The Quantum Threat to Bitcoin has become one of the most discussed security topics in crypto. As quantum computing improves, some investors fear these machines could one day break Bitcoin’s cryptography.

But a recent CoinShares report suggests the danger is being overstated and is unlikely to affect the network anytime soon.

Instead of a crisis, researchers describe this threat as a long-term technical challenge one the ecosystem has enough time to prepare for.

Source: X (formerly Twitter)

According to CoinShares, only about 10,200 BTC are stored in addresses large enough to shake markets if compromised. Although roughly 1.6–1.7 million BTC exist in older wallet formats that could theoretically face exposure, most modern wallets remain protected.

To actually break the cryptocurrency's encryption, experts estimate that quantum computers would need nearly 13 million qubits. Today’s machines are nowhere close. Analysts believe such technology may not arrive until the 2030s, and practical attacks could still be decades away.

Because of this, it appears distant rather than urgent.

Bitcoin depends on elliptic curve signatures to authorize transactions and hashing systems to secure data. Even if the computers advances, it cannot rewrite the fixed 21 million supply, skip proof-of-work, or suddenly control the blockchain.

Newer address types hide public keys until coins are spent, reducing the chance of an attack. Some reports claim up to 25% of BTC is vulnerable, but CoinShares argues these numbers exaggerate temporary risks that users can avoid by moving funds to safer wallets.

Most importantly, the network can upgrade. Developers could introduce post-quantum cryptography through soft forks long before quantum machines become powerful enough.

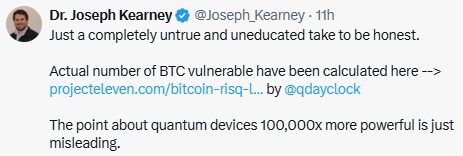

Despite the reassuring outlook, not everyone accepts the lower-risk view of the Quantum Threat to Bitcoin.

Joseph Kearney, a researcher focused on quantum computation and blockchain technologies, criticized the idea that the threat is minimal. He warned that suggesting machines must be “100,000 times stronger” could mislead investors.

Source: X (formerly Twitter)

Data from the Project Eleven tracker paints a more cautious picture. It estimates that nearly 6.8 million BTC could be theoretically vulnerable under advanced conditions representing hundreds of billions of dollars in potential exposure.

Still, “vulnerable” does not mean instantly stealable. Many of these coins are inactive, and any coordinated attack would require breakthroughs that do not yet exist.

This difference in estimates shows that the threat remains an active debate rather than a settled conclusion.

Even in an extreme scenario, analysts believe only around 10k BTC could suddenly enter circulation from compromised keys. Compared to daily trading volumes, this would likely resemble normal selling pressure instead of a systemic shock.

Another important point is that BTC would probably not be the first target. If quantum computers become strong enough to crack modern encryption, banks, payment networks, military systems, and secure internet protocols could face threats earlier.

This wider risk suggests quantum computing is a global cybersecurity issue not just a crypto problem.

The conversation around the Quantum Threat to Crypto and Bitcoin is healthy for a multi-trillion-dollar asset. Evidence today shows the risk is limited, manageable, and still years away.

Rather than an investment killer, advanced computing looks more like a future engineering task. With upgrade paths available and growing awareness across the industry, Bitcoin appears well positioned to adapt long before the threat becomes real.

YMYL Disclaimer: This article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry risk, so readers should conduct their own research or consult a financial advisor before making any decisions.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.