait and see” approach.

Source: X

This hesitation doesn’t signal a marketplace-friendly move just yet. Still, this rally today suggests that broader bullish sentiment has taken the lead—for now.

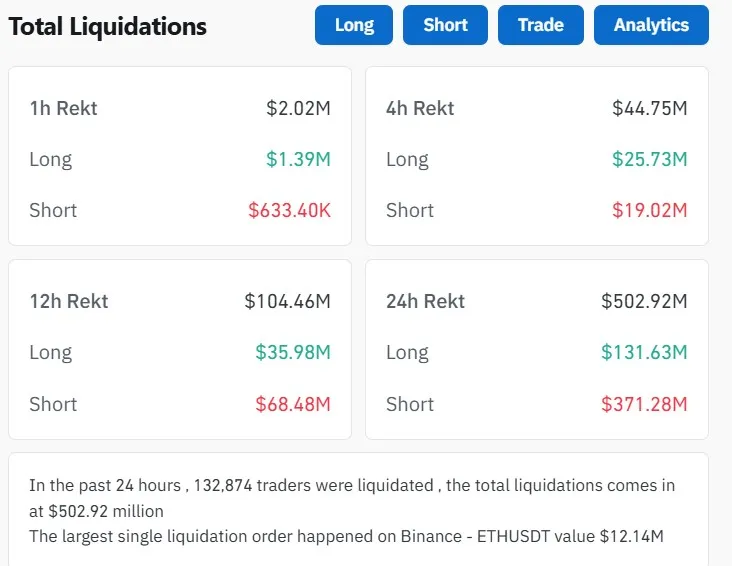

A brief Iran-Israel ceasefire was shattered after renewed attacks, triggering $500M in token liquidation. According to Coin Bureau, this included $371M in shorts and $131M in longs. Bitcoin touched $106K but now trades around $105,312. Will Bitcoin crash again? That depends—As per my analysis being a cryptocurrency observer, if BTC holds above $105K, a run to $110K is possible. If it falls below $100.6K, the industry may bleed further.

From ceasefire breakthroughs to Fed statements and stablecoin equity booms, what transpired in the surge today illustrates how headlines in digital markets are tied to world events.

Whether you’re eyeing the SEI token surge, the Circle stock rally, or simply wondering why the crypto market is surging today, this was a day of major signals. Keep a close eye on the latest marketplace news—the next 24 hours could decide if the rally holds or fades.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.