The Power Protocol Price Surge is catching strong attention in the crypto market after the token recorded a sharp rise despite overall market weakness.

Over the last 24 hours, $POWER climbed around 39% to trade near $0.401–$0.416, clearly outperforming a broader crypto market that dropped nearly 3% as per the CoinMarketCap.

The rally appears to be driven mainly by heavy trading activity and fresh exchange exposure, both of which often attract short-term traders searching for momentum opportunities.

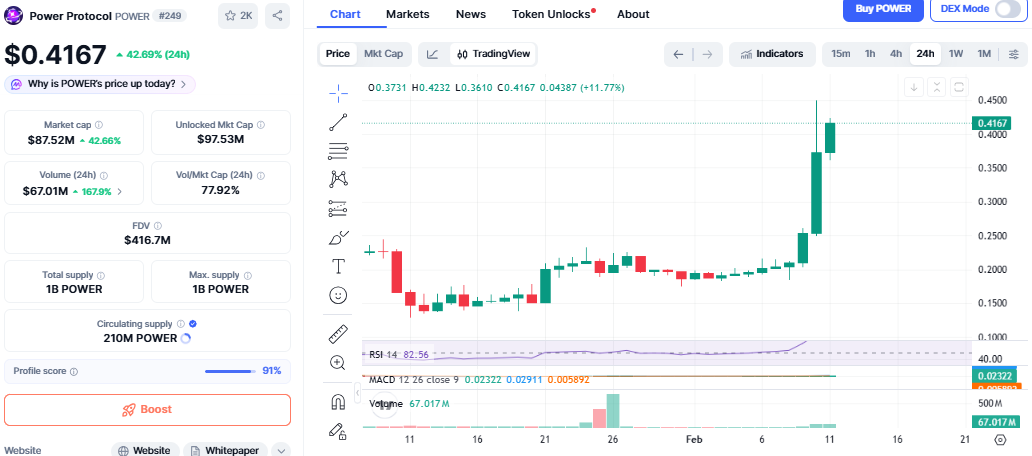

Source: CoinMarketCap Chart

One of the biggest triggers behind the Power Protocol Price Surge is the latest KuCoin Alpha listing.

The exchange confirmed that trading has started with the POWER/USDT pair on the BNB Smart Chain network, allowing traders to access the token through its Alpha Zone.

New crypto exchange listings typically increase liquidity and visibility, especially for lower-market-cap assets. This can quickly pull speculative capital into the token as traders attempt to enter early before wider adoption.

KuCoin also described the listing as a gateway to early-stage innovation, which further boosted curiosity around the project. As a result, market participation jumped soon after trading opened.

Source: X (formerly Twitter)

Another crucial reason behind the Power Protocol Price Surge is the surge in volume that was approximately $66-$67 million on a daily basis as it rose by almost 173%.

Generally, this type of high turnover is a sign of a speculative interest rather than long-run fundamental growth. Lower-cap tokens show rapid price appreciation because their liquidity is boosted.

What is interesting about this move is that the token saw an increase in price while the overall market fell. This indicates that the rise in price was not a result of the price moving up in relation to the price of Bitcoin or Ethereum but was a result of the movement within the overall market.

However, traders should watch whether this elevated volume continues. If it fades quickly, the rally may struggle to maintain momentum.

Power Protocol price today is hovering near $0.41 after touching recent highs close to $0.42 on the chart. Technical indicators show strong upward momentum, though fast rallies sometimes invite profit booking.

If it breaks above $0.42 with strong volume, the next leg higher could begin.

The near-term outlook remains cautiously bullish but volume-dependent.

Bullish Case:

If it maintains support above $0.35 and daily volume stays above $50 million, the token could retest the $0.40–$0.42 range. A confirmed breakout may open the door toward higher price discovery.

Bearish Case:

A drop below $0.35 combined with declining volume could signal buyer exhaustion. In that case, the price may slide toward the $0.30 region.

For now, momentum favors buyers but only if trading activity remains strong.

The current Power Protocol Price Surge demonstrates the potential for low capitalization tokens’ quick responses to new exchange listings and liquidity injections. Although the recent run is remarkable for the current state of the market, its survivability is dependent almost entirely on trading volumes.

Traders should keep an eye on the participation and major technical areas before they make their decisions. If the buying pressure endures, the token might continue to ascend. If not, the drop might happen with the same speed.

YMYL Disclaimer: This content is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are highly volatile; always do your own research before investing.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.