Is the market entering a deeper correction, or is this just another short shakeout? Investors searching for why bitcoin is going down today woke up to a sharp move as the asset slipped beneath the $67,000 level, trading at $66,812.89 after dropping nearly 4% in 24 hours.

The Bitcoin news trend today looks heavier. Weekly losses have reached 12%, while the monthly fall is close to 30%, highlighting sustained selling pressure. Activity has also cooled, with 24-hour trading volume declining 12% to $42.52B, reflecting weaker conviction among participants.

Three major industry triggers appear to be driving this decline. Understanding them helps decode the current bitcoin price crash reasons and what could come next.

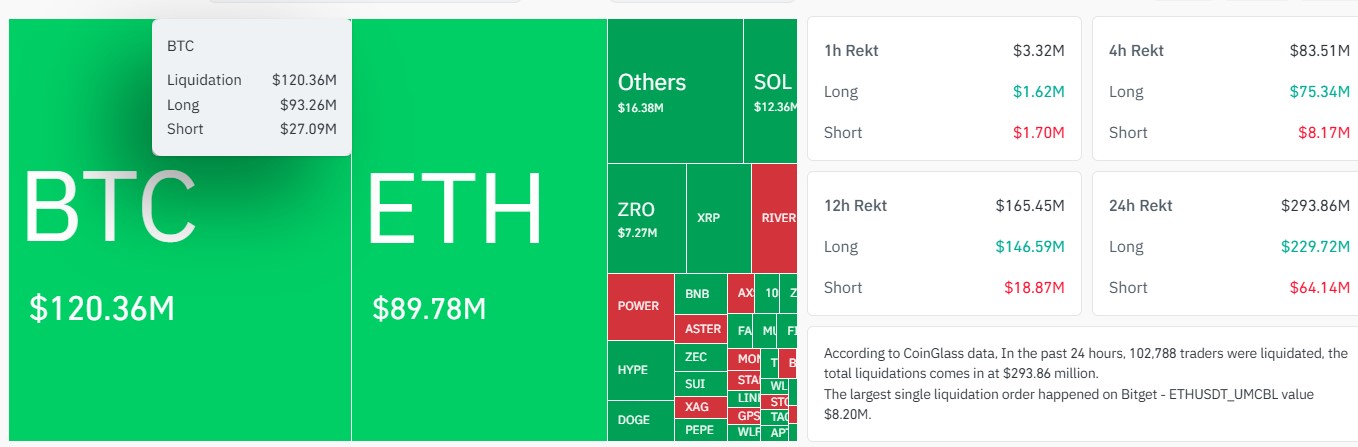

1. Data from CoinGlass liquidation shows that forced selling made the price fall faster. In the last 24 hours, about $293.86 million worth of positions were liquidated. Out of this, $229.72 million were long positions and $64.14 million were short positions. The asset alone saw $120.36 million wiped out, and more than 102,788 traders lost their trades.

When many long trades close at the same time, it creates heavy selling in the market. This is one of the key reasons why BTC is falling today.

2. Big investors are also playing a role in the recent drop. Data from SoSoValue shows that money moving in and out of BTC ETFs has started to change. Although there was still a daily net inflow of $166.56 million, some recent sessions saw strong outflows, while total assets stood at $87.75 billion. When large investors pull money out regularly, demand usually becomes weaker.

3. The Crypto Fear & Greed Index plunged to 11, firmly in Extreme Fear territory, compared with 27 last month. When risk appetite collapses, traders usually avoid entering the assets.

These 3 are the major hooks behind why bitcoin is going down today, each highlighting the key forces currently pushing the market lower.

The charts further explain the downtrend momentum. On the 1-hour TradingView chart, the token is making “lower highs.” This simply means that each small recovery is weaker than the previous one.

The RSI (Relative Strength Index) is near 31, which shows the market is close to being oversold. When RSI is this low, a short bounce can happen. At the same time, the MACD is still negative, which shows that selling pressure is still strong.

As seen in the above chart, there is an important support area between $65,000 and $64,500. If the price falls below this range, it could move down toward $62,000. On the other hand, the nearest resistance level is around $68,000.

Pressure extends beyond “Crypto King.” Ethereum fell 4% to $1,943, weakening confidence. When ETH drops, traders cut exposure across markets, often triggering a price crash.

Bearish Scenario: If the $BTC price loses the $65,000 support, liquidation pressure and extreme fear could push the selling toward $62,000–$60,000.

Bullish Scenario: If it defends $65,000, oversold RSI conditions could trigger a relief rally toward $68,500–$72,000.

CoinGabbar experts say market fear and liquidations clearly explains why is bitcoin down today, not structural weakness.

Understanding why bitcoin is going down today requires tracking liquidations, ETF behavior, and sentiment shifts together. Investors now focus on the $65K zone, as its defense or failure could shape the next major move.

YMYL Disclaimer: This article is strictly for information only and should not be considered financial advice. Cryptocurrency is facing high volatility right now, so it's always better for readers to do their own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.