The Rainbow airdrop is now official, and the clock has started. The project confirmed that the snapshot for the $RNBW airdrop will be taken on Monday, January 26th at 4:20 PM EST. This means users still have a short window to earn points before the final distribution on February 5.

What makes this moment special is that points earned from Perps trading and Prediction Markets are not shown in the app’s reward tab, yet they are safely recorded on the backend.

Source: Rainbowdotme X account

Every trade, swap, bet, and even collectible app icon activity is building a user’s share of the upcoming Rainbow listing date.

At the same time, the $RNBW Premarket price has already started trading on MEXC, giving the market its first real signal about how the token could behave once launch day arrives.

According to the official X account, the snapshot will be taken on 6 Jan. The project plans to distribute 15% of the total token supply through the Rainbow airdrop listing. That equals 150 million tokens. Distribution is expected to follow a near pro-rata model.

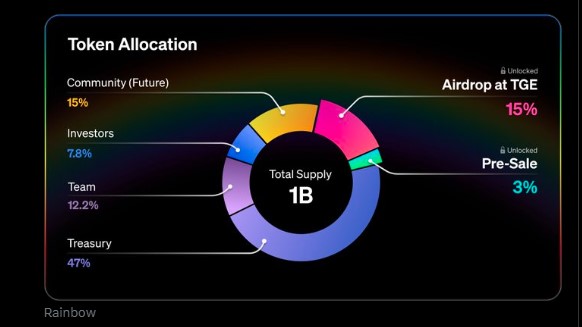

This means your share depends on how many points you hold compared to the total points in circulation. The total supply is 1 billion tokens. The token price for the sale is set at $0.10. The fully diluted value is $100 million.

Only the rewards and token sale supply will enter circulation at TGE. Everything else stays locked, keeping early circulating supply very low. For non-US users, the unlocked market cap at TGE is estimated around $18 million. This low supply is critical for early price discovery and could create sharp moves once trading begins.

MEXC confirmed Rainbow premarket listing on January 22, 2026. The $RNBW Premarket price is trading around $0.115, slightly below the highs with a mild decline near 4%.

The price is moving between $0.110 support and $0.120 resistance. This narrow range shows balance. Buyers and sellers are testing fair value, but real volume is still missing.

Low volume tells an important story. The market has not chosen a direction yet. Once the official airdrop launch starts, volume will rise, and real price discovery will begin. The current movement looks like calm consolidation, not panic selling.

The CoinList officially shared the tokenomics with a long-term structure:

Treasury: 47%

Community (Future): 15%

Airdrop at TGE: 15%

Team: 12.2%

Investors: 7.8%

Pre-Sale: 3%

The Foundation will hold 20% equity at TGE, aligning token holders with company growth. This structure reduces sudden dumping risk and improves long-term stability.

One confirmed exchange for February listing is MEXC. Other names like Binance, Bybit, OKX, BitMart, and Gate.io are only speculation for now.

Rainbow listing price expectations stay realistic:

Listing price: $0.11–$0.13, possible spike to $0.15

Short term: $0.08–$0.18 volatility

Long term:

Strong adoption: $0.25–$0.40

Weak interest: $0.05–$0.08

These prediction targets are based on MEXC pre-market trading charts, solid tokenomics, and token unlock strong schedule. The estimates might change according to the industry sentiment upon launch day.

The Rainbow airdrop and the $RNBW token Premarket price on MEXC together show how carefully this launch is being shaped. A limited circulating supply, active user rewards, and calm pre-market behavior create a balanced setup. February 5 is not just a new token listing date, it is the start of real market discovery for the project.

YMYL Disclaimer: This article is for informational purposes only. It does not provide financial advice. Cryptocurrency markets are volatile, and users should always do their own research before making investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.